(Dan here…lifted from Robert’s Stochastic Thoughts) by Robert Waldmann G and GDP update I think it might be time for an update on the crudest of tiny sample reduced form analysis of fiscal policy and the current recovery. One reason for my continued interest is that there was a rather large tax cut enacted in 2017. Trump critics tend to argue that it failed to encourage investment, but did affect aggregate demand. I wonder if the noticeable increase in...

Read More »Weekly Indicators for April 29 – May 3 at Seeking Alpha

by New Deal democrat Weekly Indicators for April 29 – May 3 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. The trend in the past couple of months across all timeframes has been very much to the positive. It is either a signal of a renewed boom, or else a countertrend bounce back from the December-January government shutdown + residual seasonality due to a late Easter. Because I do not think that the tail wags the dog, my vote is for...

Read More »Energy’s Share of Consumer Spending

One important factor to keep in mind when thinking about the economy is that energy’s share of personal consumption expenditure is now 4%, or about half of what it was in the late 1970s-early 1980s.

Read More »Fiscal Policy and GDP 2019 update

I think it might be time for an update on the crudest of tiny sample reduced form analysis of fiscal policy and the current recovery. One reason for my continued interest is that there was a rather large tax cut enacted in 2017. Trump critics tend to argue that it failed to encourage investment, but did affect aggregate demand. I wonder if the noticeable increase in GDP growth is due to the tax cut or the spending increase from the 2017 omnibus spending...

Read More »April jobs report: great headlines, signs of fraying around the edges

April jobs report: great headlines, signs of fraying around the edges HEADLINES: +263,000 jobs added U3 unemployment rate declined -0.2% to 3.6% (new expansion low) U6 underemployment rate unchanged at 7.3% Leading employment indicators of a slowdown or recession I am highlighting these because many leading indicators overall strongly suggest that an employment slowdown is coming. The following more leading numbers in the report tell us about where...

Read More »Construction spending, manufacturing, and temp jobs all decelerate further or decline

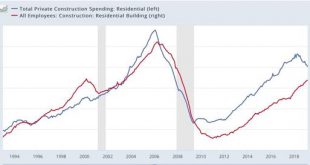

Construction spending, manufacturing, and temp jobs all decelerate further or decline On Sunday I said, “Construction spending … should follow housing permits and starts with a delay of several months. But, oddly, even though starts in particular have continued to languish, spending has come back strongly since last November. I’ll be looking to see if that anomaly continues, or whether construction spending reverts to its historical pattern.” I also wrote...

Read More »Median wage and salary growth stalls in Q1, while overall positive trend remains intact UPDATE: real household income declined

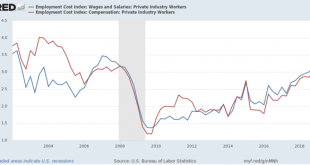

Median wage and salary growth stalls in Q1, while overall positive trend remains intact UPDATE: real household income declined The Employment Cost Index is a median measure of wages, and also total compensation, for the 50th percentile worker. Thus it escapes the “Bill Gates walks into a bar” issue with average measures. Sunday I wrote that “It has been improving for several years now, and I am expecting it to continue.” Not quite. While both the wage...

Read More »Expect a core CPI of 2% this year.

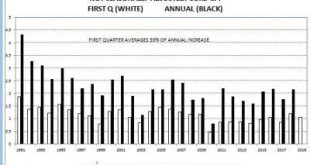

My discovery that half the annual increase in the not seasonally adjusted core CPI occcurs in the first quarter and that simply doubling the first quarter increase gives you an amazingly accurate estimate of the December to December reading work again in 2018. In 2019 it is saying the annual increase in the core CPI will be about 2% — the same as the widely accepted consensus. Figure 1

Read More »What I’m watching for this week

What I’m watching for this week This week is going to be a really busy one for economic data. I’m not going to be able to do detailed posts on everything. But because in the past couple of months most of the data has gone against my “2019 slowdown” scenario, I thought both in the interests of transparency, and to put down a few benchmarks to anchor my analysis, I’d write down what I am looking for in each release. Monday – personal income for March;...

Read More »Weekly Indicators for April 22 – 26 at Seeking Alpha

by New Deal democrat Weekly Indicators for April 22 – 26 at Seeking Alpha My “Weekly Indicators” post is up at Seeking Alpha. The data has been improving since the beginning of March, and continued to improve this week. Although at the moment the prevailing sentiment, based on new stock market highs, and yesterday’s surprise 3.2% Q1 GDP, seems to be “happy days are here again!”, my suspicion is that the intermediate and lagging data is going to fade....

Read More » Heterodox

Heterodox