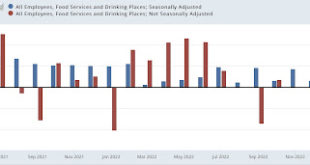

Scenes from the blockbuster jobs report 1: in January, nobody* got laid off! (*hyperbole) – by New Deal democrat There’s no important new economic data until Thursday this week. Meanwhile, there was lots to digest about Friday’s blockbuster jobs report, which I have now done, so I’m going to spend a couple (maybe 3!) days diving in to the details. Today I’ll deal with how seasonality and a very tight labor market were decisively important...

Read More »What’s fair is fair: The PRC issues a final order on the “appropriate share” issue

What’s fair is fair: The PRC issues a final order on the “appropriate share” issue, Save the Post Office, Steve Hutkins Another one of the posts by Steve Hutkins about the USPS. The effort by commercial interests to get the USPS to increase pricing has been going on for years. At the bottom, I have attached a post by Mark Jamison (“When Titans Collide: UPS petitions the PRC to change USPS costing methodologies”) detailing the efforts of UPS to get...

Read More »The Unbearable Tightness of Peaking

– Sandwichman @ Econospeak The Unbearable Tightness of Peaking Sandwichman came across a fascinating and disconcerting new dissertation, titled “Carbon Purgatory: The Dysfunctional Political Economy of Oil During the Renewable Energy Transition” by Gabe Eckhouse. An adaptation of one of the chapters, dealing with fracking, was published in Geoforum in 2021 As some of you may know, the specter of Peak Oil was allegedly “vanquished” by the...

Read More »New Deal democrat’s weekly indicators for January 30 – February 3

Weekly Indicators for January 30 – February 3 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. While yesterday’s blockbuster jobs report dominated the monthly reports, several important weekly reports, notably the 4 week average of retail sales as measured by Redbook, and the temporary Staffing Index, weakened further to new post-pandemic lows. On the other hand, January tax withholding payments had...

Read More »January jobs report: like a sports car at maximum acceleration

January jobs report: like a sports car at maximum acceleration – by New Deal democrat My focus on this report was on whether manufacturing and construction jobs turned negative or not, and whether the deceleration apparent in job growth would continue. Both of those were answered emphatically in the negative. Here’s my in depth synopsis. HEADLINES: 517,000 jobs added. Private sector jobs increased 443,000. Government jobs increased...

Read More »Some Important Bits of History for February 1

Black History Month is in February if you do not know it. Prof. Heather Cox Richardson celebrates it with a mixture of past and present facts, points, and references to it. Some of her points are ugly. Amongst her reverence to Black History Month is the detail of how the Battle Hymn of the Republic came to be. “February 1, 2023,” Letters from an American, Prof. Heather Cox Richardson On February 1, 1862, in the early days of the Civil War,...

Read More »Discussing Gun Ownership, Healthcare, and Who Pays for Shootings

This post is another part of a mini-series I am doing on healthcare and shootings. First, why the designation of bullet – spewing – weapons in this post? It eliminates the discussion of whether we are talking about a pistol, a bolt action Springfield, a semi-automatic Garand, a M14 with a twenty-round clip, a M60. or a Thompson Sub. There is a cost to owning a bullet – spewing – weapon. A cost which many people refuse to understand. There is...

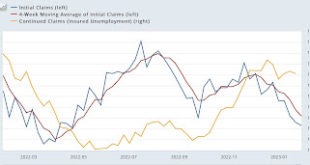

Read More »JOLTS and jobless claims: the labor market remains a strong positive

JOLTS and jobless claims: the labor market remains a strong positive – by New Deal democrat The message from the JOLTS report for December yesterday and jobless claims for last week today is that the labor market remains the strongest sector of the economy, with plenty of unfilled job openings, and almost no layoffs. Initial jobless claims last week declined -3,000 to 183,000, and the 4 week moving average declined -5,750 to 191,750. Both...

Read More »The (Recessionary) Projections of December 2022 Live On

Editorial by EMPLOY AMERICA on The Fed Chair’s 25bp hike which are aligning with the Fed’s consensus and market beliefs and Powell’s expectations of continuing inflation risks. Gotta make sure the chance of inflation is really dead. Poking at it with 25bp hike now, making sure it is dead, and two more rounds of the same in the near future. Good take by Skanda Amarnath of EMPLOY AMERICA on Fed Chair Powell’s beliefs. Skanda’s belief is the...

Read More »January manufacturing at recessionary levels; December construction spending declines

January manufacturing at recessionary levels; December construction spending also declines – by New Deal democrat The first data for the month of January is in, and with one exception, it is pretty bad. The ISM manufacturing index declined -1.0 to 47.4. According to the ISM, 48 is the cutoff below which is more consistent with a recession. Even worse, the new orders subindex cratered, falling 2.6 to 42.5: Going back 75 years, the *only*...

Read More » Heterodox

Heterodox