Forward Creeping Excessmass Wins The War On Christmas “Excessmass” is a term neologized in a column in the late 1990s in the Wall Street Journal (sorry, unable to find precise date) by my JMU colleague, Bill Wood. A devout Brethren, he was and remains disgusted by the crass commercialism associated with the Christmas holiday in the US. In this column he proposed dividing the holiday into two: a strictly religious one, “the Nativity” without gift giving,...

Read More »The chart of the decade

The chart of the decade Today doesn’t just mark the end of 2019, but the end of the 2010’s as well. So it’s only suitable that I post the one chart that I think most explains the economy over the past 10 years. In terms of public policy, that chart would be of the continual explosion of income and wealth inequality, particularly at the very top 0.1% or 0.01% of the distribution. But in terms of explaining why the economy has chugged along at roughly 2%...

Read More »Thiessen Balances His Policy Defense Of Trump

Thiessen Balances His Policy Defense Of Trump Several days ago I posted on Marc A. Thiessen’s defense of 10 policies by Trump in WaPo. I must now credit him with today on New Year’s Eve in the same venue publishing a column “The 10 worst things Trump did in 2019.” Good for him, some balance after all. I agree these are all bad things, although I disagree with some of his analysis of them, with a few caveats especially on a couple of the foreign...

Read More »2020 Hindsight: Why the world is not zero-sum

According to a report, Global Waves of Debt, pre-published by the International Bank for Reconstruction and Development: Waves of debt accumulation have been a recurrent feature of the global economy over the past fifty years. In emerging and developing countries, there have been four major debt waves since 1970. The first three waves ended in financial crises—the Latin American debt crisis of the 1980s, the Asia financial crisis of the late 1990s, and...

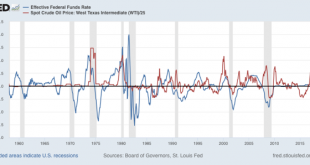

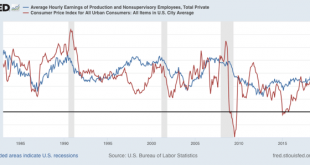

Read More »A response to Kevin Drum: for wages and inflation, it’s all about the price of gas

A response to Kevin Drum: for wages and inflation, it’s all about the price of gas Last week Kevin Drum had the following inquiry: [H]ow is it that wages can go up but overall inflation remains so subdued? That seems to be the real disconnect here. During the dotcom boom, wages went up but inflation remained around 3 percent. During the housing bubble, wages didn’t go up and inflation remained around 3-4 percent. Right now, wages are going up but...

Read More »Weekly Indicators for December 23 – 27 at Seeking Alpha

by New Deal democrat Weekly Indicators for December 23 – 27 at Seeking Alpha My last Weekly Indicators post of the year is up at Seeking Alpha. The producer side of the economy seems to be worsening, while initial jobless claims suggest some weakness is spreading over to the consumer side. As usual, clicking over and reading helps reward me a little bit for the effort I put in.

Read More »The Unreasonableness Of The Policy Defense Of Trump

The Unreasonableness Of The Policy Defense Of Trump In today’s (12/27/19) Washington Post, regular Trump defender, Mark A. Thiessen published a column, “The 10 best things Trump did in 2019” This turns out to be mostly things either not worth defending or Thiessen, who simply never criticizes Trump, misrepresenting situations. Here they are. 10. “He continued to deliver for the forgotten Americans.” This amounts to unemployment continuing to decline,...

Read More »Two Can’t Miss Sessions in San Diego Next Week

Two Can’t Miss Sessions in San Diego Next Week Well, I can’t miss them because I’m in them. You can, but why would you? Climate Crisis Mitigation: Implementing a Green New Deal and More Union for Radical Political Economics: Paper Session Friday, Jan. 3, 10:15am–12:15pm Manchester Grand Hyatt San Diego – La Jolla B “Financial Bailout Spending Would Have Paid for Thirty Years of Climate Crisis Mitigation: Implementing a Global Green New Deal and Marshall...

Read More »Anand Giridharadas in a Dutch interview: Their Parliament’s Finance Committee called him

I found this interesting. Mr. Giridharadas was invited to discuss his perspective regarding his themes of his book Winners take all. He was invited by the Dutch Parliament’s Finance Committee to discuss his book. All 6 parties showed up. All had been given the book prior and several had read it. This is a link to the entire 1.5 hour presentation via Youtube. One of his points that I found most interesting was at 7:13 of the discussion, during his...

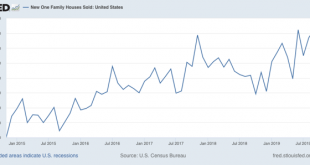

Read More »Happy [insert name of preferred religious holiday here]! 3 quick hits

Happy [insert name of preferred religious holiday here]! 3 quick hits I’ll be traveling and enjoying the holiday for a few days, so … light to non-existent posting! In the meantime, three quick hits for you: 1. New home sales – continued strength in this very forward looking sector. Even though sales declined m/m, the upward trend is pretty clear: Figure 1 2. Durable goods – flat (blue), except for Boeing (red), which is bad: Since Boeing is...

Read More » Heterodox

Heterodox