Seems the corporate profits report includes the Fed’s profits, all of which get turned over to the Treasury, of course… How the Fed Stopped the “Corporate Profit Recession” (and the Media Fell for it) By Wolf TichterThe end of the corporate “profit recession” has been declared last week. It was based on data by the Bureau of Economic Analysis, released on May 27. Corporate profits, after declining with some zigs and zags since their peak in the third quarter 2014, suddenly ticked up in the...

Read More »ADP, NY ISM

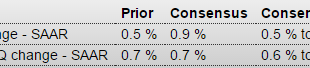

A forecast for tomorrow’s employment report: ADP Employment ReportHighlightsThe May employment report isn’t expected to be very strong but it may not prove, in contrast to expectations, to be any weaker than April, at least based on ADP’s estimate for private payrolls which comes in at 173,000 vs ADP’s revised 166,000 for April. The Econoday consensus for private payrolls in tomorrow’s government report is noticeably lower, at 150,000 vs May’s 171,000. ADP has been very accurate so far this...

Read More »Saudi Aramco Seen Increasing July Oil Premium for Asia Customers

The higher prices likely indicate a change in policy from that of putting downward pressure on prices to a more neutral stance. Might have something to due with the last change in oil ministers. We will know more when this latest chart of the history of discounts/premiums is updated: Saudi Aramco Seen Increasing July Oil Premium for Asia CustomersBy Serene Cheong and Sharon Cho(Bloomberg) — Saudi Aramco may widen Arab Light premium by 40c/bbl for July sales to Asia, accord. to median est....

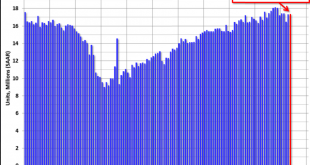

Read More »May US light vehicle sales

Car sales continue to soften from the highs of last year. And May sales unchanged from April would mean no contribution to growth this month: U.S. Light Vehicle Sales increase to 17.4 million annual rate in May by Bill McBrideBased on a preliminary estimate from WardsAuto, light vehicle sales were at a 17.37 million SAAR in May (Preliminary estimate excluding Jaguar Land Rover and Volvo).That is down about 1.5% from May 2015, and up slightly from the 17.32 million annual sales rate last...

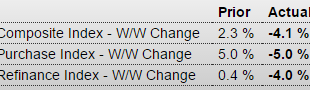

Read More »Mtg purchase apps, Mortgage origination, PMI indexes

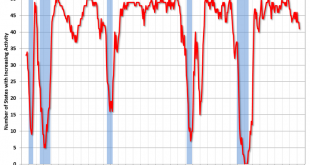

Down 5% after last week’s up 5%… ;) MBA Mortgage Applications Note that the total is in decline:This (limited) measure of retail sales is still depressed and weakening as well:Two manufacturing indexes out today. The first was slightly lower than last month and trending down: PMI Manufacturing IndexHighlightsMarkit Economics’ U.S. manufacturing sample continues to report nearly dead flat conditions, at a final May index of 50.7 which compares with 50.5 for the mid-month flash and a final...

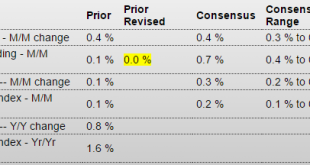

Read More »Personal income and spending, Chicago PMI, Consumer confidence, Dallas Fed, State Street investor confidence

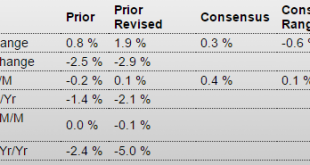

Yet another pretty good April release that I suspect will be reversed in May, as has happened with several other data series. And the increased spending on gasoline due to higher prices coincided with a reduction in the savings rate, as April spending outstripped income. And note that March’s +.1 was revised to 0 with this April number also subject to revision. Personal Income and OutlaysHighlightsApril was definitely the month of the consumer as consumer spending surged 1.0 percent for the...

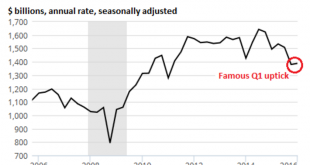

Read More »GDP, Corporate profits, Oil capex, Truck tonnage, Vehicle sales preview

Pretty much as expected, inflation a bit lower. Inventories revised up so Q2 that much more likely to see an inventory reduction along with associated cuts in output: GDPHighlightsFirst-quarter GDP is now revised higher but only slightly, to an annualized growth rate of plus 0.8 percent for a 3 tenths gain from the initial estimate. Upward revisions to residential investment and exports are behind the small gain along with an unwanted upward revision to inventories. Nonresidential...

Read More »Philly Fed indicator, Fed discount rate

Not good!The regional Feds are calling for higher discount lending rates even though borrowings are at 0! According to the Fed minutes from the discount rate meeting (different from the FOMC minutes), four of the Fed banks called for a hike in the discount rate. It’s the emergency rate at which banks could borrow directly from the Fed’s discount window – currently at 1%. This disclosure suggests that the Fed is becoming increasingly hawkish.

Read More »Durable goods orders, KC Fed, Pending home sales, Health insurance premiums

Way up and better than expected, but looks like it was all a large aircraft order and some cars. Another good headline April release also likely to reverse in May: Durable Goods OrdersHighlightsIndications on the factory sector have been mixed as is April’s durable goods report. The headline came in at a stronger-than-expected gain of 3.4 percent with March revised higher to a gain of 1.9 percent. Vehicles orders gave an important boost to April, up 2.9 percent as did the always volatile...

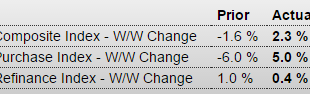

Read More »Mtg prch apps, PMI services

Not a word from the analysts when they were down 6% last week. But when up 5% this week expect lots of mentions… MBA Mortgage ApplicationsHighlightsPurchase applications for home mortgages revived in the May 20 week, increasing by 5 percent from the prior week, while refinancing activity managed to post a gain of 0.4 percent despite slightly higher rates. The average 30-year mortgage for conforming loans ($417,000 or less) was up 3 basis points to 3.85 percent. Purchase applications were 17...

Read More » Mosler Economics

Mosler Economics