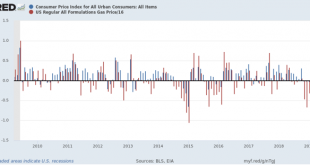

Gas prices fail to ignite overall inflation in April, but real wages flat so far for 2019 The consumer price index rose +0.3% in April, just as in March mainly as a result of a big monthly increase in gas prices. This is actually a surprisingly small increase because, as I pointed out last month, almost every time gas prices have increased by as much as they did — up 9% in March and 11% for April — consumer prices as a whole have gone up at least +0.4%....

Read More »Are initial jobless claims showing a re-assertion of an underlying weak economic trend?

Are initial jobless claims showing a re-assertion of an underlying weak economic trend? I don’t normally comment on initial jobless claims, but I’m following them with particular interest at this point. Here’s why. Last spring the long leading indicators were still at least weakly positive. I saw growth ahead through Q1 of this year, and getting questionable in Q2. By last summer, the enough long leading indicators were down that I called for a slowdown...

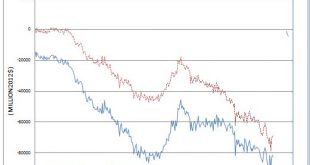

Read More »REAL TRADE BALANCE

The real trade deficit ( million 2012 $) increased from $81,558 in February to $ 82,054 in March. The March observation was between the January and February data points so it was not large enough to generate a significant change in imports 0.58 percentage point contribution to first quarter real GDP growth. In the first quarter real GDP report the significant contribution of foreign trade to real GDP growth has been interpreted by the administration...

Read More »Top 100 economic blogs

Econospeak (Barkley Rosser, pgl, Peter Dorman, Tom Walker) is in the financial section along with Bonddad blog (New Deal democrat) and Capital Ebbs and Flows (Joseph Joyce), and I am proud to say have a direct connection to Angry Bear (under general blogs…). Dear Dan, I wanted to let you know that your blog, Angry Bear Blog has been featured in the Top 100 Economics Blogs of 2019 One of the significant changes this year has been the removal of...

Read More »Uber and Lyft

(Dan here…Lifted from comments at Spencer’s SP 500 PE) PGL comments: 1. It is strike day for Lyft and Uber. Uber’s IPO is estimated to be at $90 billion which strikes me as way overpriced. Why? Net revenue is only $7.9 billion whereas operating costs are $12 billion for the latest reported year. Their net revenue is 7.5 times that of Lyft. Lyft’s operating costs turn out to be 170% of its net revenues. Interestingly both companies have net revenues that...

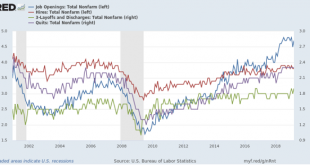

Read More »March JOLTS report: Hiring and discharges show signs of late cycle deceleration

March JOLTS report: Hiring and discharges show signs of late cycle deceleration The JOLTS report on labor is noteworthy and helpful because it breaks down the jobs market into a more granular look at hiring, firing, and voluntary quits. Its drawback is that the data only goes back less than 20 years, so from the point of view of looking at the economic cycle, it has to be taken with a large dose of salt. With that disclaimer out of the way, today’s JOLTS...

Read More »Iran: An Unfortunate Anniversary And Getting Worse

Iran: An Unfortunate Anniversary And Getting Worse It was a year ago today that President Trump removed the United States from the JCPOA nuclear agreement with Iran as well as Russia, China, UK, France, Germany, and the EU, under the auspices of the UN Security Council. According to IAEA inspectors, Iran was fulfilling its part of the agreement, and it has continued to do so up until now as well, despite this unwarranted action by the US, although that...

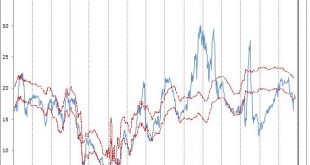

Read More »S&P 500 PE

Based on the 5 May 2019 close the S&P 500 PE on trailing operating earnings is 18.25. That places it at the bottom of my fair value band that is based largely on long term treasury bond yields. We can each have out own theories, but it appears to be that the market is correcting on fears of what Trump’s trade war will have on earnings growth. Figure one

Read More »U.S. Consumers Have Borne the Brunt of the Current Trade War

The National Bureau of Economic Research has highlighted two studies. (hat tip Spencer England) U.S. Consumers Have Borne the Brunt of the Current Trade War Recent tariff increases are unprecedented in the post-World War II era in terms of breadth, magnitude, and the sizes of the countries involved. In 2018, the United States imposed tariffs on a variety of imported goods, and other countries responded with tariffs on imports from America. Two new...

Read More »Scenes from the April jobs report

Scenes from the April jobs report The headline news in Friday’s employment report was excellent. But underneath those headlines, all is not well. Let’s celebrate the excellent headlines first. Adding 263,000 jobs in April was one of the dozen best reports of this entire expansion: Next, here is the YoY% change in nonfarm payrolls, showing an uptick after the deceleration in the prior two months: The total number of unemployed was at the lowest...

Read More » Heterodox

Heterodox