Is Venezuela Stabilizing? Maybe. It looks the inflation rate in Venezuela maxed out in January at an annuualized rate of 192,000 % , whiich fell by September to 4,600% rate, still in hyperinflationary teritoryy, but clearly coming down substantially. I am not a fan of this regime and never was, unlike some prominent economists saying nice t8ings about their economic performance, especially back in 2007, just before the world crash, when indeed...

Read More »Initial claims continue to show slowdown, but no imminent recession

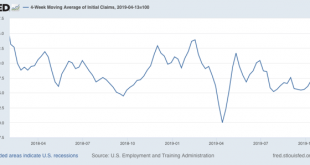

Initial claims continue to show slowdown, but no imminent recession I’ve been monitoring initial jobless claims closely for the past several months, to see if there are any signs of a slowdown turning into something worse. Simply put, no recession is going to begin unless and until layoffs increase. My two thresholds are: 1. If the four week average on claims is more than 10% above its expansion low. 2. If the YoY% change in the monthly average turns...

Read More »A simple Hayekian test for conservatives

(Dan here…Eric will be posting some of his work. He has read many econ blogs but has not published in the econ blogosphere. He is experienced otherwise…welcome Eric.) Bio for Eric Kramer I am an economist and lawyer by training and I am currently writing a book on political economy and the role of government. The book defends the liberal idea that government should actively regulate markets to promote efficiency and to ensure that opportunity and...

Read More »Ukraine Corruption and Transfer Pricing

Ukraine Corruption and Transfer Pricing As I listened to the testimony of Bill Taylor and George Kent, I was also reading up on some South African transfer pricing case involving iron ore: Kumba Iron Ore will pay less than half of the tax bill it received from the SA Revenue Service (Sars) last year following audits of its export marketing practices during the commodities boom. The settlement of R2.5bn significantly overshot the R1.5bn Kumba had set...

Read More »Real average and aggregate wages declined in October

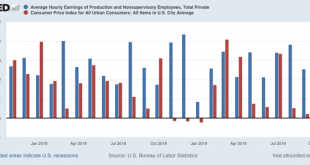

Real average and aggregate wages declined in October October’s consumer inflation reading came in at a surprisingly high +0.4%, which as shown in red in the graph below, was one of the 3 highest in the past two years. Meanwhile average hourly earnings increased less than +0.2% – the second lowest reading in the past two years, shown in blue: As a result, real average hourly earnings decreased -0.2% last month, the worst reading since late 2017: In a...

Read More »How economists blew the analysis of the manufacturing jobs shock

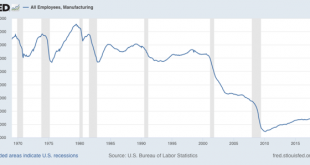

How economists blew the analysis of the manufacturing jobs shock I came across this article yesterday, posted by – to his credit – Brad DeLong, whose argument it eviscerates. Entitled “The Epic MIstake about Manufacturing That’s Cost Americans Millions of Jobs,” it deserves widespread attention. So I am summarizing it here. But by all means go and read the entire piece. Just to give you the frame of reference, here is the historical graph of...

Read More »Scenes from the October employment report: leading sectors remain poor

Scenes from the October employment report: leading sectors remain poor Yesterday I discussed unemployment and labor force participation from last week’s jobs report, which with the significant exception that better wage growth would probably lead to more people deciding that they’d like a job, remains very positive. Today let’s look at the bad news, which is the same as last month’s: leading indicators for employment are weak to negative. To begin with,...

Read More »Weekly Indicators for November 4 – 8 at Seeking Alpha

by New Deal democrat Weekly Indicators for November 4 – 8 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. The biggest story of the week was the move higher in long term interest rates. This means that the “yield curve inversion” you’ve read so much about in the past year is over. At the same time, long term interest rates (e.g., for mortgages) haven’t moved back high enough to pose a danger to the housing market. In other words,...

Read More »GDP, Manufacturing employment

David Zetland….”For years, I have complained that “nobody wakes up in the morning, looks at GDP statistics, and changes their plans for the day.” Listen to this podcast on mis-measuring productivity and manufacturing statistics, which may have given populists excuses to “fix” problems that never existed. (My impression is that many more people would be happier if they looked at their quality of life instead of a [random? inaccurate?] reference point that...

Read More »Scenes from the October employment report: full employment?

Scenes from the October employment report: full employment? Last Friday the household jobs report – the one that tells us about unemployment, underemployment, and labor force participation – has been particularly strong in the past three months. This has driven some impressive gains in labor force participation and the unemployment rate. To begin with, gains in employment as measured by the household survey (red in the graphs below), as opposed to the...

Read More » Heterodox

Heterodox