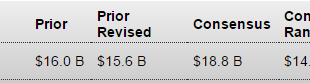

This is going nowhere: Consumer CreditHighlightsRevolving credit showed substantial life in November, up $5.7 billion and helping to boost total consumer credit by $14.0 billion. Nonrevolving credit, boosted by auto financing and student loans, has been the foundation of strength for this series during the whole recovery, but less so in November when it added only $8.3 billion for the smallest contribution since February 2012. But it’s the gain for revolving credit, growing at an annualized...

Read More »Jobs, Wholesale trade, China, Rail traffic

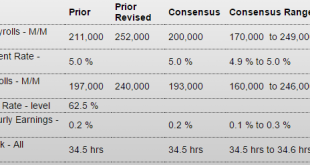

Anyone notice that the annual growth rate of employment continues the deterioration that began with the collapse in oil capex?Or that, once again, it looks like most all the new jobs were taken by people previously considered out of the labor force?And the anemic wage growth also contributes to the narrative of a continuously deteriorating plight for people trying to work for a living: Employment SituationHighlightsThe labor market is stronger than most assessments with December results...

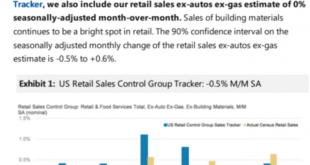

Read More »ECB comment, Retail Sales, Fed Atlanta, Oil comment

Seems there’s no wisdom on the topic of ‘money’ anywhere of consequence: No ‘plan B’ for ECB despite still low inflation: Praet Jan 6 (Reuters) — Executive Board member Peter Praet said various factors, notably low oil prices and less buoyant emerging economies, meant it was taking longer to reach the goal of inflation of close to but below 2 percent. “We need to be attentive that this shifting horizon does not damage the credibility of the ECB,” he added. “There is no plan B, there is just...

Read More »Saudi pricing, Mtg purchase apps, ADP, Trade, Factory orders, ISM non manufacturing

Saudi discounts for February. Some reduced, some increased, so probably more same- prices fall until Saudi output hits its capacity:Zig zagging a lot recently, now back down to where they’ve been for a while: MBA Mortgage ApplicationsHighlightsMortgage application activity fell sharply in the two weeks ended January 1, down 15 percent for home purchases and down 37 percent for refinancing. Rates were steady in the period with the average 30-year mortgage for conforming balances ($417,000 or...

Read More »Bank of China, Port traffic, Redbook retail sales, Car sales early indication

This does nothing apart from supporting their policy rate: Port Traffic Grew at Slowest Rate Since Recession in 2015 Container traffic rose only 0.8% last year at the 30 busiest ports worldwide, the smallest increase since 2009, according to an estimate by AlphalinerBy Robbie WhelanJan 4 (WSJ) — Container traffic at the world’s busiest ports grew last year at its slowest rate since the recession, according to an estimate by Alphaliner, a shipping industry data provider.Demand was held back...

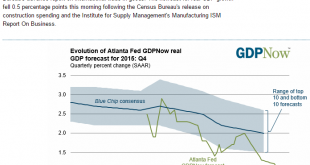

Read More »Fed Atlanta Q4 GDP forecast is +.7%

Down to only .7% for Q4 GDP forecast. JPM went down to 1% today as well. It’s a bit below the DC Fed’s 3%+ forecasts earlier in the year, when the lower price of oil was presumed to be an unambiguous positive for growth, further supported by the massive monetary stimulus of near 0 rates and trillions of QE. And a bit below their latest, similar forecasts of a couple of weeks ago when they judged the economy ‘solid’ and raised rates.

Read More »PMI Manufacturing, ISM Manufacturing, Construction Spending, Canada PMI, China Manufacturing PMI

Bad: PMI Manufacturing IndexHighlightsThe manufacturing PMI has been consistently running warmer than other manufacturing surveys which helps put into context the disappointment of December’s slowing to 51.2, down from 52.8 in November. The final reading for December is 1 tenth lower than the mid-month flash. Near stagnation in new orders is a key negative in the report, one that points to further slowing for the headline index in coming readings. Orders are still growing but at their...

Read More »Saudi production

The Saudis post prices and let their clients buy all they want at the posted prices. So their policy has been to discount the price of their oil vs benchmarks until their sales increase to meet their production capacity, which is reportedly 12 million bpd. That means the price goes low enough to cause other suppliers to cut back, such as US shale producers, which translates into higher Saudi sales and output. Or demand has to increase. Seems they haven’t made much progress so far, as the...

Read More »Chicago PMI, Jobless claims

Way below consensus and way bad: Chicago PMIThe Chicago Business Barometer contracted at the fastest pace since July 2009, falling 5.8 points to 42.9 in December from 48.7 in NovemberThere was also ongoing weakness in New Orders, which contracted at a faster pace, to the lowest level since May 2009. The fall in Production was more moderate but still put it back into contraction for the sixth time this year. The Employment component, which had recovered in recent months, dropped back below...

Read More »Pending home sales, Consumer confidence

Another bad one: Pending Home Sales IndexHighlightsPending home sales in November declined for the third time in four months as buyers continue to battle both rising home prices and limited homes available for sale. The pending home sales index was down 0.9 percent but up 2.7 percent from a year ago. Modest gains in the Midwest and South were offset by larger declines in the Northeast and West.November’s dip continued the modestly slowing trend seen ever since pending sales peaked to an...

Read More » Mosler Economics

Mosler Economics