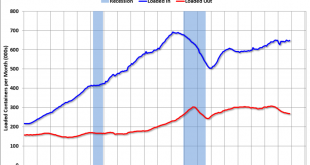

Rail Week Ending 12 December 2015: Bad Data Continues And Marginally Worse Than Last Week Week 49 of 2015 shows same week total rail traffic (from same week one year ago) declined according to the Association of American Railroads (AAR) traffic data. Intermodal traffic returned to contraction year-over-year, which accounts for approximately half of movements and weekly railcar counts continued deeply in contraction. So who would’ve thought all that ‘monetary stimulus’ wouldn’t work???;)...

Read More »PMI services index, KC Fed

Much lower than expected from the service that tends to run much higher than the others. Fed rate hike already working! ;) PMI Services FlashHighlightsThe services PMI is slowing sharply this month, to 53.7 vs 56.1 for the final November reading and vs 56.5 for the flash reading. This is the lowest reading in a year reflecting the slowest growth in new orders since January and a fifth straight month of contraction in backlog orders. Optimism over future growth is understandably down,...

Read More »Rate hike comment, Container traffic, Employment comment

So a Fed rate hike is nothing more than the federal government deciding to pay more interest on what’s called ‘the public debt’. By immediately paying more interest on balances in reserve accounts at the Fed the cost of funds to the banking system is supported at that higher level, all of which influences the interest paid on securities accounts at the Fed as well, which influences the term structure of rates. Imports up, exports down:Seems to me there’s a substantial number of people who...

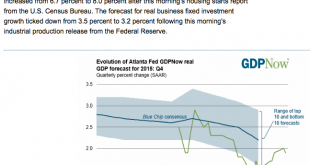

Read More »Atlanta Fed, US current account, Philly Fed

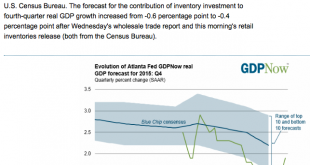

Blue chip consensus dropping quickly now, and today won’t help any:Remember a year ago when they said the oil price drop would be an unambiguous positive for the trade balance?;) Anyway, this is weak dollar stuff, vs the euro area current account surplus, which is strong euro stuff: Current AccountHighlightsThe nation’s current account deficit widened sharply in the third quarter, to $124.1 billion from a revised $111.1 billion in the second quarter. This is the widest gap of the recovery,...

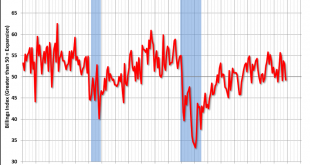

Read More »Architecture Billings Index, Fed comments

Another setback for economic forecasters as this index falls below 50, indicating contraction:Seems to me the Fed has gotten lost in its own confused rhetoric, but that’s another story. Point here is fed funds are a quarter point higher which will will make no discernible difference to macroeconomic outcomes, including the Fed’s employment and inflation mandates. FED RAISES RATES BY 25 BASIS POINTS, FIRST SINCE 2006

Read More »Mtg prch apps, Housing starts, Industrial production, Euro trade

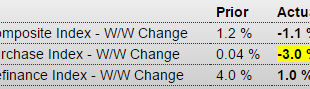

Yes, up vs last year’s dip, but remain depressed and have beenheading south since early this year: MBA Mortgage ApplicationsHighlightsApplication activity was little changed in the December 11 week, up 1 percent for refinancing and down 3.0 percent for home purchases. Year-on-year, purchase applications remain very high, up 34 percent in a gain that in part reflects a pulling forward of demand ahead of what is expected to be a rate hike at today’s FOMC. Rates were little changed in the week...

Read More »CPI, Empire survey, Redbook retail sales, Housing index

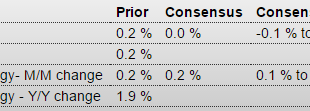

One of the Fed’s mandates. The ‘headline’ number is below target due to the energy impulse, but the ‘core’ rate, led by services, is on target. The question is whether energy prices, if they remain at current levels, will ‘pull down’ other prices. And the comparisons with last year are now vs the lower numbers that were released after the oil price collapse. And not to forget that the Fed uses futures prices as indications of future spot prices, even for non perishables, which technically...

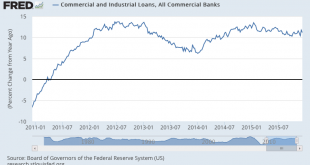

Read More »Atlanta Fed, China, S&P, bank loans

Up a notch on stats I expect will reverse in Dec, and note the street forecasts coming down:Many think the Fed is focusing on this to presume a strong underlying economy. However it’s been supported by the jump in health care premiums due to the additional people paying for insurance, a one time event, and vagaries of the deflator: Still no acceleration:

Read More »Retail sales, Business inventories, Consumer Sentiment

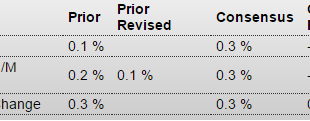

Retail sales = retail (gross) income and growth is still way down year over year, as per the charts. Also declining vehicle sales are highly problematic, as they were what was keeping a bad story from being that much worse. And not to forget when looking at year over year change oil and gas prices were already down quite a bit by this time last year: Retail SalesHighlightsOnce again the headline for the retail sales report understates underlying strength. Total retail sales rose only 0.2...

Read More »Saudi oil pricing, import and export prices, Japan Manufactures’ sentiment

Not a lot of change for January, most ‘discounts’ still at or near the wides, so price action likely to be more of same:Something the Fed takes into consideration: Import and Export PricesHighlightsCross-border price pressures remain negative with import prices down 0.4 percent in November and export prices down 0.6 percent. Petroleum fell 2.5 percent in the month but is not an isolated factor pulling prices down as non-petroleum import prices fell 0.3 percent in the month. Agricultural...

Read More » Mosler Economics

Mosler Economics