We’re seriously considering a hybrid for our next car. One species of the hybrid genus is the “plug-in hybrid,” which seemed appealing to me, both from the standpoint of gas economy and to reduce our carbon footprint. Caveat emptor:“In one study from the ICCT published in 2022, researchers examined real-world driving habits of people in plug-in hybrids. While the method used to determine official emissions values estimated that drivers use electricity...

Read More »Student Loan Crisis Would Likely Worsen Under a Second Trump Administration

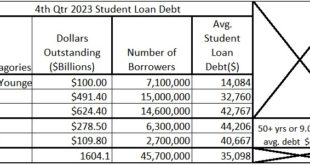

I have written about student loans or have added articles about student loans to Angry Bear here, here, here, here, etc, etc, etc. I go back years on the topic as well as Alan Collinge of Student Loan Justice does. Politicians resist loan forgiveness claiming students are taking advantage of the system. It is a lie and many of the students have interest on loans which surpass the principal. I know of no bank or business loan which has such harsh...

Read More »US lost more than two local newspapers a week this year. Why?

I still like to read the news “pages” rather than hear the news. Turning a page is more thorough than watching 2-minute clips on TV news. It challenges and stimulates the mind also. If you want short, cheap, and incomplete state, national, and global news; then the TV is your answer. Reading the daily and weekly news will render far more accurate information. You will decide for yourself what is true or false while reading the detail. US lost...

Read More »The EV market is evolving

Kevin Drum has a post up showing that EV sales have plateaued recently in the US. It’s not clear to me whether that’s all EVs or just Teslas, but since Teslas remain the dominant EVs in the US, that’s a distinction without a difference.I’d be happy to see more EVs on the road. But what would make me buy one? Well, one issue is price. I’d consider an econobox EV under $30K, but auto makers seem mostly to be slotting EVs as luxury purchases. Then...

Read More »New Deal democrat Weekly Indicators May 27 – 31 2024

Weekly Indicators for May 27 – 31 at Seeking Alpha – by New Deal democrat My “Weekly Indicators” post is up at Seeking Alpha. None of the high frequency indicators made any meaningful change this week. The short term outlook continues to be positive. As I wrote yesterday in my summation of the personal income and spending report, the leading goods-producing sectors of manufacturing and construction are most important to my analysis of where...

Read More »Battery Storage Growth to Fill Supply Gaps for States

Oil Price author Irina Slav has an interesting story up about California using battery storage of GWs to fill in the supply gaps during Summer electricity needs due to heat. Brief and a short paragraph taken from the article Rapid Battery Storage Growth Will Help California Avoid Blackouts This Summer. California could avoid rolling blackouts this summer thanks to a fast buildout in battery storage capacity, the state’s Energy Commission said...

Read More »April personal income and spending: a flat report consistent with either a temporary pause or weakness ahead

– by New Deal democrat Personal income and spending have become one of the two most important monthly reports I follow. This is in large part because the big question this year is whether the contractionary effects of Fed tightening have just been delayed until this year, or whether the fact that there have been no rate hikes since last summer mean that the expansion will strengthen. Because real personal spending on services for the past 50...

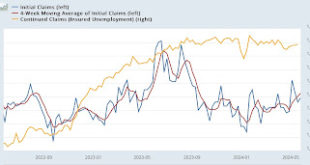

Read More »Slight increasing trend in initial jobless claims, but continuing claims continue slightly lower

– by New Deal democrat Initial jobless claims rose 3,000 last week to 219,000. More importantly, the 4 week moving average rose another 2,500 to 222,500, the highest level in 9 months. With the usual one week lag, continuing claims rose 4,000 to 1.791 million: On the one hand, it does appear that claims have been in a small uptrend for the last four weeks. But on the other hand, recall that there was a similar increase last May into summer,...

Read More »The good news, bad news economy

– by New Deal democrat We’ll get weekly unemployment claims tomorrow, and the very important personal income and spending report Friday, before we begin the slew of reports for the beginning of June next week. But since there’s a slow news day today, let’s take a bigger picture look at the state of the economy. As always, you can find optimistic data if you look for it, and DOOOMish data as well. Usually – and right now is one of those usual...

Read More »People Moving Farther Out from City Centers to Avoid Exposure to Pandemics

More People Moved Farther Away from City Centers Since Covid-19 by Lindsay Spell and Marc Perry CENSUS.Gov I guess people did not like the threat of catching Covid in crowded areas so they are going to the suburbs. Even if they are in less populous areas, they still will have to get the vaccines and distance themselves. ~~~~~~~~ In a possible sign of the COVID-19 pandemic’s lasting impact, the country’s fastest-growing places are...

Read More » Heterodox

Heterodox