Who gets the money? Follow the assets. by Steve Roth Originally Published at Wealth Economics This post by Judd Legum at Popular Information (read and subscribe!) prompts me to revisit the issue of share buybacks. This passage in particular: It seems eye-popping. But is it? Even (especially?) finance and econ types don’t really understand buybacks from a big-picture, macro, national-accounting perspective. Here’s a shot at explaining...

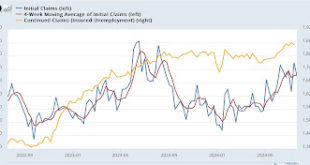

Read More »Comparing This Weeks Jobless claims to Last Summer

Jobless claims hold their ground against the most challenging comparisons of last summer – by New Deal democrat This week completed the most challenging YoY comparisons with last summer. Recall that I suspect there may be some unresolved post-pandemic seasonality in these numbers, as this year’s increase starting in late spring has been close to a mirror image of last year’s increase. So if there is some real new weakness in jobless claims,...

Read More »Suppostion? Economic performance is stronger when Democrats hold the White House

It appears people will argue the economic and social positives of the different political parties over periods of time. They probably are different. So, EPI has managed to chart the differences. What the first four charts do is detail the differences between the two parties over two different time periods. One time period staring in 1949 and the next time period in 1981. A contrast in beliefs? Maybe . . . The last two Appendix Charts compare...

Read More »Dean Baker Editorializing on the Economy

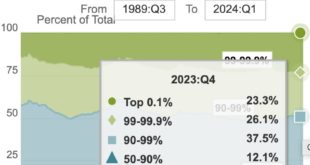

Back to my points (AB), we have survived a pandemic, provided for the welfare of the citizenry, and the nation is on its way to better times. The only sticking point being the 2017 tax cut which is leaving the nation with another reoccurring deficit. How quick the influential 1-percenters were to move away from Biden as this was on his list of things to fix. Will a President Kamala make it a priority too? ~~~~~~~~ Back in the 1990s, when...

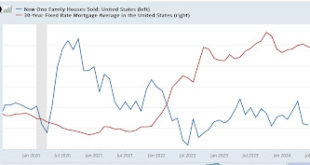

Read More »7%+ mortgages weigh on new home sales, while prices continue slight downtrend, and inventory uptrend

– by New Deal democrat Now that we have new as well as existing home sales, let’s take a little more extended look at the housing sector. Let me start by reiterating the big picture: mortgage rates lead sales, which in turn lead prices. Further, new home sales are the most leading of all housing metrics, but they are noisy and heavily revised. The much less noisy single family permits lag them slightly. Finally, we are looking for relative...

Read More »A Small Matter of Diversity and Inclusion

After going through a generation (baby-boomers) of supporting equal rights for “all” which includes women (later in the effort), Corporate America (in this case John Deere) is reversing its course. The stance is a “whatever will be, will be” and we will not make an effort to level the playing field. I was working on a cable scaffold about 20 stories up. A 20th floor window opened up and another worker with his canvas bag of tools stepped on the...

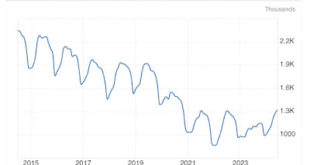

Read More »Existing homes inventory and prices move towards normalization and Sales . . . ?

Existing home market inventory and prices move slowly towards normalization, while sales remain punk – by New Deal democrat Since existing-homes sales are less important for economic purposes, and especially with new home sales being reported tomorrow morning, I will keep this brief. What we are looking for is rebalancing in the housing market. For that to happen, we want the inventory of existing homes to increase, prices to stabilize, and...

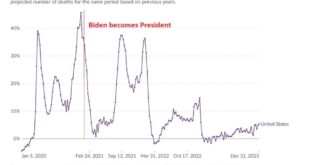

Read More »A Partial Presentation- Joe Biden’s Legacy

Biden’s legacy: a Summary by Noah Smith – an introduction to Noahpinion Noahpinion Joe Biden announced today that he won’t seek reelection for President. We don’t yet know who will replace him, but we know Biden’s tenure in office will soon end. Now is the perfect time to talk about Biden’s legacy as America’s 46th President. How Presidents are judged by history is a complicated question, and I don’t have much confidence in my ability...

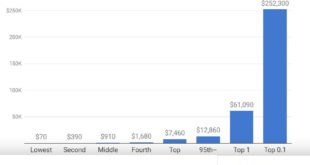

Read More »2017 Tax Breaks and Jobs Act Failed to Deliver

Morning . . . One other factor I believe you may have missed (too many factors). The 2017 Tax Cuts and Jobs Act did not pay for itself over the last 10 years. Just a small matter of it passing using Reconciliation which insists it pay for itself (being redundant here). The repeal of it impacts those in the upper 10% (or more) of the taxpayers and more so the 1 percenter who make up a million (taxpayers) or slightly more taxpayers having income...

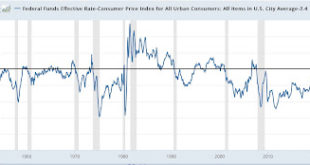

Read More »Are Real Interest Rates Restrictive?

– by New Deal democrat Over the weekend Harvard econ professor Jason Furman suggested that the Fed funds rate is not very restrictive: “As inflation has come down the real Federal funds rate has risen and is now the most restrictive it has been this cycle, a point that Austin Goolsbee has emphasized a number of times . . . That is not the way I would look at it. The rates that matter for the economy are long rates. and expected inflation...

Read More » Heterodox

Heterodox