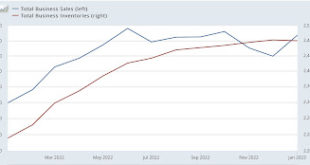

Forecast: real manufacturing and trade sales are likely to set a new record for January – by New Deal democrat One of the four monthly series of coincident indicators most relied upon by the NBER in determining whether the economy is in expansion or recession is Real Manufacturing and Trade Sales. A significant problem with it is that reporting of the data seriously lags. For example, the result for January will only be reported more than two...

Read More »Properly measured, consumer prices have been in deflation since last June

Properly measured, consumer prices have been in *deflation* since last June – by New Deal democrat The majority wisdom is that the Fed is going to go ahead and raise interest rates again when it meets next week. I have been arguing for months that the data has not supported interest rate hikes. As of this morning, I am officially taking the position that, properly measured, inflation has been conquered, and the US economy has actually had...

Read More »Interesting Stuff from My In-Box,

Quick two weeks went by and have been pretty busy. Starting to warm-up in Arizona. Been spending more time outside while I can and before it gets hot. Environment, Consumerism, Technology Micro-Apartment Makeover Includes Mini-Loft and Space-Saving Furniture, treehugger.com, Kimberley Mok. The comfort and livability of a 300-square-foot apartment are beautifully improved in this smart renovation. What changes after the Norfolk Southern...

Read More »Silicon Valley Bank (SVB) Was Donald Trump’s Bailout

For some reason, I did not release this one on the 13th. Not sure why. I was at the eye doctor for sure and he was removing membrane from the retina. Never felt a thing. So far so good. It might just be me thinking it improved my right eye vision. I was able to read the chart which the NP said was positive. I was told many people could not after surgery. Anyway, there are any number of good posts on different blogs you can read. This one by Dean...

Read More »Thoughts on Silicon Valley Bank: Why the FDIC plan isn’t (but also is) a Bailout

Thoughts on Silicon Valley Bank: Why the FDIC plan isn’t (but also is) a bailout; and why systemic risk remains – by New Deal democrat There’s no big economic data being released today. Which I guess is fortunate, since we had a little kerfuffle over the weekend. Which may or may not be over. Herewith hopefully some commentary to put this in terms non-finance people can understand. The really important issue for most people outside of the...

Read More »The USPS Eagle spins S&DCs to Postal Employees

Traditional USPS supporter at Save the Post Office, Steve Hutkins presents the latest information about the reorganization of the USPS. We had let off where President Joe Biden has/had a chance to replace two commissioners whose terms were at an end. Everyone wants two new Commissioners, but Biden has not made a move yet on their replacement. ~~~~~~~~ “The USPS Eagle spins S&DCs to postal employees,” Save the Post Office, Steve Hutkins...

Read More »“Time for a VOX Explainer” all Time Winner

I do not understand what the hell is going on regarding Silicon Valley Bank. I read something in the New York Times that seems to suggest to the no doubt completely confused me that somehow money will change hands as if uninsured deposits were insured. I have some simple questions. What happened ? What is happening now ? Why ? I guess the two key questions are 1) why are extraordinary measures being taken by the Federal Government to help...

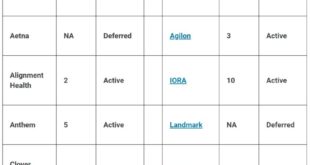

Read More »Part 2: Building on the ACO Model

Part Two explores where Medicare should be going forward as determined by doctors Richard Gilfillan and Donald M. Berwick. It is an endorsement of the ACO model with changes to it creating greater efficiency. I am not so sure Kip Sullivan would endorse this approach as opposed to Single Payer. Ultimately Single Payer is less costly when we consider the elimination of much of the administration effort. There is another post I will be putting up when I...

Read More »What Every Conservative Needs to Know about Student Loans

What Every Conservative Needs to Know about Student Loans, Alan Collinge, Medium. Conservatives have been tricked into defending the worst big-government loan scam in U.S. History; a slight majority of the borrowers identify as either republican, or independent. The 2020 election was a huge loss for the republicans. Even so, Conservatives buoyed by recent election wins, and the current unpopularity of the President. There is one issue that...

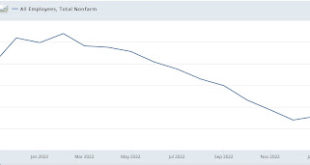

Read More »February jobs report shows decelerating trend continuing

February jobs report: the decelerating trend resumes – by New Deal democrat As I’ve written several times this week, my focus on this report was on whether manufacturing and residential construction jobs turned negative or not, whether temporary jobs continued on their downward trajectory, and whether the deceleration apparent in job growth would reappear after the blockbuster January report. Deceleration absolutely reasserted itself:...

Read More » Heterodox

Heterodox