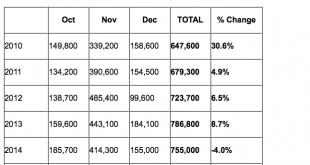

November Retail Hiring Falls To 4-Year Low – 5% Fewer Than One Year Ago As it says, Alaska is not alone, as spending cuts and tax increases due to the oil price collapse continue into next year: Alaska governor proposes first income tax in 35 years Dec 9 (AP) — Alaska Gov. Bill Walker is proposing instituting a personal income tax for the first time in 35 years as the oil-dependent state looks to plug a multibillion-dollar budget deficit amid chronically low prices.In laying out his...

Read More »Mtg apps, US wholesale trade

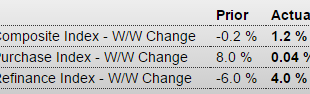

Maybe up from a year ago, but for the last several months flat to down and still at depressed levels: United States : MBA Mortgage ApplicationsHighlightsThe purchase index was little changed in the December 4 week, up 0.04 percent to an unusual second decimal place as published by the Mortgage Bankers Association. Year-on-year, however, the gain is robust with no decimals offered, at plus 29 percent. The refinance index, measured as usual with one decimal place, rose 4.0 percent in the...

Read More »Draghi quote, Euro purchasing power parity, Small business index

“Often wrong but never in doubt”?;) Quote from Mario Draghi: But there is no doubt that if we had to intensify the use of our instruments to ensure that we achieve our price stability mandate, we would. There cannot be any limit to how far we are willing to deploy our instruments, within our mandate, and to achieve our mandate. And indeed the European Court of Justice has stated that the ECB must be allowed “broad discretion” when it “prepares and implements an open market operations...

Read More »Consumer Credit, Oil comment

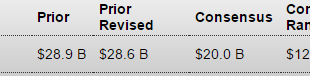

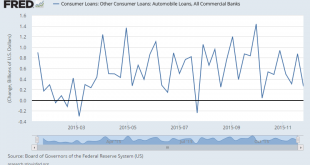

Looks like the last blip up just got reversed so it continues to go nowhere and it’s at levels higher than before the last recession: Consumer CreditHighlightsRevolving credit barely made it into the plus column in October, up $0.2 billion for what is, however, an eighth straight gain. Non-revolving credit, which in contrast to revolving credit hasn’t posted a decline since April 2010, rose an intrend $15.8 billion, once again boosted by vehicle financing and also by student loans which are...

Read More »Labor market conditions index, Euro and yen charts, Fed discussion

This is the Fed’s own index and it’s on the very weak side: Labor Market Conditions IndexHighlightsFriday’s employment report, led by a 211,000 rise in non-farm payrolls, was solid but didn’t give the labor market conditions index much of a boost, coming in at only plus 0.5 vs expectations for plus 1.7. The October index, however, was revised 6 tenths higher to plus 2.2 reflecting in part the upward revision to that month’s nonfarm payroll growth which now stands at a very impressive...

Read More »Rail traffic, Credit check, Employment flows, State and local taxes and expenditures

Rail Week Ending 28 November 2015: Contraction Growing Faster. Rail Traffic in November Down 10.4%. Week 47 of 2015 shows same week total rail traffic (from same week one year ago) declined according to the Association of American Railroads (AAR) traffic data. Intermodal traffic contracted year-over-year, which accounts for approximately half of movements and weekly railcar counts continued in contraction. The 52 week rolling average contraction is continuing to grow. Rail counts for the...

Read More »Comments on Draghi NY Speech

Excerpts from the Speech by Mario Draghi, President of the ECB, Economic Club of New York, 4 December 2015: There is no particular limit to how we can deploy any of our tools. True- limits are political And in this context it is important to recall that we operate under a clear framework of monetary dominance – we are ultimately driven by our mandate of maintaining price stability. True Indeed, it is inevitable that unconventional policy settings, ranging from negative interest rates to...

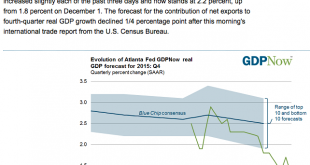

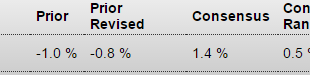

Read More »Fed Atlanta, Factory orders comments and charts, NY ISM

So they said capital goods were strong today. But as the chart shows it was just a zig up after a zag down of a volatile series that continues weak overall, especially when compared to the year before: NY/NYC ISM:

Read More »Payrolls, Trade

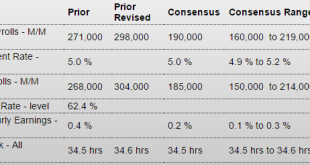

The growth rate continues to decelerate (see chart): NFP HighlightsPayroll growth is solid and, though wages aren’t building steam, today’s employment report fully cements expectations for December liftoff. Nonfarm payrolls rose a very solid 211,000 in November which is safely above expectations for 190,000. And there’s 35,000 in upward revisions to the two prior months with October now standing at a very impressive 298,000. The unemployment rate is steady and low at 5.0 percent with the...

Read More »Factory orders, ISM non mfg, ECB news

Yes, they were up, but there is a ‘seasonal’ aspect to it, including an air show, so the year over year chart is a bit more indicative of what’s going on and it’s still in negative territory. Also, vehicle orders declined, and inventories remained at levels that beg continuing production cuts. Factory OrdersHighlightsFactory orders bounced sharply higher in October and, together with the bounce higher for manufacturing in the industrial production report, confirm what was a very solid month...

Read More » Mosler Economics

Mosler Economics