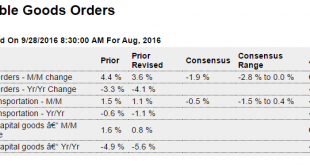

Continues in contraction year over year, and revisions likely to cause further downward GDP revisions: Highlights The headline, at a monthly zero percent, is flat and so are the indications from the bulk of the August durable goods report. Excluding transportation, orders slipped 0.4 percent. This reading excludes a 22 percent downswing in civilian aircraft orders that is offset in part, however, by a solid 0.7 percent gain for vehicle orders. Readings on core capital goods...

Read More »What about the white working-class?

from David Ruccio We can thank Donald Trump for one thing: he’s put the white working-class on the political map.* In recent months, we’ve seen a veritable flood of articles, polls, and surveys about the characteristics, conditions, and concerns of white working-class voters—all with the premise that the white working-class is fundamentally different from the rest of non-working-class, non-white Americans. But why are the members of the white working-class attracting so much attention? My...

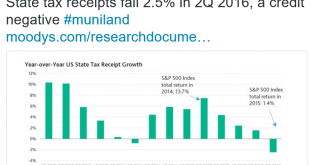

Read More »State tax receipts, Redbook retail sales, Case-Shiller house prices, PMI services, Richmond Fed manufacturing, consumer confidence

This too has followed the shale boom/bust cycle and is headed lower: No recovery here: This looks back over the last three months and seems to be decelerating from already modest levels: Up a bit but still low: The flash Markit US Services PMI came in at 51.9 in September of 2016 from 51 in August, reaching the highest figure in five months and above market expectations of 51.1. Activity picked up for the first time in three months due to ongoing new business growth while...

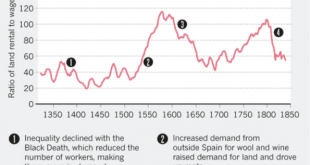

Read More »Inequality: the very long run

In Nature Branko Milanovic published an interesting article about (very) long run cycles in inequality, using among other metrics the wage-rent quotiënt as an indicator of inequality (wage income relative to income of landowners). See the first graph. I can actually add a little to this. I’ve extended the Dutch (Frisian) wage/rent series published earlier on this blog backward to 1697 and forward to 1862 (below). Up to about 1800, developments in Friesland and Spain seem to be pretty...

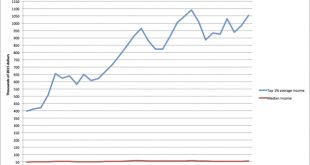

Read More »Liberal trickledown economics

from David Ruccio Has the policy consensus on economics fundamentally changed in recent years? To read Mike Konczal it has. I can’t say I’m convinced. While some of the details may have changed, I still think we’re talking about different—liberal and conservative—versions of the same old trickledown economics. But first Konczal’s argument. He begins with a pretty good summary of the policy consensus before the crash of 2007-08: Before the crash, complacent Democrats, whatever their...

Read More »Rail traffic, Philly Fed state index, NY Fed nowcast

Rail Week Ending 17 September 2016: Data Looks Better This Week Week 37 of 2016 shows same week total rail traffic (from same week one year ago) contracted according to the Association of American Railroads (AAR) traffic data. However, the data was an improvement over last week. Not looking so good: This one’s coming down as well: September 23, 2016: Highlights The FRBNY Staff Nowcast stands at 2.3% and 1.2% for 2016:Q3 and 2016:Q4, respectively. Negative news since the...

Read More »How unemployment has been considered by mainstream macroeconomic models?

from Maria Alejandra Madi From the 1950s onwards, the macroeconomic models of the neoclassical synthesis, based a system of simultaneous equations, focused on the interaction between the market for goods and services and the money market in the context of a general equilibrium analysis. According to John Hicks (1904-1989), in the general case, the capitalist economy is at full employment level of output. The underlying employment theory is based on the demand and supply of labour in a...

Read More »Hold the champagne

from David Ruccio Last week, to judge by the commentary on the latest Census Bureau report, Income and Poverty in the United States: 2015 (pdf), you’d think the fountain of broadly shared economic prosperity had just been discovered. Binyamin Appelbaum is a good example: Americans last year reaped the largest economic gains in nearly a generation as poverty fell, health insurance coverage spread and incomes rose sharply for households on every rung of the economic ladder, ending years...

Read More »Eurozone Composite PMI, US Manufacturing PMI

Also down and a bit lower than expected: United States Manufacturing PMI The flash Markit manufacturing PMI for the United States declined to 51.4 in September of 2016 from 52 in August and below market expectations of 51.9. New business growth eased further, output slowed and export orders fell for the first time in four months while payrolls increased.

Read More »KC Fed, Recent presentation

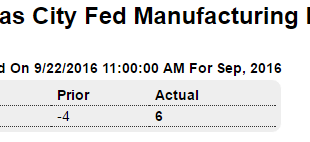

Better, apart from employment and prices, which happen to be the Fed’s mandate. So interesting that the KC Fed President wants to hike rates: Highlights Just about every month the Kansas City manufacturing index is in the negative column, but not in September which comes in at plus 6 for the second positive reading this year and the best reading since December 2014. New orders are sharply higher, at plus 12 vs August’s minus 7 with backlogs holding steady. Production and...

Read More » Heterodox

Heterodox