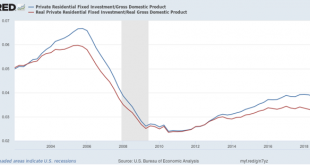

Q4 GDP: mixed signals for the future (UPDATED with graphs) I didn’t post anything yesterday, so I’ll make up for it with two posts today.This morning we finally got the very delayed first look at Q4 GDP. As per my usual practice, I am less interested in what happened in the rear view mirror, which was an annualized gain of +2.6%, than what the number tells us about what lies ahead. The two forward-looking components of GDP are (1) private fixed...

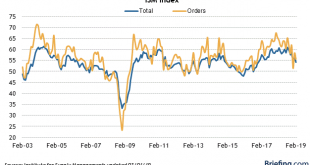

Read More »Manufacturing holds on in February

Manufacturing holds on in February The theme for most reports remains that the government shutdown in December and January, plus a 30 year record cold snap for a week in January, put a real dent in the economy. That certainly was the message of December personal spending and December and January personal spending this morning. But it looks like there was no significant damage to manufacturing. This week three regional Fed banks reported February...

Read More »December housing permits and starts mixed, support slowdown scenario

December housing permits and starts mixed, support slowdown scenario This morning we finally got December housing permits and starts. Remember that starts are more volatile than permits, and single family permits are the least volatile of all. Here’s what the overall data looks like: While starts and completions laid an egg, permits actually went up a little bit. In particular, for housing to be outright recessionary, I would want to see single...

Read More »The Trump Tax Cut and Big Pharma

The Trump Tax Cut and Big Pharma CEOs of 7 pharmaceutical multinationals addressed the Senate Finance Committee: Pharma execs offer Senate ideas to lower drug costs – except actually cutting prices. Executives from seven pharmaceutical companies — AbbVie, AstraZeneca, Bristol-Myers Squibb, Johnson & Johnson, Merck, Pfizer and Sanofi — are testifying before the Senate Finance Committee. The pharma executives have a number of ideas to reduce drug...

Read More »Iran’s Foreign Minister Is Out

Iran’s Foreign Minister Is Out This looks like bad news. Iran’s foreign minister, Javad Zarif, hass resigned. Apparently he has previously tried to resign several times, but President Rouhani refused to accept it. This time Zarif did it very publicly on Instagram, ah, the uses of social media. Anyway, apparently there is a chance he might still be talked into staying, but probably not. It seems that he has lost the favor of Supreme Leader Khamenei,...

Read More »Mars Descending? U.S. Security Alliances and the International Status of the Dollar

by Joseph Joyce Mars Descending? U.S. Security Alliances and the International Status of the Dollar A decade after the global financial crisis, the dollar continues to maintain its status as the chief international currency. Possible alternatives such as the euro or renminbi lack the broad financial markets that the U.S. possesses, and in the case of China the financial openness that allows foreign investors to enter and exit at will. Any change in the...

Read More »The Eighth Way to Think Like a 21st-Century Economist

by Steve Roth The Eighth Way to Think Like a 21st-Century Economist Asymptosis February 22nd, 2019 The teams at Rethinking Economics and Doughnut Economics have launched a contest for entries, asking “What’s the 8th Way to Think Like a 21st Century Economist?” It builds on Kate Raworth’s seven ways, here. Here’s my entry: 8. Widespread prosperity both causes and is greater prosperity: From false tradeoffs to collective well-being. “Okun’s Tradeoff” —...

Read More »Neoliberalism as Structure and Ideology in Higher Education

Neoliberalism as Structure and Ideology in Higher Education A few weeks ago I speculated on the structural aspect of neoliberalism at an economy-wide level, the way its characteristic framing of economic decision-making may have emerged from changes in the role of finance in business and the composition of high-end portfolios. My purpose was to push back against the common tendency to view neoliberalism solely as a philosophy, to be countered by other...

Read More »Housing may bottom this spring

by New Deal democrat Housing may bottom this spring Despite yesterday’s poor existing home sales report, which was the worst in over three years, the bottom in housing may be near. This post is up at Seeking Alpha. As always, reading the post should be helpful to you, and renumerates me just a bit for my efforts.

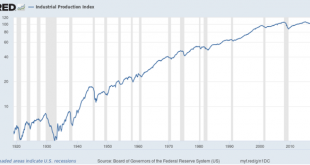

Read More »100 years of industrial production

100 years of industrial production This is a post that can literally be written only once in 100 years! Because as of last Friday, it has been exactly 100 years since the first publication of industrial production by the Fed in January 1919. So this is a good time to take a sweeping historical look at production in the United States. The first graph below is the entire 100 year history, on log scale so that equal percentage changes in each time period...

Read More » Heterodox

Heterodox