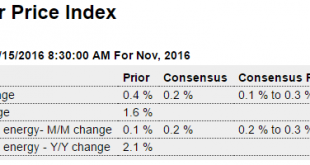

Fed still failing to hit its 2% target after years of trying, and after years of forecasting that it would hit its 2% target: Highlights Inflation at the consumer level remains low. The CPI rose 0.2 percent in November with the year-on-year rate up 1 tenth to plus 1.7 percent. The core rate, which excludes food and energy, also rose 0.2 percent with this year-on-year unchanged at 2.1 percent. Food prices were unchanged in November though energy did move sharply, up 1.2...

Read More »Retail hiring, Yellen on fiscal, Rep Williams on Fed hike, Fx chart

November 2016 Retail Hiring Falls To 6-Year Low Dec 13 (Econintersect) — Retailers added fewer workers through the first two-thirds of the typical holiday hiring period – and is down nearly 10% from a year ago. The latest data from the Bureau of Labor Statistics (BLS) showed that employment in retail grew by 371,500 in November. That was down 9.3 percent from a year ago, when jobs in the sector increased by 409,500. It was the lowest November employment increase since 2010....

Read More »Purchase apps, Retail sales, Industrial production, Inventoriese, Analyst comments

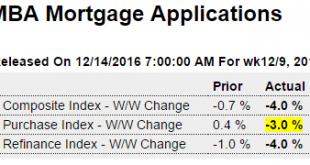

Continues to decline. One less reason for the Fed to hike today… Highlights Rising interest rates continue to take their toll on mortgage activity, with purchase applications for home mortgages falling a seasonally adjusted 3.0 percent in the December 9 week, while refinancing applications fell 4.0 percent. The purchase index now stands just 2 percent above its reading a year ago, a 1 percentage point decline from the prior week. Reaching the highest level since October...

Read More »Small business survey, McConnell, Redbook retail sales

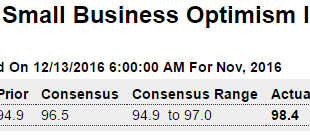

Nice Trumped up spike, led entirely by expectations the new President would make everything better, but even with that low by historical standards: Highlights The small business optimism index rose a sharp 3.5 points in November to 98.4, significantly exceeding expectations and posting the highest reading since May 2015. The NFIB said small business optimism remained flat leading up to Election day, but then rocketed higher, ignited by business owners’ expectations of better...

Read More »Oil comments, Trump talk

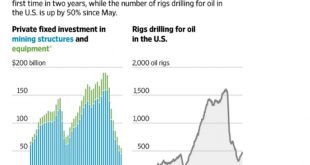

At this point in time higher oil prices are an unambiguous negative for the US economy. The higher prices will drain low income consumer $, and while incomes for higher end consumers with oil related income will benefit, I don’t see them increasing spending as fast as the low end cuts back. Also, with the US importing more oil and at higher prices, incomes of foreign oil producers will benefit but, again, I don’t see them buying as many more US goods and services. And oil...

Read More »Michigan survey, Inventories

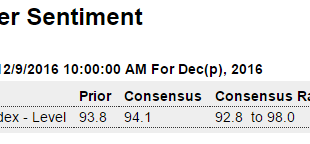

Post election euphoria? In any case, as per the chart, historically it doesn’t tend to stay this high for long: Highlights Post-election confidence continues to build, lifting consumer sentiment by more than 4 points to a 98.0 level that hits the very outside of the Econoday range and is 1 tenth away from the index’s recovery peak hit last year. Consumers specifically cite expectations of new economic policies as the biggest positive. A rise in the current conditions...

Read More »Saudi pricing and output

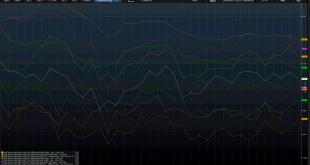

No clear signal for what might come next with regard to the price of oil: Saudis set prices (above) and then let their clients buy all they want at the posted prices. The chart shows clients have been buying a bit more lately, but not anywhere near the Saudis currently presumed daily capacity of about 12 million barrels per day:

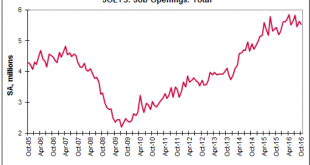

Read More »JOLTS, Consumer Credit, Soft Bank

Looks a lot like the top looked back in 2007? Declining growth of consumer credit means credit driven spending isn’t adding as much to GDP this year as it did last year: Highlights Consumer credit keeps expanding including moderate and consistent gains for credit cards. Consumer credit outstanding rose $16.0 billion in October, driven as usual by vehicle financing and student loans but also by revolving credit which is where credit-card debt is tracked. Revolving credit rose...

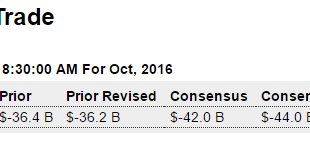

Read More »Trade, Factory orders, Redbook retail sales, Saudi pricing, Comments on Trump tactics

Trade deficit moving back out. I expect a lot more to come this quarter and next. Oil is getting more expensive and the quantity imported is up as well. The ‘one time’ soybean export bulge is behind us, and global trade in general has slowed. Wouldn’t surprise me if Trump responds by having the US start buying foreign currencies, which would send the dollar lower to offset ‘foreign currency manipulation’. And, of course, he’d show a ‘profit’ in fx purchases as the dollar...

Read More »Wire article, Trump news, Italy

What Does Modern Money Theory Tell us About Demonetisation? Dec 5 (The Wire) — Warren Mosler, a founder of MMT, explains the idea of “taxes drive money” using a simple example. He pulls out his visiting card in a classroom and … Continuous flow of this stuff:Donald Trump insults China with Taiwan phone call and tweets on trade, South China Sea PR No. 298 PM TELEPHONES PRESIDENT-ELECT USA Islamabad: November 30, 2016 Prime Minister Muhammad Nawaz Sharif called...

Read More » Mosler Economics

Mosler Economics