More on the FTC investigating Albertsons and Kroger as to whether they are truly competitors. The issue being how much of the market-controlled now by each and what would result after Kroger acquires Albertsons. Both the FTC and Unions argue “FTC argues different stores have different use cases. FTC lead attorney Susan Musser noted “you can’t just get a single avocado at a Costco, while the union pointed out that many stores, unlike Kroger and...

Read More »Labor Market Conditions – Sahm

Yes, I get occasional commentaries from this substack. No, I am not going to post it all here. Follow the link after you read what I did post of Claudia Sahm’s here. Labor market conditions. – by Claudia Sahm Tomorrow (9/6) is the jobs report for August 2024. There is intense attention for any clues on the direction of the U.S. labor market, particularly with the Fed set to begin cutting rates in a few weeks and concerns about a possible...

Read More »August jobs report: for the first time, including revisions, more consistent with a hard landing

– by New Deal democrat My focus continues to be on whether jobs gains are most consistent with a “soft landing,” i.e., no further deterioration, or whether there is further decline towards a recession. For a change, this month the Establishment report was the weakest in several years, if still positive. Meanwhile the Household report rebounded for the month, but now shows an absolute decline in job holders YoY. Below is my in-depth...

Read More »Strikes start at top hotel chains as housekeepers seek higher wages and daily room cleaning work

CNBC The plight of hotel workers in cleaning up after residents who stay for a few days and leave the room in a wreck. The pay id the minimum that can be made. The hazards are such a worker can become readily sick. from exposure. I am sure the pandemic caused issues. Plus, people do not tip the housekeeping staff. A couple of $dollars left on a night stand goes a long way. Another story on the plight of housekeepers which are mostly women....

Read More »Economically weighted ISM indexes show an economy on the very cusp of – but not in – contraction

– by New Deal democrat Recently I have paid much more attention to the ISM services index. That’s because, since the turn of the Millennium, manufacturing’s share of the economy has contracted to the point where even a significant decline in that index has not translated into an economy-wide recession, as for example in 2015-16. When we use an economically weighted average of the non-manufacturing index (75%) with the manufacturing index...

Read More »What are we To Do With the Phillips Curve ?

The Phillips curve plays a central role in the policy debate (this is partly due to the fact that debaters have finally learned to ignore very highly theoretical and unrealistic DSGE models). Just to review, the Phillips curve should show a negative relationship between unemployment and actual inflation minus expected inflation (it has been defined this way since 1960) The point where inflation is equal to expected inflation is called the...

Read More »Soft Landing ?

A soft landing (disinflation without a recession) looks possible. Also the remaining threat is the FED’s sticking with high interest rates, even though inflation is at a very reasonable level. I personally publicly and will almost certainly decline even if unemployment remains low. The change can be predicted, because the US index includes owner equivalent rent, a price which no one pays which is a calculation of how much homeowners would pay if...

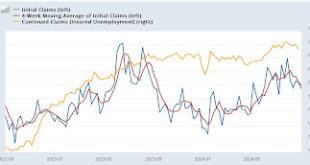

Read More »Jobless claims: all good news

– by New Deal democrat The weekly news from jobless claims continues to be good. The hypotheses that the summer increase was unresolved post-pandemic seasonality, plus the several week spike post-Beryl was all about Texas, both have held up very well. And that has continued to be the case against more challenging YoY comparisons as the data heads into September. Initial claims declined -5,000 last week to 227,000. The four week moving average...

Read More »Day 3 of the Courts Review of the FTC v Kroger Merger

Devastating Impact of Proposed Kroger/Albertsons Merger on Good Union Jobs Scrutinized in Day 3 of Merger Hearing, Economic Liberties Portland, OR — After the third day of the Federal Trade Commission v. Kroger-Albertsons hearing in the U.S. District Court for the District of Oregon, the American Economic Liberties Project released the following summary. As posted by Research Manager Laurel Kilgour, reporting from Portland of the key arguments...

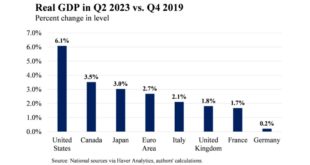

Read More »The US economy is the envy of the first world

Since the beginning of the Covid epidemic, the US economy has performed better than European economies and the Eurozone average. This comparison is useful, and not just for boasting rights. Fiscal policy in the USA and in the Eurozone has been dramatically different – The US Federal Government implemented Six very large fiscal stimuli: The CARES act signed into law by Donald The bipartisan (Manchin) stimulus enacted In December 2024 signed...

Read More » Heterodox

Heterodox