Read Brad’s post. my comment on “Milton Friedman’s redefinition of “neutral monetary policy” to mean “whatever monetary policy keeps nominal GDP on its trend growth path” led people prone to motivated reasoning in a laissez-faire direction completely and horribly astray… astonishing failure to mark one’s beliefs to market” Someone should write a book “Economic Theory: What Went Wrong”. You had a draft in your mind some years ago. PseudoDeLong wrote...

Read More »Angry Bair

Sheila Bair, who ran the FDIC during the crisis, argues against further bank bailouts. She earned great respect. One thing, which she doesn’t mention, is that she refused to let Geithner use the FDIC trust fund to bear the lower tail risk while leaving the upper tail profits to investors in Public Private Investment Partnerships. She insisted on having a veto on non-recourse FDIC loans used to purchase newly made pools of iffy mortgages. As a result,...

Read More »Emoluments As Grounds For Impeachment

Emoluments As Grounds For Impeachment I have said this before, but am saying it again. The clearest grounds for impeaching Donald Trump are not his obstruction of justice on which so much attention is being focused, but in my view his blatant and unequivocal acceptance of emoluments from foreign governments, with this most clearly evident at his hotel in Washington, with these emoluments the basis of lawsuits by the governments of Maryland and D.C....

Read More »Weekly Indicators for May 20 – 24 at Seeking Alpha

by New Deal democrat Weekly Indicators for May 20 – 24 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. The big contradiction between what the yield curve is forecasting, and what most of the rest of the long leading indicators are forecasting, continues. Meanwhile Trump’s tariff “policies” are creating chaos in other sectors. As usual, clicking over and reading should not only bring you up to date, but helps reward me with a penny or...

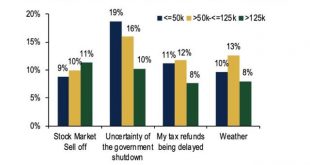

Read More »Yes, Virginia, the government shutdown really did cause a mini-recession

Yes, Virginia, the government shutdown really did cause a mini-recession For the past several months, I have been pounding on the idea that the government shutdown, during which 800,000 jobholders were temporarily laid off without pay, had a much bigger impact on the economy than was originally thought. This morning we get the following graph from Bank of America Merrill Lynch, which speaks for itself: One of the most important insights from...

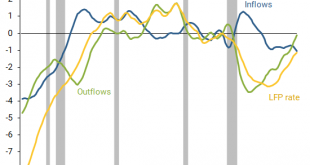

Read More »San Francisco Fed: ease of finding a new job is driving improved labor force participation

San Francisco Fed: ease of finding a new job is driving improved labor force participation This is a surprising result that is worth noting: the San Francisco Fed found that the increase in prime age labor force participation in the past five years has not been due to new people being drawn into the labor force, but rather by a very large decrease in people leaving it: [Note: keep in mind that prior to the early 1990s, both inflows and outflows are...

Read More »A comment about the economy and the 2020 election

A comment about the economy and the 2020 election Recently I’ve seen a bunch of takes to the effect that “the economy is doing great, and therefore it is likely that Donald Trump will be re-elected.” In my opinion that fear is overblown for three important reasons. The first, least noteworthy reason, is that there is still a lot of time between now and the election. As I noted Monday, many – but not all – models of the economy indicate that a recession...

Read More »Twelve Big Picture bullet points on the economy

Twelve Big Picture bullet points on the economy It’s a really slow week for economic data. Really the only important report is new home sales, which will be released Thursday. I’ve been working on a few things, but they are really information-dense and time-consuming to organize, and because they deal with how long leading indicators interact with one another, I’ll probably post them on Seeking Alpha. So in the meantime, let me give you a few hopefully...

Read More »Weekly Indicators for May 13 – 17 at Seeking Alpha

by New Deal democrat Weekly Indicators for May 13 – 17 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. The stock market’s “tariff tantrum” is driving down interest rates in bonds. We are in a time when government policy decisions – sometimes just passing tweets – are driving winners and losers in economic activity. And these can have immediate impact, disrupting the scheme of long leading -> short leading -> coincident indicators...

Read More »Sanctions On Iran Are Hitting Hezbollah

Sanctions On Iran Are Hitting Hezbollah That is the top headline, upper right corner front page, of today’s Washington Post, a quite long article by Liz Sly and Suzan Haidamous. WaPo has been much criticized by Trump and his supporters for alleged “fake news” critical of his leaving the Iran nuclear deal while Iran was compliant and not only reimposing the sanctions put on by Obama to get Iran to the negotiating table for that deal, but adding more and...

Read More » Heterodox

Heterodox