.[embedded content] As always a pleasure listening to Edward Leamer and his critical views on the (mis)uses of statistical methods in empirical research. Main message: without a deep understanding of context, statistical and econometric analyses are useless!

Read More »Blog Archives

Consumer income and spending continued to power ahead in October

Despite a few soft spots, consumer income and spending continued to power ahead in October – by New Deal democrat The monthly personal income and spending report is along with the jobs report, one of the two most important coincident metrics for the entire economy, because it is a fairly comprehensive look at the consumer sector. In October both nominal and real personal income and spending increased 0.2%. Since the beginning of the...

Read More »COP28: Tackling health inequalities must be at the centre of climate action

Blog COP28: Tackling health inequalities must be at the centre of climate action Why the first-ever COP Health Day should aim for health equity and enshrine the principle and goal of a fair transition By Fernanda Balata 01 December 2023 The main...

Read More »Tony Thirlwall (1941-2023)

Leading academic and Keynesian best known for Thirlwall’s Law on economic growthJohn McCombieThe economist Tony Thirlwall, who has died aged 82, was, in his own words, an “unreconstructed Keynesian”. He saw this not as a pejorative title, but more as an accolade, considering that many of the insights of John Maynard Keynes, and in particular the importance of demand, are still relevant for understanding today’s economy.Tony is perhaps best known for his original way of thinking about...

Read More »Why we need causality in science

Why we need causality in science Many journal editors request authors to avoid causal language, and many observational researchers, trained in a scientific environment that frowns upon causality claims, spontaneously refrain from mentioning the C-word (“causal”) in their work … The proscription against the C-word is harmful to science because causal inference is a core task of science, regardless of whether the study is randomized or nonrandomized. Without...

Read More »A new rule that would grant exemptions on swap trades

Here we are agin, trying to make it easier to trade derivatives. Never mind the lessons we thought we learned when Goldman Sachs called on AIG to ante up. There were little in reserve for the swaps and AIG was ready to collapse. Congress and the Fed (or reverse) saved them and the economy. The issue was Wall Street and Greenspan did not take swaps/derivatives seriously even after the Bankers Trust and Long-Term Capital Management. LTCM crisis –...

Read More »Weekend read – The great re-boot. Perhaps.

from Peter Radford I keep coming upon ideas that seem to make such sense that, surely, they have been imported into economics. But, no, hubris prevents an expansion of the discipline to include such novelty. The threat they represent to the entire mainstream edifice is too much of a threat. The guild closes ranks. The guild closes its mind. And gets quite snooty in the process. Outsiders are seen as simple, lacking in basic understanding, or naively misunderstanding the great...

Read More »Market rise getting speculative

Sentiment and flows suggest caution.

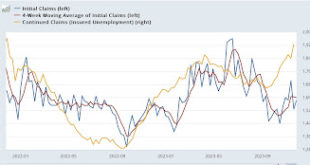

Read More »Despite the continuing elevation of continued claims, initial claims signal continued expansion

Despite the continued elevation of continued claims, initial claims signal continued expansion – by New Deal democrat I’ll comment on personal income and spending later this morning, but let’s start out with our weekly update on jobless claims. Initial claims rose 7,000 to 218,000, while the 4 week average declined -500 to 220,000. With a one week delay, continuing claims rose 86,000 to 1.927 million, a nearly 2 year high: On the more...

Read More »The Parody that we call Economics

This week have content creator and economic commentator Dave Foulkes. Dave have created some very amusing videos on the state of the economic profession, and if you have watched this livestream before, you know he's going to fit right in. He also has a very nice Substack blog called "Let's get beyond Survival": https://beyondsurvival.substack.com/

Read More » Heterodox

Heterodox