Expressions that pass from hand to hand like sealed containers… In Herbert Marcuse and Planned Obsolescence I undertook to develop a theoretical foundation for ‘planned obsolescence’ from Georg Simmel’s analysis of the “preponderance of objective culture over subjective culture that developed during the nineteenth century.” My intuition has proved to be uncannily prescient. Besides the indirect influence of Thorstein Veblen — by way of Vance...

Read More »Original Sin And Planes In The Air

Original Sin And Planes In The Air The original sin of the current catastrophe in Ukraine was the failure of the US and UK to defend the sovereignty and territorial integrity of Ukraine when Putin’s Russia seized control of Crimea as they promised to do in the Budapest Accord of 1994 when Ukraine gave up the third-largest stock of nuclear weapons in the world. They are also now in violation of that Accord now by their weak effort to save...

Read More »Weekly Indicators for February 21 – 25 at Seeking Alpha

by New Deal democrat Weekly Indicators for February 21 – 25 at Seeking Alpha My “Weekly Indicators” post is up at Seeking Alpha. The invasion of Ukraine by Russia has added some elevated risk to a few of the numbers, but there is nothing that indicates any economic crisis. In general, there are accumulating signs that last year’s Boom is over; but on the other hand, no accumulating signs that a recession is anywhere near. In short, a...

Read More »War Comes to Kyiv

War Comes to Kyiv | The New Yorker, Joshua Yaffa Interesting article that showed up in my inbox. This is a copy and paste ot it with minor editing. If you follow the link, there are other short articles to be read. I believe the takeaway from this article is the courage of Zelensky. The Ukraine will fall apart without him. Can the Russians be this bad militarily? The road into Kyiv is lined with military checkpoints, many of which are manned by...

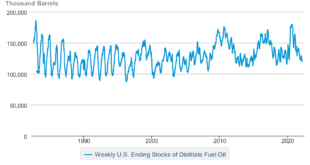

Read More »EIA, Latest US Oil Supply and Disposition Data

RJS, Focus on Fracking, SPR at a 19 year low: total oil + products supplies, including SPR, at a 7 3/4 year low, distillate supplies at 26 month low Overall oil inventories finally rose after a million+ barrel per day jump in oil imports; commercial crude supplies saw their biggest increase since October 10th after pulling ~350k barrels per day out of the SPR, i.e. switching the deck chairs on the Titanic . . . other trends remained in...

Read More »The Gilded Lily

One micron is about ten gold leaves thick. The gilded age, one. Since, and yet, there are those who would return the nation to that time. To their minds, it was the best of times; that all that need be done was rid the nation of the odious Progressive and New Deal Era laws that in fact had had nothing to do with the age’s demise, and the labor unions that formed up during the period; then let the laws of capitalism and of free markets take their...

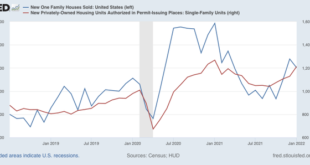

Read More »New home sales increasing trend continues – for now; expect a major pullback in coming months

New home sales increasing trend continues – for now; expect a major pullback in coming months With mortgage rates having risen sharply (as of this morning Mortgage News Daily has the 30-year rate up to 4.19%, the highest in nearly three years), we are at an important moment for the housing market. In that context, let’s look at this morning’s new home sales report for January. There are two important things to know about new home sales: (1) it...

Read More »Discussions on Healthcare Topics

Every week my mailbox fills up with articles. Some of which I subscribe too and pay for and others which are freebies. The freebies are slowly disappearing. The first article is an old one and has been on AB before and discussed by Maggie Mahar. Atul asks if healthcare is a right. Maggie and Shadowfax (an ER doctor) would argue it is more a moral obligation. That discussion can be found here: Is Health Care a Right? – The Health Care Blog. Further on...

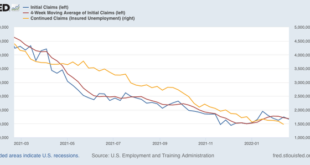

Read More »New 50+ year low in continuing jobless claims

New 50+ year low in continuing jobless claims [Programming note: I will post about new home sales later this morning.]Initial claims (blue) declined 17,000 to 232,000 (vs. the pandemic low of 188,000 on December 4). The 4 week average (red) declined 7,250 to 236,250 (vs. the pandemic low of 199,750 on December 25). Continuing claims (gold, right scale) declined 112,000 to 1,476,000 (not just a new pandemic low, but the lowest number in over 50...

Read More »Vladimir V. Putin Loses His Mind And Becomes A War Criminal

Vladimir V. Putin Loses His Mind And Becomes A War Criminal Russian President Vladimir V. Putin has just announced a “special military operation” to “de-Nazify the Ukrainian government” so as to halt the supposed “genocide” being committed against Russian speakers in Ukraine. There is not a shred of justification for any of this. The extreme nationalist fascist groups in Ukraine do not support and are not part of the current Ukrainian...

Read More » Heterodox

Heterodox