from Lars Syll Every method of statistical inference depends on a complex web of assumptions about how data were collected and analyzed, and how the analysis results were selected for presentation. The full set of assumptions is embodied in a statistical model that underpins the method … Many problems arise however because this statistical model often incorporates unrealistic or at best unjustified assumptions … The difficulty of understanding and assessing underlying assumptions is...

Read More »ISM services, ADP, oil, trade, Fed Atlanta GDP Now

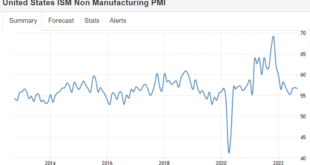

Remains in positive growth mode: No recession indication here- this is a forecast for Friday’s employment report: My take is at the July meeting with President Biden the Saudis agreed to bring prices down in return for various favors. The only way for this to happen was for them to confidentially discount their official selling prices with their customers, and for this was done without consultation with the rest of OPEC+. For reasons unknown to me that agreement has come...

Read More »ISM services, ADP, oil, trade, Fed Atlanta GDP Now

Remains in positive growth mode: No recession indication here- this is a forecast for Friday’s employment report: My take is at the July meeting with President Biden the Saudis agreed to bring prices down in return for various favors. The only way for this to happen was for them to confidentially discount their official selling prices with their customers, and for this was done without consultation with the rest of OPEC+. For reasons unknown to me that agreement has come...

Read More »CB gold purchases, heavy trucks, total vehicle sales, mortgage purchase applications, new homes under construction

Central Banks Are Stocking Up On Gold Which Countries Own the Most Gold | SchiffGold “Central banks purchase a net 270 tons of gold through the first half of the year. This fell in line with the five-year H1 average of 266 tons.” This is the driving force behind gold. When central banks buy it, they pay for it by crediting a central bank member bank’s account on their own books. It is spending that adds to currency depreciation and ‘inflation’ in general. I call it off...

Read More »CB gold purchases, heavy trucks, total vehicle sales, mortgage purchase applications, new homes under construction

Central Banks Are Stocking Up On Gold Which Countries Own the Most Gold | SchiffGold “Central banks purchase a net 270 tons of gold through the first half of the year. This fell in line with the five-year H1 average of 266 tons.” This is the driving force behind gold. When central banks buy it, they pay for it by crediting a central bank member bank’s account on their own books. It is spending that adds to currency depreciation and ‘inflation’ in general. I call it off...

Read More »The market did not cause inequality, no matter how much the New York Times insists

from Dean Baker It is a complete article of faith in intellectual circles that the market is responsible for the rise in inequality that we have seen in the United States and elsewhere over the last half-century. Intellectual types literally cannot even consider the alternative that inequality was the result of government policies, not the natural workings of the market. The standard line is that technology and globalization were responsible for the increasing gap in income between people...

Read More »Job openings, hires, Manufacturers orders, real estate lending

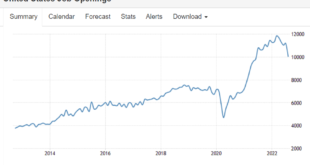

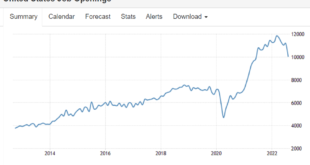

Continues to look to me to like the increased government deficit from the rate hikes, at the macro level, continues to support output and employment and is not triggering a recession as feared? Still a very high number- well above pre-Covid levels: Back to pre-Covid trend line: A slight decline for the month but still trending higher. No sign of recession here: The rate of growth of bank real estate lending continues to increase since the rate hikes were initiated:...

Read More »Job openings, hires, Manufacturers orders, real estate lending

Continues to look to me to like the increased government deficit from the rate hikes, at the macro level, continues to support output and employment and is not triggering a recession as feared? Still a very high number- well above pre-Covid levels: Back to pre-Covid trend line: A slight decline for the month but still trending higher. No sign of recession here: The rate of growth of bank real estate lending continues to increase since the rate hikes were initiated:...

Read More »Open thread Oct. 3, 2022

The price of economics

from Peter Radford Thank you Mariano Torras. You said the following in a letter to the Financial Times: “I would venture that there is a professional motive for perpetuating — through the use of elegant and abstract models — the fantasy that economics is a science. The prestige, the stature and influence that such a myth permits is undeniable. Yet, far more perniciously, the ostensible neutrality of “economic science” provides seemingly unshakeable ideological cover against critics who...

Read More » Heterodox

Heterodox