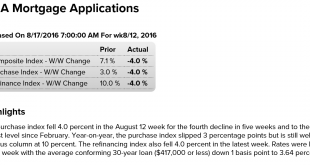

Bad news for housing today- mtg purchase apps at the lows of the year, prices moderate, and existing home sales weak, so, as previously discussed, not looking like housing will be contributing to growth this year:

Read More »Euro consumer confidence, Military accounting, ECB thought…

The beatings will continue until morale improves… The Collapse of Rome: Washington’s $6.5 trillion Black Hole The Defense Finance and Accounting Service, the agency that provides finance and accounting services for the Pentagon’s civilian and military members, has just revealed that it cannot provide adequate documentation for $6.5 trillion worth of “adjustments” to Army general fund transactions and data. According to a report released July 26 by the by the Inspector General...

Read More »Redbook retail sales, PMI, Richmond Fed, New home sales

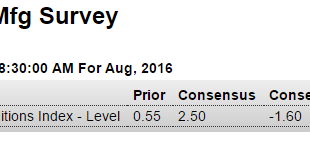

Still extremely depressed:Down and well below expectations: HighlightsWeakness in orders and employment were unfortunate themes of last week’s Empire State and Philly Fed reports and likewise headline the manufacturing PMI report. The PMI, which is based on a nationwide sample of manufacturers, slowed by 8 tenths in the August flash to 52.1, a reading only modestly above breakeven 50 to indicate no more than limited expansion in composite activity. Output is the month’s best...

Read More »MMT in the news, Chicago Fed, Dividends

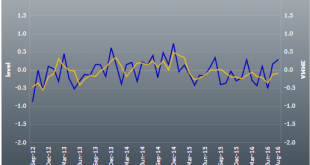

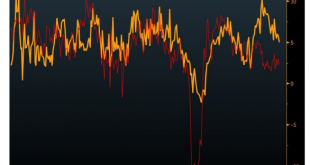

Stephanie Kelton #1, Pavlina Tcherneva #4!http://theweek.com/articles/643874/hillary-clintons-economic-dream-team Up a bit for the month, but the 3 month moving average remains negative:

Read More »Bank loans, Japan savings, Comments on the economy

Accelerated with the shale boom, still decelerating with the shale bust: Problem is incentives to not spend income, as below, reduce sales, output, and employment. That is, they’ve got it backwards if the goal is increased GDP etc. Japan mulls longer-term tax break for savers Aug 18 (Nikkei) — The Japanese government plans to offer a new option for tax-free investment accounts featuring a much longer exemption. More than 10 million of the so-called NISA accounts were opened...

Read More »Jobless claims, Philadelphia Fed business survey, Japan trade

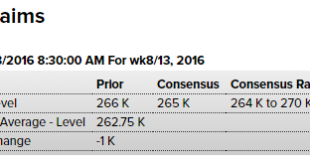

Still looks to me like this is perhaps the most misunderstood statistic, as analysts believe it is signaling strength in the labor markets. Instead I’m suggesting claims are extraordinarily low because the unemployment benefits have become much harder to get: Even with a much higher population and labor force, and with a higher unemployment rate,new claims are at 40 year lows: Not at all good: HighlightsOnce again the Philly Fed’s headline tells an entirely different story...

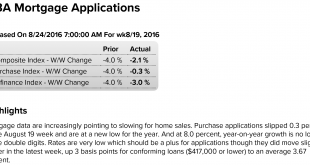

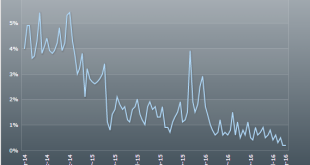

Read More »Mortgage purchase applications, Stock buybacks

The chart shows both how depressed the mortgage market is historically as well as how it’s been deteriorating over the last several months: And lots of headlines like this popping up: Wednesday, August 17, 2016Sacramento Housing in July: Sales down 7%, Active Inventory down 10% YoYLas Vegas Real Estate in July: Sales down 10% YoY, Inventory down 1% Read more at http://www.calculatedriskblog.com U.S. companies’ stock buyback plans hit four-year low: TrimTabs Aug 16...

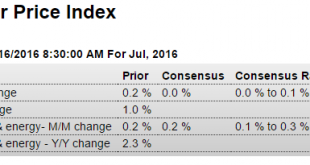

Read More »CPI, Housing starts, Redbook retail sales, Industrial production, Euro area trade balance

Lots of nuances but still tending to keep the Fed on hold: HighlightsThe headlines for the consumer price report look very soft but there are important offsetting pressures. The CPI came in unchanged in July, pulled back by a 1.6 percent monthly decline in energy prices and other weakness including flat prices for food and contraction in transportation. And it doesn’t look much better when excluding food & energy where the gain for the core is only 0.1 percent. But two...

Read More »Empire manufacturing index, Housing market index, Hotel occupancy

Just another bit of bad news: HighlightsThe New York region’s manufacturing sector remains flat based on the Empire State index which came in slightly below zero at minus 4.21 in August vs plus 0.55 in July. New orders are especially flat, at plus 1.04 vs July’s minus 1.82, with unfilled orders extending a long run of negative readings at minus 9.28. There is, however, strength in shipments, at 9.01, but it won’t last long given the weakness in orders. Employment is also...

Read More »Restaurant sales, Bank loans

Still decelerating ever since the collapse in oil capex:

Read More » Mosler Economics

Mosler Economics