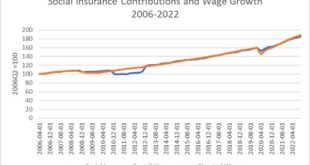

Another take on wages and salaries outpacing inflation. Not so says Robert Shapiro. Inflation Reality Check: Don’t Blame Wages and Salaries for High Prices, Washington Monthly, Robert J. Shapiro Yes, economics can be complicated, and economic reporters work under tight deadlines. There is no excuse for the media meme blaming rising wages for much of today’s inflation. The Wall Street Journal summed up this erroneous view in a recent headline,...

Read More »Updating some important coincident indicators

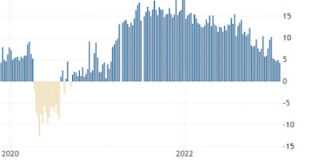

Updating some important coincident indicators – by New Deal democrat We returned to no more significant monthly data today. So here are some important coincident indicators I’ve been particularly following. Redbook consumer purchases only increased 4.3% YoY last week, the lowest number in almost 2 years. The 4 week average also declined to 4.7%, also a 2 year low: This strongly suggests that the January retail sales report, which will be...

Read More »As Holiday seasonality disappears, initial jobless claims turn higher YoY

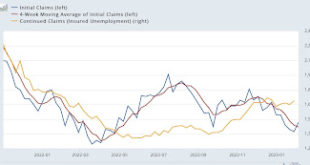

As Holiday seasonality disappears, initial jobless claims turn higher YoY – by New Deal democrat Initial jobless claims rose 13,000 last week to 196,000. The four-week moving average declined -7,500 to 189,250. Continuing claims increased 38,000 to 1,688,000. Below I show all three since initial claims first fell below 300,000 in late October 2021: Because seasonality played such a role in January’s jobs report, here are initial claims...

Read More »The Story Construction Tells About America’s Economy Is Disturbing

From the New York Times, Ezra Klein’s opinion piece, The Story Construction Tells About America’s Economy Is Disturbing Here’s something odd: We’re getting worse at construction. Think of the technology we have today that we didn’t in the 1970s. The new generations of power tools and computer modeling and teleconferencing and advanced machinery and prefab materials and global shipping. You’d think we could build much more, much faster, for...

Read More »This Is What Happens When Progressives Look the Other Way

This Is What Happens When Progressives Look the Other Way – Peter Dorman @Econospeak Recent events in Florida—the “Stop WOKE” Act, the rejection of AP African American Studies, the hostile takeover of New College—and the publication of an excellent op-ed about Diversity, Equity and Inclusion (DEI) in the Chronicle of Higher Education have me returning to a topic I blogged on several years ago, but in a new light. It was obvious, and I mean...

Read More »Credit conditions in Q4 were recessionary

Credit conditions in Q4 were recessionary – by New Deal democrat While we are still in our lull concerning monthly data, on Monday there was a significant update of one long leading indicator that is only reported Quarterly: the Senior Loan Officer Survey. This survey has an excellent history of over 30 years telling us about credit conditions. Loosening of credit, and an increase in demand for credit means expansion ahead. Credit tightening...

Read More »The day could come when we could replace the New Deal with a better deal

According to Pence, Republicans will come up with a Better Deal to replace Social Security. Allow younger people to place their funds in private and commercial investment funds. Funds from which a portion will be taken to manage them and to which will be exposed to the ups and downs of the economy. Abandoning Social Security is part of the Republican plan to resolve the national debt. Countering this pan would be to allow the trump tax cut of...

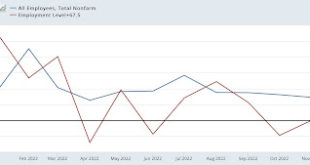

Read More »The blockbuster January jobs report 2: revisions do not resolve discrepancies in the reports

Scenes from the blockbuster January jobs report 2: revisions do not resolve discrepancies in the reports – by New Deal democrat Yesterday I wrote that the blockbuster January jobs report was essentially the result of two factors: (1) a very low number of potential applicants in the jobs pool with an unemployment rate well under 4% meant that employers were reluctant to let go of workers, which especially impacted the numbers, which particular...

Read More »‘Biden economy keeps defying predictions

Commentary from Letters from an American by commenter Fern McBride Will it last?’ (excerpts). The combination of a hiring boom and ebbing inflation has confounded forecasters, who’ve been warning of a recession, By David J. Lynch Whether the United States can keep defying the recession odds may depend on what happens in industries such as leisure and hospitality, health care and entertainment. These service businesses are enjoying a boomlet...

Read More »Household or Establishment Survey, which is Right?

Yesterday, we went off on the topic discussing changes or increases to the Household numbers. This commentary by Dean Baker looks like it might fit with our earlier discussion. Job Growth: Is the Household or Establishment Survey Right? cepr.net. Dean Baker. The January report showed that the economy added 517,000 jobs in January, far more than most analysts had expected. The household survey showed the unemployment rate dipping down to 3.4...

Read More » Heterodox

Heterodox