July jobs report: a very good *relative* gain – perhaps the last HEADLINES: 1,763,000 million jobs gained. Together with the gains of May and June, this makes up about 42% of the 22.1 million job losses in March and April. U3 unemployment rate declined -0.9% from 11.1% to 10.2%, compared with the January low of 3.5%. U6 underemployment rate declined -1.5% from 18.0% to 16.5%, compared with the January low of 6.9%. Those on temporary layoff decreased...

Read More »Necessity of America

If not the US, who? In order to get it right, it is so important that we know what is going on now. In the midst of a pandemic, overpopulated, ever more marginalized by Global Warming, beggared with inequality, and sorely lacking leadership; the world is indeed going to hell in a handbasket. Take a look: An index of Fragile States: https://en.wikipedia.org/wiki/Failed_state#/media/File:Fragile_State_Index_2018.png...

Read More »How To Measure Quarterly Changes In GDP Can Make A Big Difference

How To Measure Quarterly Changes In GDP Can Make A Big Difference We have had dramatic headlines and commentary in recent days since the BEA issued its initial estimate of quarterly changes in GDP, which they do not officially measure on an shorter time period. This is a measure of the average GDP in one quarter compared to the average GDP in the next quarter. Looking at Q1 of this year and Q2 of this year, they reported the largest quarterly decline...

Read More »Q2 GDP does not bode well for early 2021

Q2 GDP does not bode well for early 2021 There are two components of quarterly GDP that are long leading indicators, giving us information about the economy 12 months from now. If you think, as I do, that it is likely there will be a new Administration in Washington next year, which will competently follow the science, then there is every reason to believe that by 12 months from now the pandemic will have been contained, and so the long leading...

Read More »Catching up with wages, income, and layoffs

Catching up with wages, income, and layoffs Yesterday and today have seen several significant data releases. Let’s catch up. Wages The Employment Cost Index was released for Q2 this morning. This is a particularly important release because unlike the monthly “average hourly wages” number, this report normalizes by job category, e.g., it compares clerks’ wages in Q1 with clerks’ wages in Q2. So if clerks have experienced widespread wage cuts, it should...

Read More »A Republican Idea for Onshoring Pharmaceutical Intangible Assets

A Republican Idea for Onshoring Pharmaceutical Intangible Assets Alex Parker reports on a proposal from Representative Darin LaHood: As part of the next round of pandemic relief, House Republicans are pushing new incentives for companies to bring home offshore intellectual property — something that they contend could boost job growth but that critics see as another corporate giveaway … While the 2017 Tax Cuts and Jobs Act overhauled the federal tax code...

Read More »International Factor Payments and the Pandemic

(Dan here…Joseph Joyce writes for Econbrowser) International Factor Payments and the Pandemic I have written a piece on international factor payments (migrants’ remittances, FDI income) and the pandemic for Econbrowser, the widely followed blog of Menzie Chinn of the University of Wisconsin and James Hamilton of the University of California-San Diego. You can find it here:...

Read More »Goodbye To The Last True Georgist Economist: Mason Gaffney

Goodbye To The Last True Georgist Economist: Mason Gaffney Mason (“Mase”) Gaffney died on July 26 in Redlands, CA of Covid-19 at age 96. He was both a great guy as well as arguably what the title to this says: “the last true Georgist economist,” with such economists being followers of Henry George, whose 1878 book, Progress and Poverty, was the best-selling book on economics in the US during the 19th century. George was a journalist who ran...

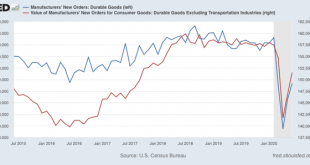

Read More »June durable goods orders continue rebound

June durable goods orders continue rebound Last week I wrote a synopsis of the short leading indicators and what they suggested about the ultimate Presidential election result in November. Basically, they have improved over the last several months and suggested the polls would tighten compared with the present. Among the missing June indicators were durable goods. They were reported this morning, and continued their sharp rebound from May, making up in...

Read More »Managing A Zoom Conference

Managing A Zoom Conference As of the end of this week, I completed chairing the 30th annual international conference of the Society for Chaos Theory in Psychology and Life Sciences, with 54 participants from around the world. It basically went well, and it was kind of cool to make introductory remarks at 8 AM during EDT, with somebody on at 6 AM their time in Montana and someone else on at 10 PM their time in Sydney, Australia. It can be done, and...

Read More » Heterodox

Heterodox