Saudi production remains well below their claimed 12 million bpd current max capacity, as they continue to set price and let sales and output float. Market action suggest they have altered their posted prices, but so far publicly available information doesn’t indicate a change in pricing policy. If so, the latest move up in prices will prove temporary: The American Consumer is Doing Less to Support GDP Growth By Rick DavisSummary and CommentaryAlthough the headline remained positive, this...

Read More »GDP, KC Fed

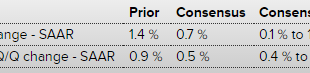

Weak, a bit below expectations, and not much hope left for Q2 either. And some time last year the govt changed the seasonal adjustments, adding a bit to Q1 and taking some away from the other quarters. So this release included that new seasonal adjustment: GDPHighlightsConsumer spending, largely on services, helped hold up first-quarter real GDP which came in at an annualized plus 0.5 percent rate and just below the Econoday consensus for 0.7 percent. Consumer spending (personal consumption...

Read More »Mtg purchase apps, Pending home sales, Bank liquidity, Apple

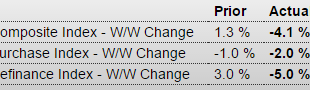

Continues at depressed levels: MBA Mortgage ApplicationsHighlightsPurchase applications are not pointing to Spring acceleration for the housing sector, down 2.0 percent from the April 22 week with the year-on-year rate continuing to come down, to 14 percent from 17 percent. This rate was as high as 30 percent as recently as March. Refinancing activity also declined, down 5.0 percent in the week. Rates remain very low with the average 30-year mortgage for conforming loans ($417,000 or less)...

Read More »Durable goods orders, Redbook retail sales

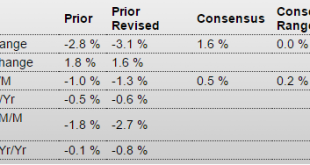

Not good.Note the year over year change.And inventories remain way high: Durable Goods OrdersHighlightsThe factory sector posted a respectable March with orders for durable goods up 0.8 percent which follows a revised downswing of 3.1 percent in February and a very solid 4.3 percent gain in January. March reflects a big gain for defense goods which helped offset a downward swing for commercial aircraft. A negative in the report is a 3.0 percent decline for motor vehicle orders reflecting...

Read More »New home sales, Dallas Fed

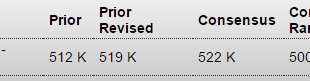

Still weak and worse than expected. And prices weakening as well: New Home Sales HighlightsGrowth in new homes isn’t spectacular but, given how soft general economic conditions are, the sector is posting moderate and still respectable numbers. March sales came in at a 511,000 annualized rate which is on the low side of expectations but the report includes a 7,000 upward revision to 519,000 for February which now stands as among the very best months since 2008. Year-on-year, sales are up 5.4...

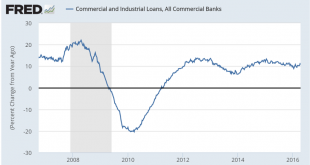

Read More »Bank lending, quick macro recap

Loan growth remains uninteresting:And now real estate loan growth, which wasn’t much to begin with, is showing signs of leveling off: In case you thought today’s macro policies were some kind of gift to banks: Again, wouldn’t surprise me if revisions in coming years show the US has been in recession since not long after oil prices got low enough for capex to collapse. And it’s an old fashioned ‘under consumption theory’ slowdown- any agent that spent less than his income needed to be...

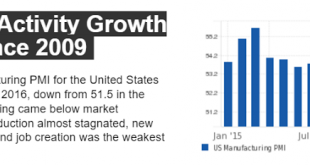

Read More »PMI Manufacturing, apt market, ISIS cash

More bad stuff: PMI Manufacturing Index FlashHighlightsEarly indications on April factory conditions are no better than mixed with strength in the Empire State report offset by yesterday’s flat readings from the Philly Fed and another set of flat readings from today’s PMI flash. The PMI, at 50.8, is still over 50 to indicate monthly growth but is the least above 50 since the beginning of the recovery, in September 2009. Growth in both output and hiring is slowing as is growth in new orders...

Read More »Philly Fed, Chicago Fed, New unemployment claims

Whoops, back down: Philadelphia Fed Business Outlook Survey Same here: Chicago Fed National Activity Index If this is indeed falling because benefits have been made that much harder to get it means this channel of increased govt expenditures is disabled, and the cycle will get that much worse before it gets better: Jobless ClaimsHighlightsThe labor market once again, against a background of soft data, shows itself as the economy’s leading positive. Initial claims fell 6,000 in the April...

Read More »Freight index, Philly Fed state index, Fed labor index, Info graphics

Off to a slow start this year:Dropped again:Does the Fed care about it’s internal index?Israeli study: How Information Graphics Reveal Your Brain’s Blind Spots Houston airport: Passengers were complaining about the inordinately long time they had to wait to pick up their bags. The airport decided to look more closely at the baggage collection process. They found that passengers typically got off an airplane, walked for about a minute from the gate to the baggage claim carousels, then...

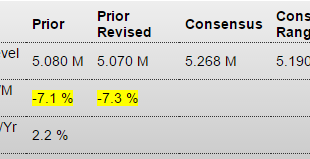

Read More »Existing home sales, Architecture Billings, Commodity prices

You can see from the chart this is not any kind of ‘engine of growth’ at this point in time: Existing Home SalesHighlightsExisting home sales rose more than expected in March, up 5.1 percent to a 5.330 million annualized rate that, however, fails to reverse a downwardly revised 7.3 percent drop in February. And the year-on-year rate, at only 1.5 percent, is decidedly weak. But looking at the first quarter as a whole, which is important for housing data given their volatility, existing home...

Read More » Mosler Economics

Mosler Economics