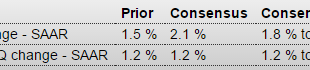

Output was revised up, but mainly due to growing unsold inventory, with other spending revised lower and showing more deceleration than the first release: GDPHighlightsThird-quarter GDP is revised to an annualized plus 2.1 percent, up 6 tenths from the initial estimate but showing less strength by the consumer with final sales now at plus 2.7 from plus 3.0 percent. Higher inventories are a big factor in the upward revision, subtracting 6 tenths from GDP vs an initial 1.4 percent...

Read More »Copper, Japan, Corp tax policy

They must have found a way for their workers to live on fewer calories… Copper Miners’ Pain Doesn’t Stop Buildup Nov 23 (WSJ) —Global copper production is on track to hit an all-time high of 18.7 million metric tons this year, according to BMO Capital Markets. The cost of producing a pound of copper at Freeport’s Grasberg mine in Indonesia will drop to 61 cents next year, from an estimated $1.05 cents in 2015, according to BMO. Next year, four new mines will increase the world’s copper...

Read More »Chicago index, PMI manufacturing index, Existing home sales, Saudi pricing

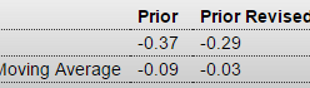

Still negative. This is just a composite of other indexes that have been released: Chicago Fed National Activity IndexHighlightsOctober was a soft month for the economy but solidly improved from September, based on the national activity index which is at minus 0.04 vs September’s revised minus 0.29. October’s improvement is centered in the key component of employment, at plus 0.11 vs September’s minus 0.06. The gain reflects the month’s very strong 271,000 rise in nonfarm payrolls and the 1...

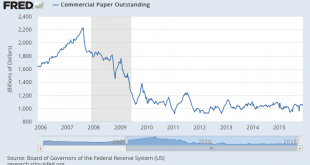

Read More »Rail traffic, credit check

Rail Week Ending 14 November 2015: Contraction Grows Week 45 of 2015 shows same week total rail traffic (from same week one year ago) declined according to the Association of American Railroads (AAR) traffic data. Intermodal traffic contracted year-over-year, which accounts for approximately half of movements. and weekly railcar counts continued in contraction. The 52 week rolling average contraction grew. Not much happening:

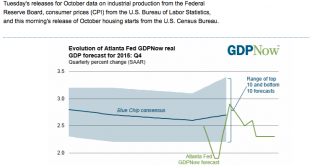

Read More »Atlanta Fed, Investor poll, Fed surveys

The crowd is not always wrong, but it’s not always right, either: Fund managers polled at the start of November have significantly hiked their allocation to equities and cut cash holdings to levels not seen since July, according to research from Bank of America Merrill Lynch.Of the 200 investors managing $576 billion of assets that were quizzed by the bank for its monthly fund manager survey, four-fifths now expect the U.S. Federal Reserve to raise rates this quarter.Some 43 percent of...

Read More »Housing starts, High end weakness

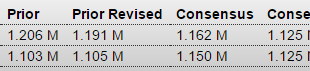

Falling off, as previously discussed, particularly multi family, which had been the driver: Housing StartsHighlightsPulled down by a big drop in multi-family homes, housing starts fell a steep 11.0 percent in October to a 1.060 million annualized rate that is far below Econoday’s low estimate. Starts for multi-family homes, which spiked in September following a springtime jump in permits for this component, fell back 25 percent in the month to a 338,000 annualized rate. Single-family starts...

Read More »Brussels Presentation Announcement

Euro, the moment of Truth [embedded content]

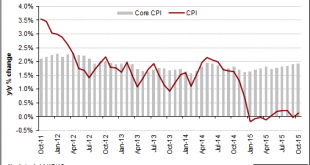

Read More »CPI, Redbook Retail Sales, Industrial Production, Housing Index, Containers, FHA Capital, EU Car Registrations, Japan

Part of the Fed’s mandate is to hit it’s 2% inflation target:Still at recession type levels:This is also what recession looks like:The anointed ‘driver of the economy’ continues to falter as previously discussed: Housing Market IndexHighlightsThe housing market index from the nation’s home builders shows weakness, at 62 for November and missing the Econoday consensus by 2 points. And compared to a revised October, the index is down 3 points. Yet readings in the report, though slowing,...

Read More »Empire State Manufacturing, China Power Usage, Stock Buy Backs

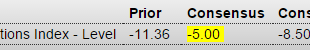

The recession continues: Empire State Mfg SurveyHighlightsNegatives are beginning to run in Empire State with the index at minus 10.74 in November, right in line with the prior four readings and well below the Econoday consensus for minus 5.00. Several components are showing extended weakness including unfilled orders, at minus 18.18 for the lowest reading of the year, and also the workweek, at minus 14.55 for a fifth straight decline and the weakest run since mid 2013. With unfilled orders...

Read More »LA port traffic, Philly Fed Forecasting Survey, Job Growth Chart, Japan

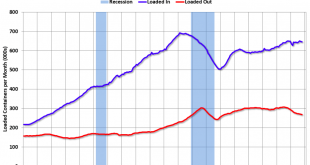

LA area Port Traffic declined in October By Bill McBrideFirst, from the WSJ: Quiet U.S. Ports Spark Slowdown Fears For the first time in at least a decade, imports fell in both September and October at each of the three busiest U.S. seaports, according to data from trade researcher Zepol Corp. analyzed by The Wall Street Journal. …The declines came during a stretch from late summer to early fall known in the transportation world as peak shipping season, when cargo volumes typically surge...

Read More » Mosler Economics

Mosler Economics