September Trade Deficit Rises 11.2% to a Record High on Lower Exports of Precious Metals, Oil & Oil Products and Capital Goods, MarketWatch 666, Commenter and Blogger RJS Our trade deficit rose by 11.2% in September as the value of our exports decreased and value of our imports increased…the Commerce Dept report on our international trade in goods and services for September indicated that our seasonally adjusted goods and services trade...

Read More »September Trade Deficit Rises 11.2% to a Record High

September Trade Deficit Rises 11.2% to a Record High on Lower Exports of Precious Metals, Oil & Oil Products and Capital Goods, MarketWatch 666, Commenter and Blogger RJS Our trade deficit rose by 11.2% in September as the value of our exports decreased and value of our imports increased…the Commerce Dept report on our international trade in goods and services for September indicated that our seasonally adjusted goods and services trade...

Read More »Well, Its About to Become Worse – Update

Economist and Farmer Michael Smith Introduction Well, Its About to Become Worse as Urea prices jumped to a record strong demand creating supply shortages. Food prices to increase . . . And the Details I was recently sitting on a conference call with a fertilizer analyst and a bunch of monocrop growers, generally feeling out of place with my few dozen pounds of peppers, cucumbers and radishes sitting in cold storage while they go over...

Read More »Well, Its About to Become Worse – Update

Economist and Farmer Michael Smith Introduction Well, Its About to Become Worse as Urea prices jumped to a record strong demand creating supply shortages. Food prices to increase . . . And the Details I was recently sitting on a conference call with a fertilizer analyst and a bunch of monocrop growers, generally feeling out of place with my few dozen pounds of peppers, cucumbers and radishes sitting in cold storage while they go over...

Read More »September Income and Outlays, Durable Goods and New Home Sales

Commenter and Blogger, RJS MarketWatch 666 3rd quarter GDP, September’s income and outlays, durable goods, & new home sales The key economic reports that were released this week were the 1st estimate of 3rd quarter GDP and the September report on Personal Income and Spending, both from the Bureau of Economic Analysis ….the week also saw the release of the advance report on durable goods for September and the September report on new home...

Read More »September Income and Outlays, Durable Goods and New Home Sales

Commenter and Blogger, RJS MarketWatch 666 3rd quarter GDP, September’s income and outlays, durable goods, & new home sales The key economic reports that were released this week were the 1st estimate of 3rd quarter GDP and the September report on Personal Income and Spending, both from the Bureau of Economic Analysis ….the week also saw the release of the advance report on durable goods for September and the September report on new home...

Read More »Theft of alien labour time is a miserable foundation

Theft of alien labour time is a miserable foundation In the early 1980s, I was riding home from work on a bus and looked out the window at a Toyota pickup truck alongside. I was overwhelmed by the realization that I could never in my life make such an object by hand, even if I had a well-supplied metal workshop. From that perspective, how could I hope to own such an item? I did own a Volkswagen Rabbit but somehow the pickup truck made more of an...

Read More »Theft of alien labour time is a miserable foundation

Theft of alien labour time is a miserable foundation In the early 1980s, I was riding home from work on a bus and looked out the window at a Toyota pickup truck alongside. I was overwhelmed by the realization that I could never in my life make such an object by hand, even if I had a well-supplied metal workshop. From that perspective, how could I hope to own such an item? I did own a Volkswagen Rabbit but somehow the pickup truck made more of an...

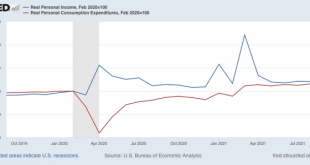

Read More »Consumers’ “cushion” of pandemic assistance savings is now exhausted

September personal income and spending: positive, but consumers’ “cushion” of pandemic assistance savings is now exhausted Real personal income and spending held up well throughout the pandemic, due to a vigorous government response. This morning these were reported for the first month after the expiration of the last such assistance. In nominal terms, personal income declined -1.0%, but spending rose 0.6%, and the previous month was revised...

Read More »Gasoline at 47 month low & Distillate at 18 month low

Commenter and Blogger RJS, Focus on Fracking, The Latest US Oil Supply and Disposition Data from the EIA US oil data from the US Energy Information Administration for the week ending October 22nd indicated that after a modest increase in our oil imports and a modest decrease in our oil exports, we had surplus oil to add to our stored commercial crude supplies for the fourth time in five weeks and for the for the ninth time in the past thirty weeks...

Read More » Heterodox

Heterodox