Does Menzie Chinn Or Tyler Cowen Replace Mark Thoma? The retirement of Mark Thoma, whose Economist’s View has been praised on his retirement with having transformed the econoblogosphere back in the mid- noughties by linking regularly, daily in his heyday, to other blogs, including this one. Thanks to him when the big crash happened, there was a wide open debate across levels and schools of thought in economics about what was going down. But for some...

Read More »Weekly Indicators for December 16 – 20 at Seeking Alpha

by New Deal democrat Weekly Indicators for December 16 – 20 at Seeking Alpha My Weekly Indicators post is Up at Seeking Alpha. Are we just having a slowdown, or actually slipping into contraction? The short leading indicators would like to have a word. As usual, clicking over and reading should bring you up to the moment on the economy, and rewards me a little bit for my efforts.

Read More »The consumer vs. producer divergence widens at year end

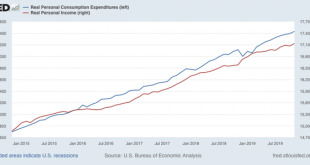

The consumer vs. producer divergence widens at year end My economic theme for about the past half year has been the contrast between the floundering producer sector vs. the decent consumer sector. With two of the last important reports of the year out this morning, that divergence has been highlighted. First, the good news: real personal income rose +0.4% in November, and real personal spending rose +0.3%. Here’s a look at the past five years: Figure...

Read More »The field was rigid and closed until Mark Thoma’s Economist’s View opened the debate to all comers

Noah Smith’s The End of Econ Blogging’s Golden Age, Bloomberg Opinion. December 17, 2019. “If someone asked you to name the greatest economics blogger of all time, you might name Paul Krugman, or my Bloomberg Opinion colleague Tyler Cowen. But there’s a third name that deserves to be on that short list: Mark Thoma, an economics professor at the University of Oregon. On Friday, Thoma announced a well-deserved retirement. But the changes his blog made in...

Read More »Review: Secondhand

by David Zetland (originally published at One-handed Economist) Review: Secondhand I read this 2019 book at record speed due to its breezy (“magazine”) tone and discussion of one of my favorite passions: reusing old stuff. A few years ago Adam Minter wrote Junkyard Planet about the trash trade, but many readers told him about how they reused stuff rather than about their trash. Their passion led to this book (subtitle: Travels in the New Global Garage...

Read More »Initial claims turn neutral on seasonality, but no red flag

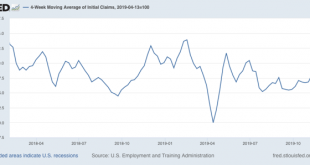

Initial claims turn neutral on seasonality, but no red flag As you know, I’ve been monitoring initial jobless claims closely for the past several months, to see if there are any signs of a slowdown turning into something worse. Simply put, if businesses aren’t laying employees off, those same people are consumers who are going to continue to spend, which is 70% of the total economy. So the lack of any such increase has been the best argument that no...

Read More »Is The Trump Trade War Over?

Is The Trump Trade War Over? Probably not, but maybe. The basic problem is that Trump has long wanted to beat up on other nations in a trade war; but now he is getting impeached, he needs positive news, and the stock markets like words of his making trade deals. So we get his trade deals, but it is all sort of a mess. So there are two matters here. One involves China, discussed in a new post here by pgl, which I shall comment on later. But my quick take...

Read More »Exaggerated Benefits for U.S. Farmers from the China Trade News

Exaggerated Benefits for U.S. Farmers from the China Trade News How gullible is Reuters? China will likely hit $50 billion in purchases of U.S. agricultural products, U.S. President Donald Trump said on Friday after earlier announcing that he would roll back scheduled tariffs on Chinese imports as Washington and Beijing finalized an initial trade deal. That was their opening paragraph. Fortune had a different take: The Markets Have Spoken: Phase One...

Read More »November average real wage growth stable, but aggregate growth now puts expansion in second place behind 1990s

November average real wage growth stable, but aggregate growth now puts expansion in second place behind 1990s November consumer inflation came in at +0.3%. Since in last Friday’s jobs report average hourly earnings also increased +0.3%, real average hourly earnings were unchanged: In a longer term perspective, this means that real wages remain at 97.9% of their all time high in January 1973: Since in November 2018 consumer inflation came in a 0%,...

Read More »Smoking At The Fed

Smoking At The Fed This is about the now late Paul Volcker, but I shall come in from an odd and particular persprctive. Upfront, I did meet the late Paul Volcker several times, although never in an official situation. Much of “inside” stuff I shall say comes from others. I do not know the details of the Fed prior to the 1970s, but at least as of the Chairmanship of Milton Friedman’s major prof, Arthur Burns, who capitulated to the demands of Nixon for...

Read More » Heterodox

Heterodox