Attached is an excellent piece on the euro zone by Professor Andrea Terzi Sales aren’t falling year over year but they aren’t growing at 5% as they would do in ‘normal’ times:In ‘normal’ times inventories increase with sales, adding to output. But when sales slow inventory growth stops and reverses: I like this headline:

Read More »Saudi output and pricing update

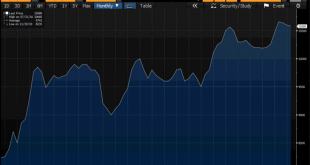

The Saudis set prices via discounts to benchmarks, which will trigger either price appreciation or depreciation, or, if they happen to get the discounts ‘exactly neutral,’ at least near term stability. They then allow their clients, who are all refiners, to buy all they want at the posted prices. To date the total purchased has been less than their presumed 12 million barrel per day production capacity. the chart shows that the price cut a couple of years ago, from over $100...

Read More »Retail sales, NFIB sales, Election comments

Online sales growth now decelerating as well:NFIB small business sales Trump won largely because people couldn’t bring themselves to vote for Clinton, and not so much because anyone like him or his presumed agenda. And along the way he destroyed the Republican party, which may or may not sitso well with Republicans in Congress. So it’s not like he has a mandate to do anything or that he can rely on Republican support for anything. Regarding his proposed tax cuts, under...

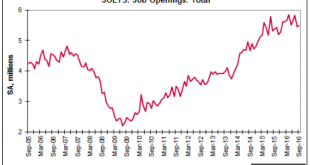

Read More »Jolts, Small business index, Redbook retail sales

When this chart heads lower as it’s doing it’s all over: The chart is well below what in the past were recession levels, and still looking like it can go a lot lower: Highlights The small business optimism index rose 0.8 points in October to 94.9, slightly exceeding expectations and extending a rebound from the 2-year low at 92.6 set in April. Of the 10 components of the index, 5 posted gains, 3 were down and 2 remained unchanged. The largest gain was recorded in plans to...

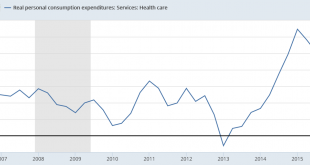

Read More »PCE health care, Bank lending survey, Consumer credit

Best I can tell this is mainly about health care insurance premiums, which ‘count’ as personal consumption expenditures and have been adding support to GDP: Inflation adjusted: Not inflation adjusted: Looks like the support is starting to fade: The ‘one time’ adjustment for Obamacare may have passed, along with it’s supportfor GDP. And note the growth of employment was well below the growth in costs: Bank credit tends to tighten up as the economy slows, which slows lending...

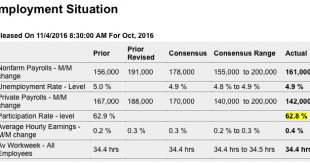

Read More »Payrolls, Tax receipts, Saudi price hikes

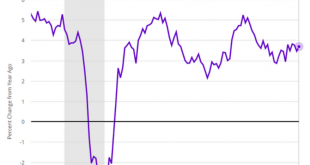

As per the chart, the deceleration of employment growth continues in what’s now been a very steady decline going on 2 years. And with employment growth decelerating at this rate it’s likely the unemployment rate will remain elevated indefinitely: Highlights Solid payroll growth is not the whole story of the October employment report. Average hourly earnings are rising, up an outsized 0.4 percent in the month with the year-on-year rate, at 2.8 percent, suddenly near 3.0...

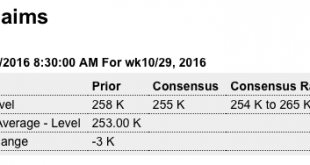

Read More »Jobless claims, PMI services, ISM services, Factory orders

As previously discussed, jobless claims are down largely because they are a lot harder to get:https://www.bloomberg.com/view/articles/2016-11-02/the-good-news-on-jobs-isn-t-all-that-good And now they are going up a bit, though still very low historically: Highlights Jobless claims are holding at or near record lows, with initial claims up only 7,000 in the October 29 week and continuing claims down 14,000 in the October 22 week. The 4-week average for initial claims, now at...

Read More »US Auto sales, Atlanta Fed, ISM NY

The Fed is looking for ‘some improvement’ Let me know if you see any! ;) Sideways at best as this prior source of growth is no longer contributing:After just one day it’s come down a bunch: United States ISM New York Index The ISM NY Current Business Conditions Index fell to 49.2 in October 2016 from 49.6 in September. Volume of purchases continued to fall (44.3 from 47.1 the previous month) and current revenues went up at a slower pace (51.4 from 51.6). By contrast,...

Read More »Personal consumption, Swiss retail sales, Redbook retail sales, PMI manufacturing, ISM manufacturing, Construction spending

Gotta like the headlines. The growth rate remains below where it was during the beginning of the last recession… That is, we could already be well into recession: Adjusted for inflation, also below prior recession levels: And it doesn’t seem like building $600 billion of reserves, buying US stocks, and a negative rate policy have done much for the Swiss consumer: Not even a hint of improvement here: As previously discussed, manufacturing seems to be leveling off at reduced...

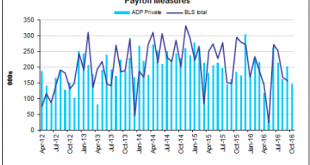

Read More »ADP, Mtg purchase apps

Weakening further ever since the collapse in oil capex: speaks for itself:

Read More » Mosler Economics

Mosler Economics