As I mentioned, this 4 part presentation is being done by Sesotec GmbH, a company which manufactures recycling equipment. Even so the information given by Sesotec is to the point on the topic of pollution by man made packaging and products which can be sued again and again and in some cases up to 8 times. Fair warning as the pitch comes with regards to Sesotec’s abilities. Around 70 years after the first plastic product hit the market, a world without...

Read More »Chaos Theory And Global Climate Change

Chaos Theory And Global Climate Change I am currently attending the Southern Economic Association meetings in Fort Lauderdale, where the street facing the hotel was underwater during the most recent hurricane to pass through. Anyway, I saw a talk today that took me back to when I first learned about chaos theory, actuallly in the early 1970s before the word “chaos” was used for it. I learned about it and the butterfly effect, aka sensitive dependence on...

Read More »Excellent October housing report is good news for employment

Excellent October housing report is good news for employment I’ll have a more comprehensive report up at Seeking Alpha, and I’ll link to it when it goes up, (UPDATE: It’s finally up, here ) but in the meantime let me just share the least volatile most leading component which is single family permits: These made a new expansion high. The housing rebound, following lower mortgage rates, is firmly in place. Additionally, both housing completed and under...

Read More »Plastic: Part of the Problem . . . Part of the Solution – Part 2: the European Union’s Solution

As you can read for yourself, this is the second part of the series. This part will introduce the EU’s proposed solution to plastic waste material of which Sesotec is to be a part of the solution. Since I am using Sesotec’s information, I will be stating their name as owner’s of this information from time to time. Some 70 years after the first plastic products hit the market, a world without plastic waste still appears far off. We need a different...

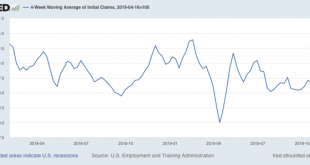

Read More »Initial claims weaker, but still not at cautionary levels

Initial claims weaker, but still not at cautionary levels I’ve been monitoring initial jobless claims closely for the past several months, to see if there are any signs of a slowdown turning into something worse. Simply put, no recession is going to begin unless and until layoffs increase, and the lack of any such increase has been the best argument that no recession is imminent. My two thresholds for initial claims are: 1. If the four week average on...

Read More »A yellow flag from temporary hiring

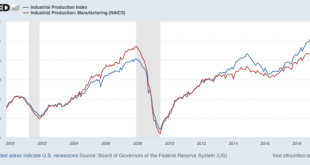

A yellow flag from temporary hiring In the conclusion of my latest Weekly Indicators post, I wrote that, except for temporary staffing, I didn’t see any signs of weakness spreading out beyond manufacturing and import/export. Manufacturing, as measured by industrial production, has been in a shallow recession all year. By contrast, the consumer – 70% of the economy – continues to do ok, boosted by lower interest rates for mortgages and somnolent gas...

Read More »Liberal economists are open to persuasion. What about conservatives?

by Eric Kramer Liberal economists are open to persuasion. What about conservatives? There are many examples within the economics profession of cases where liberals have been persuaded by conservative arguments that raise doubts about the value of government intervention in markets. Harold Demsetz argued that it is a mistake to call for government intervention simply because markets depart from perfect efficiency, because not all inefficiencies can be...

Read More »Big data helps monopolies, not you

by David Zetland (originally published at One handed economist) Big data helps monopolies, not you Economists say competition in markets rages from “perfect” (no company can charge a price over cost without losing 100% of its customers to another company) to “monopoly” (one company sets prices to maximize profits). Two caveats are important. First, the monopolist doesn’t charge as much as possible but whatever maximizes profits. There might be a lot of...

Read More »Weekly Indicators for November 11 – 15 at Seeking Alpha

by New Deal democrat Weekly Indicators for November 11 – 15 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. Although a few indicators backed off some this week, the overall tone, ex-manufacturing, across all timeframes is positive. You may be reading a few takes today about the poor nowcasts out of the NY and Atlanta Feds, after yesterday’s face-plant of an industrial production reading. Keep in mind that they are mechanically applying...

Read More »Industrial production tanks on GM strikes; Real retail sales decline slightly

Industrial production tanks on GM strikes; Real retail sales decline slightly First, let me briefly address industrial production, which fell -0.8% in October. On its face this is an awful number. But take it with a big grain of salt: mainly it reflected the GM strike. Here’s the applicable note from the Federal Reserve: Manufacturing output fell 0.6 percent in October to a level 1.5 percent lower than its year-earlier reading. In October, the strike...

Read More » Heterodox

Heterodox