Housing permits and starts for November: yet more evidence of an economy primed for takeoff in 2021 If there was bad news yesterday in the further increase of initial jobless claims, there was also good news in the 10+ year highs in new housing permits. Here’s the graph of permits (blue), single-family permits (red, right scale), and housing starts (green): Not only total permits but also the much less noisy single-family permits made...

Read More »Portfolio Capital Flows to Emerging Markets amid the Pandemic

by Joseph Joyce Portfolio Capital Flows to Emerging Markets amid the Pandemic Among the most notable economic responses to the COVID-19 pandemic has been the turnaround in capital flows to emerging markets. A sudden reversal in portfolio flows of over $100 billion to these countries in March has been offset by a surge of capital this fall. But many of these countries have accumulated debt burdens that will affect their ability to recover...

Read More »November retail sales poor m/m, but trend still good

November retail sales poor m/m, but trend still good Retail sales for November clocked in at -1.1% without adjusting for inflation. After inflation, the number was -1.3% m/m.While the seasonally adjusted headline was certainly bad, this year tracking the unadjusted numbers is also important due to the havoc COVID is playing with consumption and employment. So the below graph shows the m/m changes over the past 5 years of both the adjusted (blue)...

Read More »Jobless claims negative trend reversal likely; expect a poor December jobs number

Jobless claims negative trend reversal likely; expect a poor December jobs number This week new jobless claims rose further from their recent pandemic lows, while continuing claims, seasonally adjusted, made a new pandemic low. Nevertheless, I strongly suspect the downward trend has broken.On an unadjusted basis, new jobless claims declined by 21,335 to 935,138. Seasonally adjusted claims, on the other hand, rose by 23,000 to 885,000. The 4-week...

Read More »Industrial production continues to progress, at a slower rate, in November

Industrial production continues to progress, at a slower rate, in November I call industrial production the “King of Coincident Indicators” because it is the metric that is usually the decisive one for the NBER in determining when recessions and expansions begin and end. November’s report continues the trend of a strong rebound in production, as overall production increased 0.4% from October, and manufacturing 0.8%. Total production has...

Read More »Portfolio Capital Flows to Emerging Markets amid the Pandemic

by Joseph Joyce Portfolio Capital Flows to Emerging Markets amid the Pandemic Among the most notable economic responses to the COVID-19 pandemic has been the turnaround in capital flows to emerging markets. A sudden reversal in portfolio flows of over $100 billion to these countries in March has been offset by a surge of capital this fall. But many of these countries have accumulated debt burdens that will affect their ability to recover from...

Read More »November inflation tame again, with the economy weak, but real wage gains strong

November inflation tame again, with the economy weak, but real wage gains strong Consumer prices rose 0.2% in November on a seasonally adjusted basis, but declined -0.1% unadjusted: As shown in the above graph, a November decline in prices is typical. This year’s decline was less than either of the past two years.On a YoY basis, consumer prices were only up 1.2%: For the past 40 years, recessions had typically happened when CPI less...

Read More »JOLTS report for October: similar to previous 2 recoveries, but a decline in actual hiring may be a warning

JOLTS report for October: similar to previous 2 recoveries, but a decline in actual hiring may be a warning This morning’s JOLTS report for October showed a jobs market recovery that, for one month at least, paused. Openings and quits were up (good), but layoffs and discharges were also up (bad) while hires were down (bad). While the JOLTS data is a deep dive into the dynamics of the labor market, since it only dates from 2001, there are only...

Read More »Noah Smith on Macroeconomists behaving well

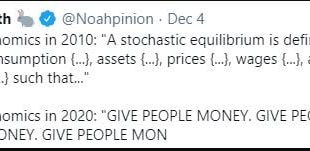

Noah Smith wrote a very interesting post on how macroeconomists are behaving very differently in 2020 than in 2008-9 : The new macro: “Give people money” . He notes two differences : first there is little discussing of theory or of the models used in most peer reviewed articles, second there is (as far as he can tell and he would know more than me) a virtual consensus that we need stimulus and that austerity would be a mistake. Or as a tweet...

Read More »Constructing An Alternative Reality

Constructing An Alternative Reality This has been gradually developing for about the last quarter of a century or so. While there was some of this going on before, it took off after the Newt Gingrich-led GOP took over Congress in the 94 election and Rush Limbaugh began his radio show. Not long after Fox News began a more aggressive stance against President Clinton, pushing any and every scandal that would lead to his impeachment for lying about...

Read More » Heterodox

Heterodox