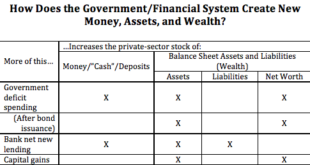

Asymptosis » Actually, Only Banks Print Money, Steve Roth I’m thinking this headline will raise some eyebrows in the MMT community. But it’s not really so radical. It’s just using the word money very carefully, as defined here. Starting with the big picture: You can compare the magnitude of these asset-creation mechanisms here. (Hint: cap gains rule.) The key concept: “money” here just means a particular type of financial instrument,...

Read More »This Time It’s Different ?

I guess this is the latest installment in my soft landing series. However, it might also be a warning of terrible trouble in the fairly near future (next 5 years). It is certainly proof (if more were needed) that I am clueless. The topic is the US housing market. This is highly related to the (possible) soft landing as one important surprise is that residential construction has held up in spite of high mortgage interest rates. The question for...

Read More »December jobs report: consistent with a “soft landing,” despite discordance in household data

December jobs report: consistent with a “soft landing,” despite discordance in household data – by New Deal democrat My focus remains on whether jobs gains are most consistent with a “soft landing,” i.e., no further deterioration, or whether deceleration is ongoing; and more specifically: Whether there is further deceleration in jobs gains compared with the last 6-month average Whether the unemployment rate is neutral or decreasing; or...

Read More »Initial claims: the return of “almost nobody is getting laid off”

Initial claims: the return of “almost nobody is getting laid off” – by New Deal democrat We’re back to the virtuous scenario where almost nobody is getting laid off. Initial jobless claims for the last week of December declined -18,000 to 202,000, the lowest since October. More importantly, the 4-week average declined -4,750 to 207,750, the lowest since last January. With the usual one-week delay, continuing claims declined -31,000 to 1.855...

Read More »Being grateful for one big thing Baby boomers did

This is Part 1 of 2 of an article by Andy Kiersz of Business Insider. Rather than smash it altogether, I thought splitting it into two likely parts would improve the presentation on Angry Bear. Gen Z, Millennials Should Stop Complaining About Baby Boomers, Economy, business insider, Andy Kiersz Nostalgia might be one of the most powerful and enduring human emotions. Civilizations have always looked to a golden age in the past when times were...

Read More »ISM manufacturing index remains in contraction, and the trend in vehicle sales may have turned down as well

ISM manufacturing index remains in contraction, and the trend in vehicle sales may have turned down as well by New Deal democrat The ISM manufacturing index, where any value below 50 indicates contraction, once again came in negative for both the total index, at 47.4, and the more leading new orders subindex, at 47.1. Both have been indicating contraction for more than a year: Which begs the question. Because, despite a nearly flawless 75...

Read More »Open Thread January 4 2024 overly “restrictive” monetary policy

Dollar eases as Fed minutes offer few clues on rate cuts timeline, MSN, Markets Today Tags: monetary policy

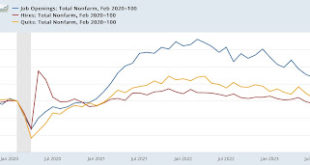

Read More »New Year, same old labor market deceleration

New Year, same old labor market deceleration – by New Deal democrat This morning’s JOLTS report for November continued the same trend of labor market deceleration that we have seen since the blazing hot boom of 2021. Job openings declined -62,000 to 8.790 million, the lowest level since March 2021. Actual hires fell sharply, by -363,000 to 5.465 million, the lowest since the pandemic lockdown month of April 2020. Quits declined by -157,000...

Read More »American society was not always so car-centric.

Introduction: Nice piece on how Americans are so tied to their gasoline powered cars, pickup trucks, etc. and the impact on cities and environment. What is key to this article and the author’s thought is this statement: “The obvious solution … lies only in a radical revision of our conception of what a city street is for.” Where I live, the smaller city is 30 minutes away at 65 MPH (if they are doing such). If you drive faster, maybe you...

Read More »Construction spending continued to increase in November

Construction spending continued to increase in November – by New Deal democrat I’m feeling a little under the weather today, so I am going to keep this brief. Total construction spending rose 0.4% in November, while residential construction rose 1.1%: Keep in mind that these are nominal numbers, affected by the cost of construction materials. Typically residential construction moves in tandem with building units under construction....

Read More » Heterodox

Heterodox