This is a good recital by the GAO on Food Prices, its trends, factors affecting it, and how the government plays a role in it. It covers quite a bit of territory on costs and prices pre-2021 and 2021 to 2022. It was those two years when Covid was having an impact on the nation and globally. The impact came in getting food to market, processing it, and making it available. If have some time to review this report, I believe you will come away with...

Read More »The coming of the 14th Amendment and Why

The following sounds familiar, yes? Not much has changed since the Civil War. Still the same attitude, we belong but only on our terms. The Democrats of the South, now today’s Republicans starve for some type of leadership and glommed on to trump. What a compliment to trump that someone needed him and adored him. The murder of Lincoln was unfortunate. Southerners again had Black Americans under their thumb regardless of constitutional amendments...

Read More »New Deal democrats Weekly Indicators January 29 – February 2

Weekly Indicators for January 29 – February 2 at Seeking Alpha – by New Deal democrat My “Weekly Indicators” post is up at Seeking Alpha. One week ago many of the high frequency indicators hit an “air pocket.” This week some – but not all! – resolved. At present there is one of the more anomalous situations I have observed. Most of the data is not just positive, but frequently strongly so. On the other hand, there is a nagging minority...

Read More »Just One U.S. GDP Chart to Talk About

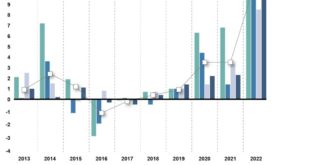

U.S. winning world economic war, axios.com, Neil Irwin. The United States economy grew faster than any other large, advanced economy last year, by a wide margin, and is on track to do so again in 2024. Why it matters: America’s outperformance is rooted in its distinctive structural strengths, policy choices, and some luck. It reflects a fundamental resilience in the world’s largest economy that is easy to overlook amid the nation’s...

Read More »January jobs report: a very strong report, but with pockets of significant weakness

January jobs report: A very strong report, but with pockets of significant weakness – by New Deal democrat As per usual, the Establishment and Household portions of the jobs report gave somewhat different impressions, complicated by annual revisions to each. In general, not only was January excellent of the Establishment report, but most months in the past year were revised upward as well. The Household report mainly was “meh,” neither...

Read More »New month’s data starts out with leading indicators in both manufacturing and construction indicating expansion

New month’s data starts out with leading indicators in both manufacturing and construction indicating expansion – by New Deal democrat As usual, the new month’s data starts out with information on manufacturing and construction. The ISM manufacturing index has been a good leading indicator in that sector for 75 years. The difference over time, especially the last 20 years, is that manufacturing makes up a smaller share of the total US...

Read More »Wrong about Biden economy

We are into the fourth year of Biden’s first term as President and some are finally beginning to realize that maybe, just maybe what Joe did was mostly correct. Yeah sure, there were some things he got wrong. However, he did lead us through one of the worst economic calamities the nation has survived, a pandemic. Democrats in Congress did help. In 2008, Obama had two years of Democrat support which went away in 2010. Recognized Biden’s efforts...

Read More »Continuing claims near 2+ year high; likely the effect of Silicon Valley layoffs

Continuing claims near 2+ year high; likely the effect of Silicon Valley layoffs – by New Deal democrat Initial claims rose by 9,000 to a three month high of 224,000 last week. The four-week moving average also rose 5,350 to 207,750. With the usual one-week lag, however, continuing claims rose sharply, by 70,000, to 1.898 million, close to a 2+ year high: On the more important YoY% change basis, initial claims were up 12.6%, while the...

Read More »A comment on median vs. mean, and job-stratified wage growth

A comment on median vs. mean, and job-stratified wage growth – by New Deal democrat Before today’s avalanche of data, I wanted to comment briefly on the Employment Cost Index for Q4 that was reported yesterday. This index has the advantage of weighting for type of employment. If low wage workers gain a disproportionate number of jobs, that will tend to hold down *average* wages. But the ECI hold the weighting of low, medium, and high wage...

Read More »New Solar Panel Technology

I know Joel had Solar Panels on his home in St. Louis. He was pretty happy with them. If I remember correctly, he had them for a number of years. Since I am in AZ, it makes sense to install them. Maybe when we sit down and consider the return we will consider such. They are not low in cost. Japan’s new solar panel technology (perovskite solar panel) might forever alter the renewables market, The Week, Devika Rao For a long time, the solar...

Read More » Heterodox

Heterodox