The false dichotomy of climate change remediationYears ago, I had a Facebook friend from my hometown who was a big enthusiast of molten salt nuclear reactor technology. He wasn’t a scientist or engineer, but his dad had worked on MSRs in the ‘60s, and he fetishized his dad’s memory. As some point, I mentioned that we had installed rooftop solar on our house, and he began attacking me. Rather than see MSRs and solar as two parallel paths towards...

Read More »Blog Archives

UAW files federal labor charges against Donald Trump and Elon Musk

Who is the bigger scab? In an interview with Musk, Trump appeared to endorse firing striking workers. The United Auto Workers Union has filed federal labor charges against former President Donald Trump and Elon Musk, the union said Tuesday. In a thread on X, the union said Trump and Musk had illegally attempted to “threaten and intimidate workers who stand up for themselves by engaging in protected concerted activity, such as strikes.” Musk...

Read More »CMS ramps up suspensions of health insurance agents registered with HealthCare.gov

CMS finally clamping down on agents plan switching, assigning existing enrollees to themselves. CMS requires agents seeking to act on an existing account with a different Agent of Record or with no AOR to: – either conduct a three-way call with the client and the marketplace center. The client authorizes the new agent to act on their behalf, or – have the client click the final button after an agent makes changes to the account using a...

Read More »Soft Landing ? House construction holds up with high interest rates.

I am late to the discussion of the (possible) US soft landing. I think I better write about the soft landing (so far) in case it is ceasing to be soft (I am not making a forecast). The remarkable thing is that the dramatic increase in the Federal Funds Rate did not induce a downturn let alone a recession The way interest rates affect GDP is principally residential investment and exchange rates. Other monetary authorities also raised rates in...

Read More »Today was a throwaway day.

Everything could be reversed tomorrow if Powell gives the market what it wants.

Read More »As the Debby effect dissipates, initial claims remain positive for the economy

– by New Deal democrat For the last several months, jobless claims have been buffeted first by unresolved post-pandemic seasonality, and then also by the effect of Hurricane Debby on claims in Texas. The first is now abating, and the second has ended, as this week claims in Texas declined to their typical level last year at this time. To the numbers: initial claims rose 4,000 to 232,000, while the four-week moving average declined -750 to...

Read More »Kroger Engages in Theater – Kabuki Style

“Kabuki is a form of classical theater in Japan known for its elaborate costumes and dynamic acting. Phrases such as Kabuki theater, kabuki dance, or kabuki play are sometimes used in political discourse to describe an event characterized more by showmanship than by content.” Maybe I am wrong in calling it such. The style of play occurring between the two companies and the management give ne the impression of such. If you have been following...

Read More »The Economics Cult Ignoring Reality.

The Economics Cult Ignoring Reality.

Read More »Healthcare Costs Expected to Surge at Highest Rate in 15 Years

Forecast of commercial healthcare costs to come in 2025 (MedCity report), what has occurred in the past, and what is expected beyond 2025. Meanwhile Congress is twiddling their thumbs arguing amongst themselves over what is more important to their existence . . . constituents or big business. Interesting too, how the Sadlers are getting themselves off the hook for the Opioid epidemic. They didn’t know? New Survey, employers’ project trending...

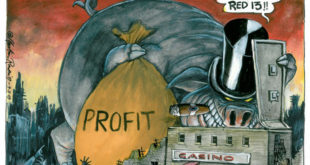

Read More »Casino capitalism

According to Keynes, financial crises are a recurring feature of our economy and are linked to its fundamental financial instability: It is of the nature of organised investment markets, under the influence of purchasers largely ignorant of what they are buying and of speculators who are more concerned with forecasting the next shift of market sentiment than with a reasonable estimate of the future yield of capital-assets, that, when disillusion falls upon an over-optimistic...

Read More » Heterodox

Heterodox