Escape from Muddle Land, Econospeak, Peter Dorman Let’s get the up-or-down part of this review over with quickly: Escape from Model Land: How Mathematical Models Can Lead Us Astray and What We Can Do About It by Erica Thompson is a poorly written, mostly vacuous rumination on mathematical modeling, and you would do well to ignore it. Now that that’s done, we can get on with the interesting aspect of this book, its adaptation of trendy radical...

Read More »Industrial production ‘meh’ in February, but down sharply since last summer

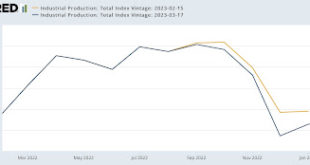

Industrial production ‘meh’ in February, but down sharply since last summer; real manufacturing and trade sales forecast to decline in Febuary – by New Deal democrat Industrial production was unchanged for the month of February, while manufacturing production rose +0.1%. But the bad news is that both were revised lower for the past 5 months, as shown on the two graphs below: As a result, industrial production (blue below) is now -1.8% below...

Read More »A New Year in 2022 and New Pharmaceutical pricing, a short Explanation

An early attempt as to explaining the drug market. It is a start and I have to program myself to understand what is said. Brief and down to earth with pictures too! Much of this is a C&P with some editing. Much credit to the authors for giving us this opportunity to understand. Welcoming a New Year with new drug prices, 46brooklyn Research This year has proven to be little different from past years. In keeping with tradition (for as long...

Read More »Housing construction: the good news and the bad news

Housing construction: good news and bad news – by New Deal democrat This morning’s report on housing construction contained both good news and bad news. First, the good news. Both permits (gold in the graph below) and starts (blue) increased, the former by 185,000 on an annualized rate, the latter by 129,000: It is very possible that January’s rate of 1.339 million permits annualized and 1.321 starts will be the low for this cycle....

Read More »Barney Frank Disagrees with Senator Elizabeth Warren on the weakening of financial rules

This is conversation between Summers and Frank are from March 13th. In this conversation, Barney could be right. He is refusing to agree that raising the limit for banks was a bad idea. If so, then how do you protect the public and the bank from bank managers doing stupid things? Gambling again with other people’s money is something they seem to be accustom to doing. JUANA SUMMERS, HOST: Two banks have failed in the last few days. The federal...

Read More »Medicare Plan Commissions May Steer Beneficiaries to Wrong Coverage

This article is easy reading exploring some the differences and why people may choose one plan over the other plan. Attached is also a Commonwealth Fund article with more detail. Medicare Plan Commissions May Steer Beneficiaries to Wrong Coverage, MedPage Today, Cheryl Clark. Agents and brokers selling Medicare plan coverage often steer their clients to a Medicare Advantage (MA) plan because it earns them a higher commission compared with a...

Read More »Jobless claims: nobody is (still!) getting laid off

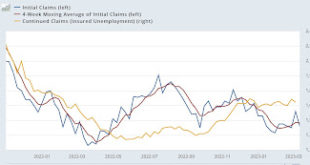

Jobless claims: nobody is (still!) getting laid off – by New Deal democrat Initial jobless claims declined -20,000 this week, back below 200,000 to 192,000. The 4 week average declined -750 to 196,500. Continuing claims, delayed one week, declined -29,000 to 1.684 million: For all intents and purposes, it is still the case that “nobody” is getting laid off. As the above graph shows, we are now almost one year past the lowest level of new...

Read More »Prescriptive View: Three Layers of a Fed Failure

In 2018. I made a similar argument without the detail Skanda Amarnath provides today. My points were not accepted. I went to a “we shall see” mode. And we did see banks taking risks because they could do so because Congress (which included Democrats) gave them the slack to do so too soon. In 2018, a decade after Wall Street and Banks blew up main street with their gambling, I felt it was too soon to give banks slack of this nature. It was only 7-8...

Read More »Economic Insomnia? A Review of “The Guest Lecture”

Peter Dorman’s critical review of “The Guest Lecture.” His review was first posted at Econospeak. Economic Insomnia? A Review of “The Guest Lecture” by Martin Riker. It’s a rare day when an economist plays the key role in a novel, and even rarer when one of the supporting players is John Maynard Keynes himself. So, spurred on by enthusiastic reviews, I sailed through Martin Riker’s The Guest Lecture this week, a novel in which a woman, just...

Read More »Accountability for Medicare Advantage Plans is long Overdue

A different viewpoint by the Physicians for a National Health Program. Mainly speaking as advocates for a universal national health program which would be as cost-effective as possible. They are proposing the plan could be constructed as an improved form of Traditional Medicare. They do too find similar issues as what Gilfillan and Berwick extensively discussed in the commentary Medicare ‘Money Machine, Part One and Part Two. Comments on CY 2024...

Read More » Heterodox

Heterodox