This is Part One covering Medicare Advantage, Direct Contracting, and the MA Money Machine of which the Risk Scores drive the payout. If the Risk Scoring methodology was eliminated, ~$355 billion over the next eight years if just the risk-score related overpayments were eliminated. This is a pretty good read if you have the patience to cover all of it. I have added acronym and other definitions at the bottom. I have also added some additional...

Read More »“Some of us are illegal and some are not wanted . . .

This NYT story just dredges up the stories we would read and hear in the fifties and sixties. Popular song when I was hanging around the coffee houses then. No Starbucks then or laptops. If the song was of your ilk. Arriving in record numbers, the children escaping other countries are ending up in jobs violating child labor laws. Their presence can be found in the factories making the products your own and safe children might be eating or wearing....

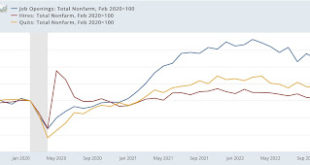

Read More »January JOLTS report consistent with a softening, but still very strong, labor market

January JOLTS report consistent with a softening, but still very strong, labor market – by New Deal democrat This morning’s JOLTS report for January, unlike the recent payrolls report, generally showed further softening in the labor market. While hires (red in the graph below, normed to a value of 100 as of February 2020) increased 121,000, quits (gold) declined 207,000, and openings (blue) declined 410,000: The downward trend in quits...

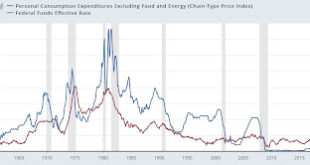

Read More »The Fed still seems determined to bring about a recession

The Fed still seems determined to bring about a recession – by New Deal democrat As I wrote on Saturday, several coincident indicators have stabilized in the past several months (for example, Redbook consumer sales, which has been at roughly 5% YoY for 8 weeks; and payroll tax withholding, which was only up 1.2% YoY for the last 4 months of 2022, but is up 4.7% YoY for the first 9 weeks of this year). This has led to increased speculation that...

Read More »Some Conversation About Student Loans

Unfortunately, this did not include the screening of “Loan Wolves.” The clip is approximately 36 minutes long. It includes Alan Collinge of Student Loan Justice who I have known for over a decade. Alan has been on Angry Bear Blog multiple times. He has not given up his, the crusade seeking relief for student loans. “Loan Wolves” Writer and Director Blake Zeff has written for The Onion and Politico besides doing other things. He is the chief...

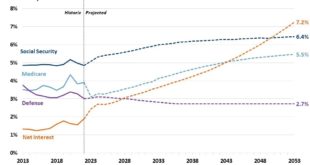

Read More »SOCIAL SECURITY CRFB LETS CAT OUT OF THE BAG, NO ONE NOTICES

Dale Coberly talking about reforming entitlements and the impact on Social Security . . . CRFB, “The Committee For a Responsible Federal Budget”, is an organization dedicated to reducing the National Debt or federal budget deficit, so it says. But it seems to spend most of its time calling for “reforming entitlements,” meaning “cut Social Security” which has nothing to do with the Debt/Deficit. Social Security is paid for entirely by the...

Read More »New Deal democrat’s Weekly Indicators February 27 – March 3

Weekly Indicators for February 27 – March 3 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. A number of indicators which had been declining have stabilized since the beginning of the year, leading to increased speculation about a “soft” landing or even a “no landing” at all. The bulk of the long and short leading indicators beg to differ. As usual, clicking over and reading will fill you in on...

Read More »Republicans repeatedly exploit people’s biases to win elections

For one, I find it difficult for behavior economics to explain why people are reacting in irrational ways. For example, University of Chicago poses some statements or questions on the issues. “Why do people often avoid or delay investing in 401ks or exercising, even if they know that doing those things would benefit them?” And, “Why do gamblers often risk more after both winning and losing, even though the odds remain the same, regardless of...

Read More »In Answer to a Headhunter looking for a Candidate

Many of you know me from my telling of past experiences. Here is one more to add to the pile. A recent email to me about an employment opportunity in automotive. My return email to the headhunter. Renaldo: Thank you for your interest. Having been trapped between Engineering and the plants over the years where I was working was an experience. No amount of logic would sway their demands for what they wanted regardless of their being a part of...

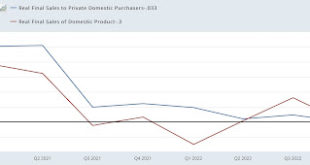

Read More »Real final sales and inventories as portents of recession

Real final sales and inventories as portents of recession – by New Deal democrat As I have mentioned previously from time to time, I read people who have interesting things to say even if their worldview is very different from mine. One such person is Mike Shedlock, a/k/a Mish. He’s an aggressive libertarian and has a long track record as a Doomer, but he frequently parses some thought-provoking economic data. It makes me think, even if I...

Read More » Heterodox

Heterodox