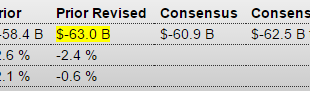

Not good for Q4 GDP. Remember, lower oil prices were supposed to reduce our trade deficit…;) International Trade in GoodsHighlightsNovember’s international trade goods deficit narrowed to $60.5 billion from the revised $63.0 billion in October. October’s estimate previously was minus $58.4 billion. Expectations were for a deficit of $60.9 billion. Both exports and imports continued to decline on the month. Goods exports were down 2.0 percent while imports were 1.8 percent lower. Weak...

Read More »Dallas Fed, Japan restarting nukes

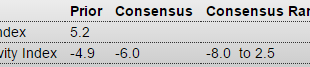

From bad to worse: Dallas Fed Mfg SurveyHighlightsTexas factory activity increased for a third month in a row in December. The production index, a key measure of state manufacturing conditions, rose from 5.2 to 13.4, indicating stronger growth in output. Some other indexes of current manufacturing activity also reflected growth in December, but the survey’s demand measures showed continued weakness.New orders, an indicator of incoming demand, declined at a faster pace. The index has been...

Read More »Unemployment claims, NYC apts, Japan spending, interview in Truth-Out

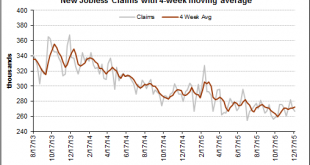

Claims readings could be distorted because a smaller share of those potentially eligible for benefits are applying. The share of recently unemployed workers seeking benefits has fallen this year to just above 50%, according to the National Employment Law Project, a group that advocates for the unemployed.The rate is down from record high of almost 80% just after the recession ended.The application rate typically declines as expansions age, but the current pace is the lowest in 15 years....

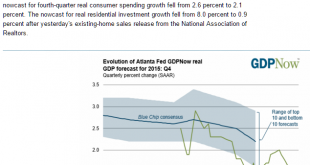

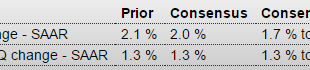

Read More »Fed Atlanta GDP forecast

Down to +1.3%must be the rate hike at work…;)

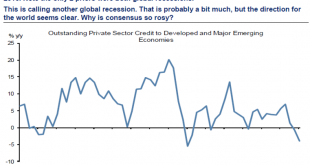

Read More »Private sector credit growth, Philly Fed State index

It all ended when oil capex collapsed about a year ago, as previously discussed: Merry Christmas!

Read More »Mtg purchase apps, Durable goods orders, New home sales, Personal income and outlays, Chemicals Activity Barometer

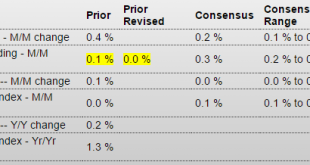

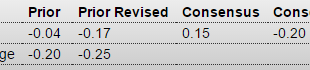

Up some this week. Been bouncing around a lot with looming Fed hike, regulation changes, etc. but mtg apps and home sales remain depressed:More bad here: Durable Goods OrdersHighlightsOctober was a rare good month for the factory sector, not November where manufacturing production in the industrial production report was no better than unchanged and now new orders were also unchanged. Excluding transportation, orders dipped into the minus column though just barely at minus 0.1...

Read More »Personal spending

Consumer spending revised down for last month. Seems best to wait for at least the first revision before commenting.;) And still waiting for the consumer to spend his gas savings?;) United States : Personal Income and Outlays HighlightsBecause of a glitch at the Bureau of Economic Analysis, the personal spending portion of the personal income & spending report was posted early. Personal spending rose an as-expected and very respectable 0.3 percent in November with October revised 1...

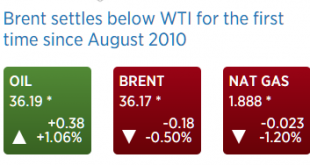

Read More »Oil prices, Existing home sales chart

This means ‘the swamp has been drained’ and falling production has eliminated the trapped oil in Cushing that caused WTI to be at a discount to Brent. In fact, Brent should trade at a discount to WTI when the shortage is fully eliminated, reflecting transportation costs to the US. This, however, does not mean there’s any kind of national shortage or that prices will go up as unlimited imports are continuously available at then current prices, and last I saw the Saudis are still discounting...

Read More »GDP, existing home sales, Richmond Fed

Not so good since oil capex collapsed about a year ago: GDPHighlightsA downward revision to inventories pulled down the third revision to third-quarter GDP, coming in at an annualized and expected rate of 2.0 percent. Revised inventory growth, at $85.5 billion vs an initial $90.2 billion, was the most negative factor in the quarter, which is actually a plus of sorts as businesses held down inventories due to slowing sales, a move that should limit future disruptions in production and...

Read More »Spending and tax bill, Chicago Fed, CRE lending

800 billion over 10 years is something, but not enough to turn things around as it’s maybe .25% of GDP per year or so. Historically it’s taken a good 5% of GDP deficit to reverse a decline, which today means close to a 1T deficit annually. And interesting how they just jumped all over Trump for his tax plan that they claimed would add 1T to the debt over 10 years… Massive Spending and Tax Package Leaves Deficit Fears Behind Congress passed far-reaching legislation Friday to fund the...

Read More » Mosler Economics

Mosler Economics