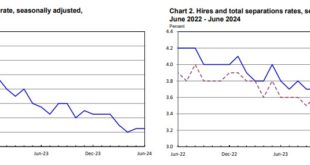

The latest Jobs Report numbers I pulled off of the Bureau of Labor Statistics website. It would appear the FED has done its job in lowering inflation to the point the nation may slip into a recession. For the last couple of months this is what New Deal democrat has been reporting also. “In other words, if 2% inflation is a target and not a ceiling, the Fed need not wait any further before starting to trim interest rates lower.“ Latest Bureau...

Read More »Rebalancing between New and Existing home sales

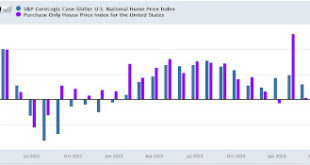

Repeat home sales were benign in May, forecast continued downtrend in shelter CPI in months ahead – by New Deal democrat First, a brief administrative note: I am traveling this week, so posting is going to be sporadic and delayed. I’ll get to this morning’s JOLTS report later today or tomorrow morning. With that out of the way, let’s take a look at repeat home sales prices. To reiterate my focus, in the housing data I am looking at any...

Read More »New Deal democrats Weekly Indicators July 22-26

Weekly Indicators for July 22 – 26 at Seeking Alpha – by New Deal democrat My “Weekly Indicators” post is up at Seeking Alpha. The high frequency data, like the personal income and spending report, continue to show a strong consumer. Some of the long term negatives have also gotten “less bad” as well. As usual, clicking over and reading will bring you up to the virtual moment as to the data, and reward me a little bit for organizing it...

Read More »Pharmacy Benefit Managers (PBMs) are Hiking the Price of Drugs

A follow-up to the much longer report on Insulin (test on this later) and how PBMs impact pricing on other drugs. “Insulin A Drug Pricing Analysis,” Angry Bear. “Drug manufacturers alone set and raise drug prices, and PBMs are holding drug companies accountable by negotiating the lowest possible cost for drugs, including insulins, on behalf of patients.“ According to 46brooklyn, this is an overly simplistic view on drug pricing. It should be...

Read More »The business model of American research universities

Ever since I graduated high school, I’ve been associated with one or another research university, either as a student, a postdoc or a faculty. And during nearly all of that time, I was engaged in some form of research.William Rouse wrote a book in 2016 entitled “Universities as Complex Enterprises: How Academia Works, Why it Works These Ways, and Where the University Enterprise is Headed.” He updated and summarized his research in a paper published...

Read More »The Middlemen of Healthcare Pharma Especially

I copied the two paragraphs below (actually I took one and split it) from Matt Stoller’s Big News Letter. Matt is talking about the same issues I have been talking about for years. The Pharmaceutical Industry and their rip off pricing. It is a good read if you wonder over there. The YouTube is also from his site. I can not lay claim to posting such before. Doctor Glaucomflecken makes a valid point. United Healthcare Group is one of the top PBMs....

Read More »The shingles vaccine may protect from dementia

As America ages, dementia is becoming a bigger and bigger healthcare burden. Medicare won’t pay for long-term nursing home care. Dementia will be a growing drag on the US economy at least until the baby boomer die off.Shingles is caused by herpes virus, a neurotrophic virus. For many people who had chicken pox as a child, the virus hid out in their ganglia, emerging decades later as a painful rash. There’s a vaccine for shingles now that is protective...

Read More »Personal income, spending, and prices

Personal income, spending, and prices: consumer remains strong, inflation close to 2% target no matter how you measure it – by New Deal democrat I am on the road today, so I will have to keep this brief. In June nominal personal income rose 0.3%, and spending rose 0.2%. Since PCE inflation rose less than 0.1%, real income rose 0.2% and real spending rose 0.1%. Since spending on services tends to rise even during recessions, the more...

Read More »Again not recessionary, but more evidence the Fed should start to lower rates now.

Coincident real GDP metric is good, but leading indicators from the GDP report are not: is the Fed listening? – by New Deal democrat Real GDP grew 0.7% in Q2, or a 2.8% annualized rate, a perfectly good number in line with the past three years: Probably even more importantly, the GDP deflator increased 0.6% for the quarter, or at an annualized rate of 2.3%. As the below graph shows, this is a perfectly normal rate going back to the start...

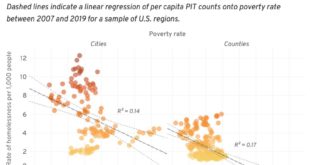

Read More »Homelessness is a Housing Problem

by Gregg Colburn and Clayton Page Aldern Homelessness is a housing problem Somewhat of a writeup on homelessness using a review and the author’s introduction to the economic problem. Amazon published review of the book, “Homelessness Is a Housing Problem.” Authors Gregg Colburn and Clayton Page Aldern seek to explain the substantial regional variation in rates of homelessness in cities across the United States. In a departure from many...

Read More » Heterodox

Heterodox