More evidence the capital spending contraction is not over: CEO Confidence Goes From Bad to Worse Dec 1 (Fox Business) — CEO confidence in the U.S. economy is dwindling. The Business Roundtable CEO Economic Outlook Index for the 4Q, which looks out six months, fell to the lowest level in three years For third consecutive quarter, U.S. CEOs cautious on economy Dec 1 (Reuters) — The Business Roundtable CEO Economic Outlook Index fell 6.6 points to 67.5 in the fourth quarter. The long-term...

Read More »Recent interview transcript, Car sales, Fed Atlanta GDP forecast

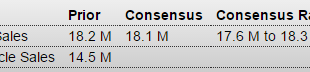

Transcript: Interview with Economist Warren Mosler Interesting- total sales rate unchanged, but domestic vehicle sales rate down again. In other words, not currently growing: Motor Vehicle SalesHighlightsConsumers have really shown their strength the last three months, buying vehicles at a 12-year high annualized rate of 18.2 million. That’s right, for three months in a row. The results, however, do not point to a monthly gain for the motor vehicle component of the November retail sales...

Read More »Saudi output, Redbook sales, PMI, ISM

While demand for Saudi crude is up a bit, seems it’s still far below their presumed 12 million or so bpd capacity, and their strategy has been to lower their prices to the point where they are selling their full capacity: Nice bounce here, as the year over year comparisons get ‘easier’: RedbookHighlightsStore sales surged in the November 28 week, the week that includes Black Friday. Redbook’s same-store year-on-year sales tally jumped to plus 3.9 percent, more than doubling the pace of...

Read More »Saudi production, Restaurant index

Just came out. Saudis still producing and selling far below their stated ‘cap’: OPEC November Crude Output Down 33,000 Bbl/Day to 32.121 Mln2015-11-30 17:55:55.463 GMTNew York, Nov. 30 (Bloomberg) — Crude-oil production from the 12 OPEC members in November declined 33,000 barrels a day from October, the latest Bloomberg survey of producers, oil companies and industry analysts shows. Figures are in the thousands of barrels a day.Nov. Oct. Monthly 1/1/2012 Nov. vs Est.OPEC Country Est. Output...

Read More »Chicago PMI, Pending home sales, Dallas Fed

Another bad one, reversing last month’s suspect move up: Chicago PMIHighlightsVolatility is what to expect from the Chicago PMI which, at 48.7, is back in contraction in November after surging into strong expansion at 56.2 in October. Up and down and up and down is the pattern with prior readings at 48.7 in September (the same as November) and 54.4 in August.New orders are down sharply and are back in contraction while backlog orders are in a 10th month of contraction. Production soared...

Read More »Credit check

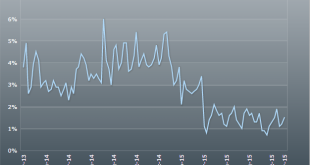

Nothing of consequence here. Growth still below prior cycles and not accelerating as it was beginning to do before oil capex collapsed: While growth of real estate lending is still far below the prior cycle, it has been increasing, probably due to fewer ‘all cash’ purchases, and the modest recovery in prices and sales:Consumer credit growth remains modest and, if If anything, is softening most recently: Looks to me like car loan growth is slowing a bit:

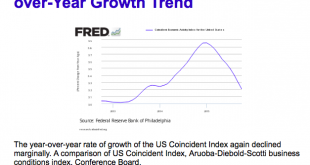

Read More »Philly Fed Coincident Index, Rail Chart, Truck Tonnage

Mtg prch apps, Durable goods, Personal income and outlays, New home sales, Consumer Sentiment, PMI services

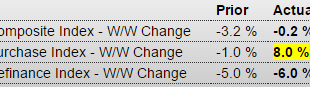

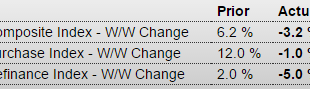

Purchase apps have been flat to down for quite a while now,and the year over year comp will be reflecting that in a few months as well: United States : MBA Mortgage ApplicationsHighlightsAfter spiking sharply in the prior when rates jumped and triggered concern they would move even higher, mortgage application volumes eased in the November 20 week as rates settled back with purchase applications down 1.0 percent and refinancing applications down 5.0 percent. However, purchase applications,...

Read More »Redbook retail sales, Corporate profits, Inflation adjusted real house prices

Sales = gross income, and profits are net income: Still down: Adjusted for inflation housing prices are about where they were 10 years ago:

Read More »Discount rate, Profits, GDP commentary

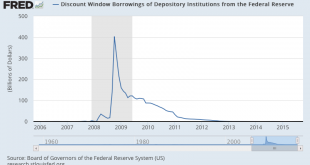

Interesting, with no discount borrowings, the regional Federal Reserve Bank presidents want a discount rate hike? Nine Fed banks called for discount rate hike: minutes Nov 24 (Reuters) — The number of regional Federal Reserve banks pushing for a hike in what commercial banks are charged for emergency loans rose to nine in October, minutes from its discount rate meeting showed. Eight Fed banks had voted to raise the discount rate at the prior meeting in September, a jump from five in July...

Read More » Mosler Economics

Mosler Economics