An important reason to read history is to gain a perspective on current events. If you watch exclusively mainstream media television, particularly Fox News, you might be forgiven for the belief that things in this country are the worst they have ever been in history. “1877: America’s Year of Living Violently” by Michael Bellisiles is one effective antidote to that impression.The panic of 1873, when a post-Civil War speculative bubble burst, launched...

Read More »Coronavirus update: mid year 2023

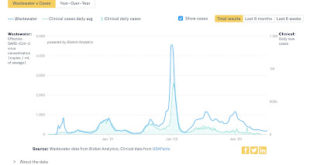

Coronavirus update: mid year 2023 – by New Deal democrat I haven’t done an update on the state of COVID since March or April. As we are halfway through the year, and just past the July 4 holiday get-togethers that sparked summer waves in the past, let’s take a look. Covid isn’t gone, but it is very much in a lull. Almost all case tracking by governments is gone. But Biobot’s wastewater monitoring, which has been very reliable, continues....

Read More »Cultural dinosaurs and creative exhaustion

Infidel talks about the costly flops by the movie making behemoth executives and brought to us at our nearby Big Screen theater only to be disappointed and bored whichever comes first. Hopefully, there is good buttered popcorn . . . Infidel753: Cultural dinosaurs and creative exhaustion, Infidel753 Blog It’s no secret that American movies are in the doldrums. By a recent estimate, all of Disney’s last eight big films flopped, losing a total...

Read More »Catching a Credit Card Thief is Near to Impossible

How does this article fit into Angry Bear’s typical offering? It doesn’t really or it does if you believe it to be an issue of economics, personal economics, and education. An education to be careful how and where your credit cards are used. My rule(s) of thumb. If it takes too long to process a credit, ask questions about there being a problem. If the person leaves the area from where you can watch them transact the purchase, there should be an...

Read More »Manufacturing and construction sectors continue downward pull on economy

Manufacturing and construction sectors continue downward pull on economy – by New Deal democrat As usual, we start the month with new manufacturing and construction data. The ISM manufacturing index goes all the way back to the 1940s, and has been a very good short leading indicator of recession throughout that time (although nothing’s perfect!). However, since the “China shock” started 20 years ago, with so much offshoring of...

Read More »New Deal democrats Weekly Indicators June 26-30

SUNDAY, JULY 2, 2023 Weekly Indicators for June 26 – 30 at Seeking Alpha – by New Deal democrat My “Weekly Indicators” post is up at Seeking Alpha. Movement among the indicators continues to be slow as molasses, but an important bifurcation stands out: indicators focusing on services continue to show good growth, while indicators focusing on goods are either stalled or outright contracting. As usual, clicking over and reading will...

Read More »More Worker Suffering Needed to Bring Inflation Down?

As read at Naked Capitalism, Yves Smith writes . . .”This post provides a high-level debunking of the Fed/central bank approach of squeezing wages as the first line of attack against of inflation. It cites the views of James Galbraith. If you’d like to read a fuller discussion, please see his article The Quasi-Inflation of 2021-2022 – A Case of Bad Analysis and Worse Response.” NYT Says More Worker Suffering Needed to Bring Inflation Down...

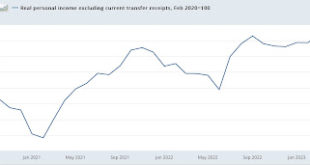

Read More »Real income continues to set records, while real spending and real total sales falter

Real income continues to set records, while real spending and real total sales falter – by New Deal democrat Real personal spending faltered in May, and real total sales continued to falter in April, as of this morning’s report; while real personal income continued to be aided by the big decline in gas prices that started a year ago. Let me start with the good news. Real personal income less government transfer receipts is one of the...

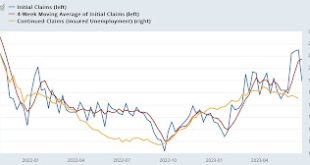

Read More »Jobless claims: still at distress levels, still not red flag recession warning

Initial jobless claims: still at distress levels, still not red flag recession warning – by New Deal democrat Initial claims dropped -26,000 last week to 239,000, the top of their former range this spring. The more important 4 week moving average rose 1,500 to 257,500, a new 18 month high. With a one week lag, continuing claims declined -19,000 to 1.742 million: For forecasting purposes, the more important comparison is YoY. By this metric,...

Read More »US recession fears ease: surprisingly strong data on housing, consumer confidence, labor market

Fed Chair Jerome Powell already warned he “may” have two more planned Fed rate increases in the making. Even a Fed comment is enough to stymie a housing market increase. US recession fears ease: surprisingly strong data on housing, consumer confidence, labor market, Financial Review, Vince Golle and Reade Pickert President Joe Biden told donors he thinks the US will avoid a potential recession that economists and banks have long been...

Read More » Heterodox

Heterodox