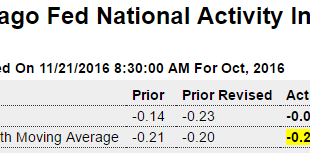

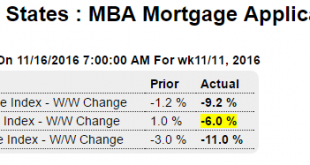

These sales are reported based on actual closings, and they look to have flattened around the 5.5 million/yr rate. But that was before lenders hiked mortgage rates due to Trumpenomics frears, and mortgage purchase apps did drop a full 6% last week. And this number is not ‘population adjusted’: Talk about cheerleading- the order book remains in contraction: UK Factory Orders Rise in November: CBI The Confederation of British Industry order book balance rose to -3 in November...

Read More »Chicago Fed, Japan, China, UK, US container counts, Euro area savings desires, Fed comment, Dividends comment

Still in the red: This is not a good sign for global demand. And Japan’s continuing trade surplus recently enhanced by the falling yen isn’t a positive for US GDP: Japan’s trade surplus grows 4.7-fold in October Nov 21 (Kyodo) — Japan’s trade surplus expanded 4.7-fold in October from a year earlier to 496.17 billion yen ($4.5 billion). The value of exports dropped 10.3 percent from a year earlier to 5.87 trillion yen while imports plunged 16.5 percent to 5.37 trillion yen....

Read More »Yellen statements

Not good: Said Yellen: “The long-run deficit probably needs to be kept in mind.”http://www.usatoday.com/story/money/2016/11/17/yellen-fed-track-dec-rate-hike/93991628/ http://www.bloomberg.com/news/articles/2016-11-17/yellen-signals-fed-won-t-be-cowed-after-trump-s-election-victory “In addition, with the debt-to-GDP ratio at around 77 percent there is not a lot of fiscal space should a shock to the economy occur, an adverse shock that did require fiscal stimulus,” she said....

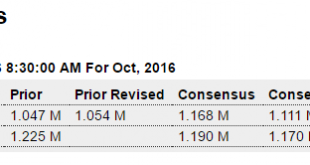

Read More »Housing starts, Consumer price index, Philly Fed survey

Nice move up after a large move down. Note that the average of the last two months is about where this series has been. And, again, it’s the permits that count, and they are about the same as last month. And not to forget mortgage applications to buy homes fell a full 6% last week after rates went up in response to the election. Highlights In data that will lift estimates for fourth-quarter GDP, housing starts surged 25.5 percent in October to a 1.323 million annualized...

Read More »Bannon, DB on repatriation, The $

The big stupid continues uninterrupted from regime to regime: Documentary Of The Week: Stephen Bannon Explains America’s Problems By John Lounsburry Nov 15 (Econintersect) — Econintersect: This lecture was presented to the inaugural session of the Liberty Restoration Foundation in Orlando, FL October, 2011. Stephen Bannon, the CEO of Donald Trump’s successful presidential campaign and to-be Chief Strategist in the Trump White House, describes his view of what is wrong with...

Read More »Taper tantrum redux, Repatriating rhetoric, Architectural billings index

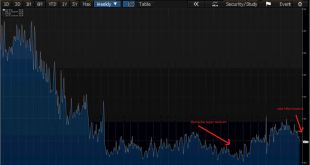

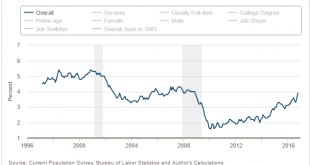

With the Bernanke taper tantrum a housing market showing at least some signs of recovery immediately reversed course and headed south. The shale boom got things going again, and the shale bust saw some softening. But with the latest anticipatory spike in mtg rates and still not much underlying effective demand, we’re seeing the beginnings of another setback. This is the chart for the index for mortgage applications for home purchases: I haven’t yet seen any reason for a...

Read More »Mtg rates, Industrial production

If rates were being raised due to excess demand for mortgages the higher rates wouldn’t likely slow things down. But in this case demand has been relatively low, so the jump in rates not due to demand will likely slow demand: Highlights Purchase applications for home mortgages fell a seasonally adjusted 6 percent in the November 11 week as a sharp increase in mortgage rates took its toll on application activity. The rise in rates had an even greater impact on refinancing,...

Read More »Fed Atlanta wage tracker, Layoffs, State 2017 spending cuts, misc. charts

So if new hires are at the lowest end of the wage scale, a reduction in the growth of new hires increases the average growth rate? Also note the large ‘dip’ in growth to less than 2% from the last recession. The ‘lost wage growth’ doesn’t even begin to get ‘made up’ until the rate of growth exceeds the prior average of about 4%: Aggregate demand is still being lost as the cutbacks from the collapse of oil capex 2 years ago continue: U.S.-based energy companies announced plans...

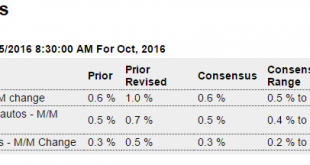

Read More »Retail sales, Empire manufacturing, Redbook retail sales, Business inventories

Good report, driven by autos, which were up from last month though down from last year. However, on a year over year basis vehicles sales if anything seem to be moderately declining, and so won’t be contributing to growth as they had in the past. So a glimmer of hope here, but guarded to say the least: Highlights The consumer started the fourth-quarter better than expected and finished the third-quarter even stronger than that. Retail sales jumped 0.8 percent in October...

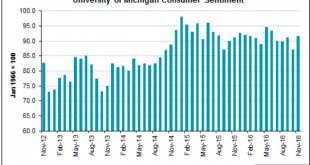

Read More »Consumer sentiment, Retail employment

A bit of a Trump boost, but the general downtrend of the last couple of years is still intact: Retail Employment Gains Fall 21% From A Year Ago By Challenger Gray and Christmas Nov 10 (Econintersect) — Despite largescale hiring announcements from numerous major retailers, the number of October employment gains in the sector declined 21 percent from a year ago to 154,600. That was the fewest job gains to kick off the holiday hiring season since 2012. ...

Read More » Mosler Economics

Mosler Economics