More evidence global demand is slowing as both exports and imports fell. In any case the trade surplus continues, providing fundamental currency strength which probably translates into continuing fx reserve builds: China’s exports drop again in April; imports also plungeHighlightsEmployment has been the economy’s central strength but has not been in the positive column for the labor market conditions index which remains in contraction for a 4th straight month, at minus 0.9 in April. Still,...

Read More »Employment report, consumer credit

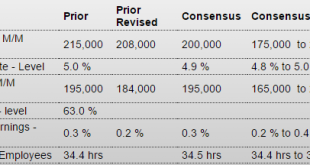

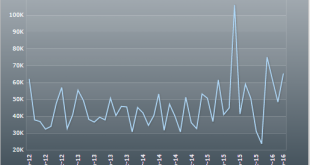

The chart shows the year over year and ongoing deceleration that in general began when oil capex collapsed. Nor will there be a reversal until after deficit spending increases- public or private- and I see no evidence of that happening: Employment SituationHighlightsAdd employment to those reports showing weakness, at least moderate weakness as nonfarm payrolls rose a lower-than-expected 160,000 in April. Revisions are minor, down a combined 19,000 in the two prior months with March now at...

Read More »Euro reserves, Rail week, St. Louis Fed, China, Profits and Payrolls

The euro level is in dollar terms, but in any case, as previously discussed, the chart shows that there was an exit from the euro when the ECB initiated its aggressive interest rate and QE policies. And the way I see it it was that selling that weakened the euro, not anything ‘fundamental’: Rail Week Ending 30 April 2016: Rail Contracted 11.8 Percent From Same Month One Year Ago Week 17 of 2016 shows same week total rail traffic (from same week one year ago) declined according to the...

Read More »UK, health care costs, US labor force

As discussed back when the law was first proposed, this version of ‘moral hazard’ renders the entire program unworkable and to the best of my knowledge and understanding there is no ‘fix’: Health Insurers Struggle to Offset New Costs May 4 (WSJ) — Insurers have begun to propose big premium increases for coverage next year under the 2010 health law. The companies also have detailed the challenges in their Affordable Care Act business in a round of earnings releases. The health law instigated...

Read More »Saudi pricing, layoffs

If true, the $1.10 increase in the differential for Asia is substantial. However the other, much smaller adjustments are not material, so it’s hard to say from this information whether or not this is a policy move designed to stabilize prices at current levels: (Bloomberg) — Saudi Aramco raised prices for most crude grades sold to Northwest Europe, Mediterranean next month while lowering prices for most grades it sells to U.S. Official pricing statement confirms increased prices for Asia...

Read More »Mtg purchase apps, ADP, Trade, Factory orders

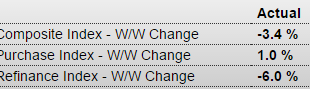

Same story, depressed and growing too slowly to matter: MBA Mortgage ApplicationsHighlightsPurchase applications for home mortgages managed to rise 1.0 percent in the April 29 week, but refinancing continued to decline, down 6.0 percent after falling 5.0 percent in the prior week. Though purchase applications are 13 percent higher than the same week a year ago, the year-on-year gain has narrowed sharply from the 30 percent gains seen as recently as March. Rates crept slightly higher, with...

Read More »Car sales, Home prices

Car sales came in about as expected. Note the year over year 3 month moving average continues its deceleration, and so far not adding as much to growth this year as last year: The luxury home market may be losing some of its luster.Average sales prices for homes listed at $1 million or more fell 1.1 percent in the first quarter compared with a year earlier, marking the biggest decline in more than two years, according to Redfin.The decline at the top marks a stark contrast with the broader...

Read More »China, Redbook retail sales, UK manufacturing, yen comments

Still in negative territory:Still stone cold dead:Exporters have serious clout over there. Intervention on their behalf would be no surprise: Japan exporters stand to take nearly $10bn hit from rising yen The yen’s sharp appreciation threatens to undercut profits at major Japanese exporters by more than 1 trillion yen ($9.37 billion) this fiscal year, outweighing any benefits of a stronger home currency for some companies, estimates by The Nikkei show.Even at exchange rates of 110 yen to...

Read More »CNY/EUR, construction spending

Good chance China is now rebuilding euro reserves sold when they panicked over negative rates, qe, etc. In fact, they could now be targeting the euro area for export growth:This came out this am. Note how construction flattened in the middle of last year when the NY tax incentives expired, and so far there is no sign of a repeat of last year’s growth for this year:When it comes to downsizing govt, Obama looks to have been the best ever. What more could the Tea Party ask for?

Read More »ISM manufacturing, Construction spending, PMI manufacturing index

Another worse than expected report, and now it’s been over a year since it all started going bad, even as analysts continue to find reasons to be optimistic that have yet to pan out: ISM Mfg IndexHighlightsApril’s 50.8 for the ISM manufacturing index may be moderately below expectations for 51.5 but details in the report are positive. New orders did slow by 2.5 points but the level at 55.8 still points to a very solid rate of growth. New export orders, offering positive evidence on the...

Read More » Mosler Economics

Mosler Economics