Calculated Risks Bill McBride Fed Chair Jerome Powell is participating in a panel discussion today at the European Central Bank (ECB) Forum on Central Banking 2023 in Sintra, Portugal. Federal Reserve Chairman Jerome Powell talked tough on inflation Wednesday, saying at a forum that he expects multiple interest rate increases ahead and possibly at an aggressive pace. From Jeff Cox at CNBC: Powell says more ‘restriction’ is coming, including...

Read More »Pent-up demand and sales: an Update

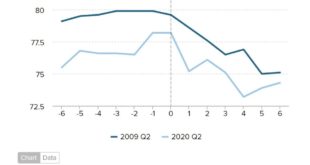

Pent-up demand and sales: an update – by New Deal democrat There’s no big economic news today. So while we wait to see if initial jobless claims continue to worsen tomorrow, and what happens with real personal spending and income, as well as real business sales on Friday, let me point you to an updated detailed discussion of why the Fed’s rate hikes haven’t yet caused the economy to turn down (hint: gas prices plus pent-up demand in several...

Read More »Desensitizing young children with Peanut Allergy

This is kind of a big deal. We have all heard about peanut allergy and how dangerous a reaction can be. A new skin patch might increase their tolerance of the legume, according to the results of a late-stage clinical trial. It is not 100% protection if exposed or ingested. It does offer protection equivalent to 3-4 peanuts and for children 1-3 years of age. A start to something better. Just in passing. Good News for Toddlers with Peanut...

Read More »Higher new home sales, with lower prices in May: good!

Higher new home sales, with lower prices in May: good! – by New Deal democrat Let me start with my usual caveat about new home sales: while they are the most leading of all housing metrics, they are very noisy and heavily revised. With that out of the way, the bottom line is that they offered pretty definitive evidence that sales have bottomed, while prices are still declining, at least on a YoY basis. Which makes sense, because as I always...

Read More »Supply Chain Backlog, Profit Taking, or Labor Driving Inflation?

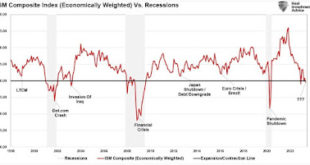

Corporate profits have contributed disproportionately to inflation. How should policymakers respond? Economic Policy Institute, Josh Bivens The inflation spike of 2021 and 2022 has presented real policy challenges. In order to better understand this policy debate, it is imperative to look at prices and how they are being affected. The price of just about everything in the U.S. economy can be broken down into the three main components of...

Read More »House prices increase for third straight month . . .

House prices increase for third straight month, but Case Shiller index now negative YoY – by New Deal democrat Seasonally adjusted house prices through April as measured by both the FHFA (red in the graph below) and Case Shiller (blue) Indexes rose, the former by 0.7% and the latter by 0.5%. This is the third straight increase in a row. Thus house prices have probably bottomed. But on a YoY basis, prices have continued to decelerate sharply,...

Read More »Childcare Can Increase the Labor Force

This is not a bad idea. It is one issue long over due and needed if we are to attract more people into the Labor Force. It should be government sponsored to cut the costs of it. To Increase the Supply of Workers, Our Economy Needs Childcare, Roosevelt Institute, Mike Konczal Tuesday February 23, the Department of Commerce announced the CHIPS for America Funding Opportunity. This action is a part of the bipartisan CHIPS and Science Act designed...

Read More »Medicare survey shows, VA hospitals out-performing private hospitals

This recent article on NPR was passed on to me after a recent conversation with Steve Early who along with Suzanne Gordon write articles on veteran’s affairs. Usually and in this instance, NPR is careful who or what they support. However, you still have to read things carefully. Steve in conjunction with Suzanne Gordon and Jasper Craven recently released their book “Our Veterans.” I post on the bool most recently. The book “critically examines the...

Read More »Minnesota’s future: How to contain health care costs, revisited

This is an interesting occurrence. On its own Minnesota is moving forth with a health care study to be completed by March 2024. The study topic is the implementation of single payer within the state and its impact on administrative costs. This year the state began questioning its present commitment to traditional healthcare’s and its administrative role in healthcare. Kip on numerous occasions has pointed out the costs of administrative costs of...

Read More »Former Students Plan to Ignore Loan Repayments When Pause Ends

Former Students Plan to Ignore Loan Repayments When Pause Ends, Newsweek, Khaleda Rahman “I will not give them one cent!” 45-year-old teacher Jacque Abron said about resuming her student loan repayments when the COVID-19 pandemic-era pause comes to an end. “The illegal lending scam is over and I’m fighting until we see bankruptcy rights restored.” The mother of three is far from alone in her refusal to return to a life struggling to chip away...

Read More » Heterodox

Heterodox