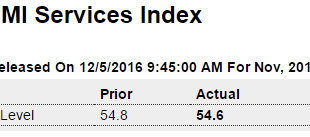

Post election surveys may prove to be a bit ‘trumped up’, just saying… Highlights In another sign of strength for the economy, the ISM non-manufacturing index jumped 2.4 points in November to a 57.2 reading that tops Econoday’s high-end forecast. Employment for ISM’s sample, where growth was soft in October, shot more than 5 points higher to an outsized 58.2. Averaging recent scores for this reading puts the trend at a softer but still very respectable mid-50s rate. New...

Read More »GDP, Rents, Saudis

This line shows total GDP growth over the prior 10 years. It makes the point as to just how sudden the latest drop off was and how severe it continues to be. It’s just screaming ‘lack of aggregate demand’ begging a fiscal relaxation of maybe 5% of GDP annually for a while. Bottom line: It’s always an unspent income story. The 2008 financial crisis led to a sharp fall off in private sector deficit spending (credit expansion) that had been offsetting desires to not spend...

Read More »Payrolls, Vehicle sales, Carrier

Year over year growth continues to decelerate, and wage growth remains critically low. And participation rates further evidence a massive shortage of aggregate demand, and it’s all only getting worse: Highlights Payroll growth is solid and the unemployment rate is down sharply, but not all the indications from the November report employment are favorable. Nonfarm payrolls rose 178,000 in November to just beat out expectations with revisions no factor, as a sharp downward...

Read More »Chain store sales, PMI and ISM surveys, Construction spending, Auto sales, Delinquencies

Highlights Chain stores are reporting mixed to lower year-on-year rates of November sales compared to October. Today’s results do not hint at another month of strength for the government’s ex-auto ex-gas retail sales reading which posted very strong monthly gains of 0.6 percent and 0.5 percent in October and September. Manufacturing muddling through at current levels: Markit Manufacturing PMI: Highlights Durable orders picked up in October and the momentum appears to...

Read More »Mortgage applications, Pending home sales, ADP payrolls, Personal income and spending, Chicago PMI

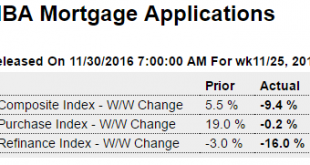

So mortgage applications for purchases rose during the first half of the year, then reversed and are looking to be at best flat vs the year before come year end: Highlights Purchase applications for home mortgages fell just 0.2 percent on a seasonally adjusted basis in the November 25 week following the prior week’s outsized 19-percent increase. But applications for refinancing were down 16 percent from the prior week, as the sharp post-election increase in interest rates...

Read More »GDP, Consumer confidence, Redbook retail sales, Headlines

Revised up a bit as expected, pretty much all from revising up consumer spending. And it’s still a soybean export and inventory building story: Highlights The third quarter has gotten a meaningful upgrade. The second estimate is 3 tenths higher than the first, at a plus 3.2 percent annualized rate and which includes an upgrade for consumer spending and, in further good news, a downgrade in inventory growth. Personal consumption expenditures rose at a 2.8 percent pace in the...

Read More »Black Friday, Trump comments, Dallas Fed Survey

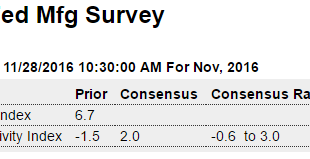

Total Black Friday sales down vs last year:http://www.reuters.com/article/us-usa-holidayshopping-idUSKBN13L0ZH?il=0 The Trump thing looks to be going to go from bad to worse. I understand that sometimes it makes sense to vote in the village idiot. But then you do have to deal with him being the President. It’s like having an 8 year old loud mouthed spoiled brat boy king without a regent. So my advice is to not get your hopes up too high for anything rational coming out of the...

Read More »Rail week, Trucking data, Bank lending

http://econintersectllc.cmail2.com/t/r-l-yhuudyld-jutdvkyuh-jy/ http://econintersect.com/pages/releases/release.php?post=201611250637&utm_medium=email&utm_campaign=Daily%20Global%20Economic%20Intersection%20Newsletter%20Feed&utm_content=Daily%20Global%20Economic%20Intersection%20Newsletter%20Feed+CID_2c6311bc7e868470eee44c0357c5f143&utm_source=newsletter&utm_term=Trucking%20Data%20Mixed%20In%20October%202016 Not looking good: ...

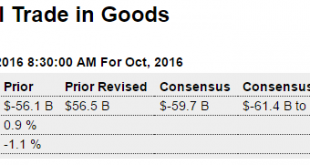

Read More »Trade, Composit PMI, Credit check

Higher trade deficit than expected, and last month revised higher. And just getting going: Highlights The advance international goods deficit widened to $62.0 billion in September from minus $56.5 billion in August. The increase in the deficit was bigger than the anticipated deficit of $59.7 billion. Exports were down 2.7 percent on the month while imports increased 1.1 percent. In August exports increased 0.6 percent while imports declined 1.0 percent. The biggest decline...

Read More »Redbook retail sales, Mortgage purchase apps, PMI manufacturing, Consumer sentiment, New home sales

Notable only in that analysts are calling the latest 1% increase ‘strong growth’… First a big move down, now a rush to get in ahead of fed rate hikes. But still remains depressed by historical standards: Highlights Rising interest rates are causing some volatility in mortgage activity, with purchase applications for home mortgages increasing by an outsized, seasonally adjusted 19 percent in the November 18 week after falling 6 percent in the prior week, while refinancing...

Read More » Mosler Economics

Mosler Economics