I should have plaque on the wall of some hospitals stating I was there and we (the hospital) made out like bandits. Some of the procedures and meds they do and give me are not in your average Tylenol category. Not much I can do about it. Merril at GoozNews posted this exposé on how the pricing for physicians is set and to which there is no outside attendance. If you do attend, you sign an agreement not to reveal information. If you are wondering...

Read More »New Deal democrats Weekly Indicators for May 22 – 26

Weekly Indicators for May 22 – 26 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. Several of the indicators that popped higher one week ago sank back lower this week. The overall picture remains very slight positivity in the coincident numbers. Meanwhile stock prices continued to make several new 3 month+ highs, but several long leading indicators, including corporate profits as reported in revised...

Read More »April report for real personal income and spending adds to the evidence that a cyclical peak might ultimately be dated to January

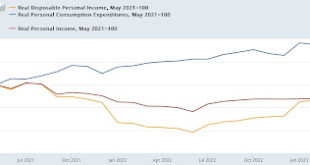

April report for real personal income and spending adds to the evidence that a cyclical peak might ultimately be dated to January – by New Deal democrat As I’ve repeated for the past several months, at present the report on personal income and spending is co-equal to the employment report as the most important monthly data. And for the second month in a row, the results were very mixed. And also, like yesterday, revisions played a big role,...

Read More »Initial claims: revisions rear their ugly head again

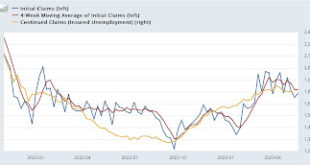

Initial claims: revisions rear their ugly head again – by New Deal democrat Revisions are a permanent hazard in reporting on economic data. That was very much in evidence in this week’s jobless claims report. Not only was last week’s number revised down by -17,000, but the initial report of 264,000 two weeks ago is now all the way down to 231,000! Big difference. Anyway, the current report indicates a weekly uptick of 4,000 to 229,000....

Read More »Financial markets in past fiscal crises; the “gold standard” of employment reports . . . big deceleration in Q4 of last year

Financial markets in past fiscal crises; the “gold standard” of employment reports shows big deceleration in Q4 of last year – by New Deal democrat I have a post up at Seeking Alpha on how stocks, bonds, and consumers behaved during the 3 fiscal crises of the last decade. Hint: recessions are always disinflationary. Also of interest: the “gold standard” of employment data is the Quarterly County Employment and Wages report, which is not a...

Read More »Another Legal Challenge of the ACA Coming Out of Texas and the Fifth District

Cost-Free Preventive Care Under the ACA Faces Legal Challenge, JAMA | JAMA Network, Gregory Curfman, MD; Kirsten Bibbins-Domingo. The same federal Jackass judge in Texas who struck down the entire ACA (2018) has risen again. In this particular instance, he is taking aim at a core protection of the ACA or Cost-free preventive care. These services range from cancer screening to pregnancy care and have benefited more than 150 million US residents of...

Read More »Survey: Toyota, Honda, GM Supplier Working Relationships

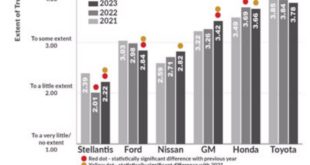

A story . . . Supplier working relationships were always tough in automotive. A lot of politicking going there, lunches, dinners, etc. Kind of difficult to walk a straight line with them and maintain an ethical standard. Yet, I did and was known for doing what I said I would do. I worked for several Tier 1 companies making components for Ford and Chrysler mostly and a bit for GM. There are no good guys here. Whatever they want, they get it....

Read More »New home sales and prices: yet another confirmation of a bottom in sales, while prices continue to decline YoY

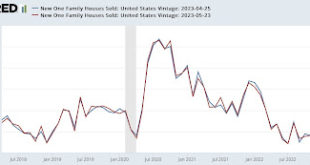

New home sales and prices: yet another confirmation of a bottom in sales, while prices continue to decline YoY – by New Deal democrat The last of the monthly updates for new home construction, new home sales, was reported this morning. And it continued the theme from the other data (permits, starts, existing home sales); namely, the bottom in sales appears to be in, while prices are still declining. First, on sales: new home sales...

Read More »14th Amendment, Debt Ceiling & Perpetual Bonds

When I read this (third article below), I thought of an earlier commentary by one of our peer-reviewed economists. This is what Robert Waldman had to say: “Investors are glad to pay the Treasury to keep their wealth safe. Now consider the US Federal Government intertemporal budget constraint — the present value of spending must be less than or equal to the present value of revenue. What is the present value of revenue ? It is calculated by...

Read More »The debt ceiling end-game

What should President Biden do if Republicans refuse to raise the debt ceiling? What should he say he will do, in advance, to avoid a catastrophe and gain leverage in negotiations? The answer to these questions is far from clear. Krugman and Klein on unorthodox legal strategies Paul Krugman argues that the administration should do something – anything – to avoid a debt default. He doesn’t care about the details – platinum coin, consul...

Read More » Heterodox

Heterodox