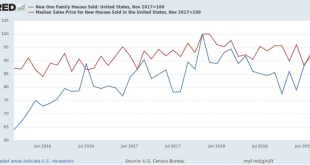

New home sales suggest housing bottom is in New home sales are extremely volatile, and extremely revised, but they do have the advantage of probably being the single most leading housing statistic, ahead of permits and starts. So it is noteworthy that new home sales for March rose to 692,000, below only one month in late 2017 when they hit their expansion high of 712,000: I have been looking for the bottom in housing, as mortgage interest rates have...

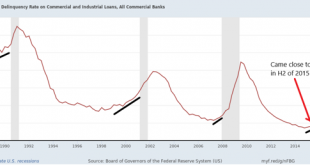

Read More »Commercial and industrial loans: another sign of a slowdown?

Commercial and industrial loans: another sign of a slowdown? There are lots of cross-currents in the economy right now. At the absolute tip of the spear is the decline in interest rates since November, which has led to an improvement in some of the housing market metrics. In the shorter-term outlook, a simple quick-and-dirty metric of initial jobless claims (new 49 year lows) and the stock market (just made new all-time highs) suggests all clear. But...

Read More »How increasing local oligopolization has distorted the housing market

How increasing local oligopolization has distorted the housing market Earlier this week new home sales for March were reported, soaring to a new expansion high bar one month (November 2017). Something else that a few other writers picked up on: the median *prices* for new homes fell to a level not seen in the past two years, off -11.8% from their peak, also in November 2017: With mortgage rates also down at approximately where they were in January...

Read More »Prisoners of Overwork: A Dilemma

Prisoners of Overwork: A Dilemma The New York Times has an illuminating article today summarizing recent research on the gender effects of mandatory overwork in professional jobs. Lawyers, people in finance and other client-centered occupations are increasingly required to be available round-the-clock, with 50-60 or more hours of work per week the norm. Among other costs, the impact on wage inequality between men and women is severe. Since women are...

Read More »Statistical Significance and the Sweet Siren of Self-Confirmation: A Reply to Taylor

Statistical Significance and the Sweet Siren of Self-Confirmation: A Reply to Taylor Just as Ulysses had himself chained to the mast of his ship so he wouldn’t succumb to the lure of the Sirens, John Ionnidis and others have argued we must bind ourselves to the discipline of statistical significance lest we fall victim to confirmation bias. Some researchers will want to proclaim they have found earth-shaking results even if they are enveloped in...

Read More »Free Speech, Safety and the Triumph of Neoliberalism

Free Speech, Safety and the Triumph of Neoliberalism I’m reading another article about debates over free speech on campus, this time at Williams College, an elite school in the northwestern corner of Massachusetts. A faculty petition asks to formalize and tighten the college’s policy on free speech by adopting the Chicago Principles, which state that “concerns about civility and mutual respect can never be used as a justification for closing off...

Read More »Trump Drops The Other Iran Oil Shoe

Trump Drops The Other Iran Oil Shoe US SecState Pompeo announced early today that the waivers granted to 8 nations allowing them to continue to import oil from Iran will not bee renewed when they expire in early May. I am not sure of the identity of three of those nations, but the big five are China, India, Japan, South Korea, and Turkey. None of them have made any public statement so far, nor has Iran. It has been announced that Saudi Arabia and the...

Read More »Noah Smith, Mud Moats and the Two Paper Rule

I think this one year old brilliant as usual post by Noah Smith is well worth another read. I googled [noah smith mud moats] when I ran into a mud moat in a comment section flame war. Click the link but I will attempt to summarize. First a very very common debating trick is to argue that the other guy really has to read the vast literature produced by some school of thought before daring to critique it. The vast literature gets critics bogged down, the...

Read More »USMCA, the International Trade Commission, and Kevin Hassett

USMCA, the International Trade Commission, and Kevin Hassett Tracey Samuelson of Market Place writes: USMCA would slightly boost U.S. economy, says ITC report – On Thursday, the International Trade Commission released its assessment of the projected economic impact of USMCA, President Trump’s proposed replacement for NAFTA. The report shows the new deal is projected to boost the U.S. economy by .35% when fully implemented. I will to read this report after...

Read More »Sales rebound from government shutdown-induced “mini-recession;” March housing lays an egg

by New Deal democrat Sales rebound from government shutdown-induced “mini-recession;” March housing lays an egg While March retail sales rose strongly, total business sales for February – also released yesterday – which includes manufacturers’ and wholesalers’ sales in addition to retail sales, continued to languish. This adds to the evidence that there was a “mini-recession” for several months likely brought about by the lengthy government shutdown, and...

Read More » Heterodox

Heterodox