New Deal democrats Weekly Indicators for June 19 – 23 2023 – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. When nothing dramatic is happening, high frequency information can be like watching paint dry. That’s where we are at the moment. The positives – like improving sentiment in the stock market – are still positive; and the negatives – like interest rates and mortgage applications – are still negative. And the...

Read More »Some Things Amazing, Economical, Finally Happening, Legal, and also Yawn About

Interesting national reports as detailed in Letters from an American. At least, I find them interestingto be redundant. Multiple topics passing in review. June 22, 2023, Letters from an American, Prof. Heather Cox Richardson Something Amazing for Drivers “To rebuild I-95 on time, we need 12 hours of dry weather to complete the paving and striping process,” Pennsylvania’s Democratic governor Josh Shapiro tweeted. “With rain in the forecast,...

Read More »‘There’s no way I can pay it’: Americans dread restart of student loan payments

About the time I was talking to USC’s Associate Director and Alan Collinge at the Student Loan Justice Facebook site, Michael “The Guardian” reporter was talking to students there about payback issues. Everyone is concerned about the startup of loan paybacks. It is a serious issue for most. ‘There’s no way I can pay it’: Americans dread restart of student loan payments, US student debt | The Guardian, Michael Sainato Many Americans are dreading...

Read More »Back to the basics: how do initial claims, total hours worked, aggregate real payrolls, and job growth relate?

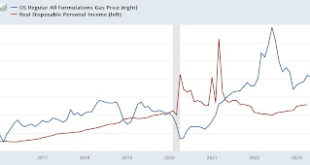

Back to the basics: how do initial claims, total hours worked, aggregate real payrolls, and job growth relate? – by New Deal democrat One of the most important reasons why big Fed rate hikes and big downturns in things like housing starts and credit provision haven’t translated into a recession this year (so far!) is the big decline in gas prices in the second half of last year. This big decline has translated into income and spending gains...

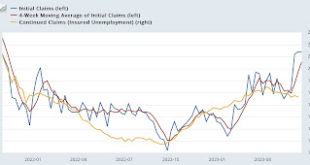

Read More »Initial Job claims: yellow caution flag turns more orange

Initial claims: yellow caution flag turns more orange – by New Deal democrat Initial claims, which were one of the most positive indicators of all last year, have turned darker in the last several months, and are edging closer to triggering their recession warning levels. Claims were unchanged at a revised 264,000 last week, the highest level in over 18 months. The more important 4 week average rose 8,500 to 255,750. Continuing claims, with...

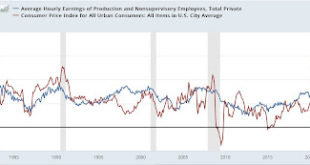

Read More »Wage Passthrough to Pricing is Minimal and Abating

This commentary is along the lines of what I have been taught when I was consulting with Ingersoll Engineers in Rockford and which is now extinct. My background includes manufacturing planning at all levels domestically and internationally for US and foreign companies. Labor’s wages are a small part of the Cost of Manufacturing, etc. Spencer England and I went round and round on this topic. Manufacturing, Inventory and Throughput planning was my...

Read More »Corporate Healthcare being Handed ‘Get Out of Jail Free Cards’

Much like Kip Sullivan in Minnesota/PNHP who Angry Bear has featured, Kay Tillow of Kentucky is a Single Payer activist. You will find Kip saying similar things about Medicare Advantage, etc. And we are all a little bit different attempting to reach the same goals . . . preventing the privatization of Medicare and achieving Single Payer. Kay’s article appeared on Common Dreams. I have added some things to her article and emphasized some points I...

Read More »Real wage growth leads spending; meaning spending seems likely to stall after an increase over the next few months

Real wage growth leads spending; meaning spending seems likely to stall after an increase over the next few months – by New Deal democrat No big economic news today, so I wanted to pick up on a subject I began a week ago Monday; namely, taking a detailed look at personal spending, i.e., consumption. To put it in more socially relevant terms, what allows average American households to spend more, or to cut back? And what are its ramifications...

Read More »Housing under construction increases back close to record; good economic news, but ammunition for a hawkish Fed

Housing under construction increases back close to record; good economic news, but ammunition for a hawkish Fed – by New Deal democrat Last month I wrote that “the Fed’s sledgehammer attempt via one of the most aggressive rate hike campaigns in its history appears to be on the verge of failure. That’s because housing construction, more than a year after the Fed started its campaign, is not meaningfully cooperating.” This month’s report did...

Read More »Pharma and Chamber of Commerce Suing to Stop Drug Negotiations

Big business organization in the form of the Chamber of Commerce and a Phamaceutical company are joining together and taking on the government to keep it from negotiating pharmaceutical pricing. Chances are well in favor of this ending up in SCOTUS based upon a moneyed corporation willing to spend its way into court. A resource Gideon Wainwright did not have. Those doors have mostly closed for citizens. And today, we have states lacking...

Read More » Heterodox

Heterodox