Still looks to be weakening: Looking weak: Tariff wars taking their toll:

Read More »Housing, Freight, Infrastructure, Trump advice, MMT hysteria, Cooling real estate markets

Tax Reform Exacerbates Sales Cooldown in the U.S. (WSJ) U.S. tax reform has exacerbated a gradual cooldown in U.S. home sales over the past year in certain parts of the country, according to research from realtor.com. The Tax Cuts and Jobs Act, which went into effect on Jan. 1, 2018, allows homeowners to deduct mortgage interest on a loan up to $750,000—down from $1 million—and caps state and local tax deductions to only $10,000. Home sales fell 6% across a sample of 30...

Read More »Automatic cuts, China vehicle sales, Greenspan on wealth effect

Trump may allow $125B in cuts if Congress doesn’t act (The Hill) President Trump has indicated that he would allow $125 billion in spending cuts to take place if Congress does not agree to his spending plan, White House adviser Larry Kudlow said Thursday. Kudlow was referring to budget caps set in place in the 2011 Budget Control Act (BCA), a law that was meant to force bipartisan cooperation on budgeting by threatening steep cuts to both defense and nondefense spending....

Read More »Freight, Pensions, ECB, Germany

Truckers Cut Payrolls As Freight Demand Softens Funding pensions reduces aggregate demand: The Long Bull Market Has Failed to Fix Public Pensions Long term loans to banks do nothing for the macro economy and negative interest rates are a tax: Mario Draghi signaled that the European Central Bank expects to rely on long-term bank loans and tweaks to its negative interest-rate policy as a first defense if officials need to intensify their fight against the economic slowdown....

Read More »Buy backs, Inflation, Credit applications, Philly Fed

So the question is regarding dividends vs stock buy backs- do stock buy backs cause stocks to be over valued or do dividends cause them to be undervalued?;) A Surprising Connection Between the Bull Market and Stock Buybacks (WSJ) A study published last year in the Financial Analysts Journal, “Net Buybacks and the Seven Dwarfs,” found that net buybacks—the number of shares that companies repurchased across the entire stock market, less the number of new shares issued—explain...

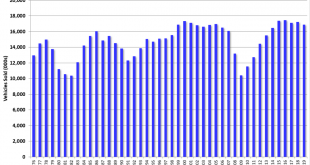

Read More »Auto sales, Lumber, Rail loadings, Global survey, Profits comments, Las Vegas Real Estate, Central Banks buying gold

This has been know to be associated with the housing cycle: Framing Lumber Prices Down 30% Year-over-year This has taken a dive recently: Global economy enters ‘synchronised slowdown’ (F) The global economy has entered a “synchronised slowdown” which may be difficult to reverse in 2019, according to the latest update of a tracking index compiled by the Brookings Institution and the Financial Times. The Brookings-FT Tracking Index for the Global Economic Recovery (Tiger)...

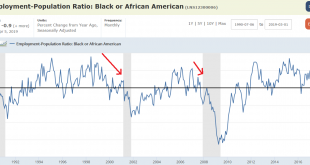

Read More »Employment, Durable goods, Trucking, Rail traffic, Draghi on rates, Dollar status

Looks like there was a drop in employment growth by firms with under 50 employees: ‘Last hire first fired’ has made this a leading indicator in prior cycles: Heavy-Duty Truck Orders Hit the Brakes in March Trucking companies slammed the brakes on orders for heavy-duty trucks in March, signaling caution amid long backlogs for delivery and a softening freight market. North American freight carriers ordered 15,700 Class 8 trucks, the big rigs used for regional and long-haul...

Read More »Earnings, New issuance, UK services, Germany, MMT comments

Expect Pre-Earnings Frowns to Turn Upside Down (WSJ) Analysts polled by Refinitiv think earnings per share for companies in the S&P 500 will be down 2% from a year earlier. The number of companies that have had negative first-quarter earnings warnings so far has outpaced those with positive preannouncements by a 2.8-to-1 ratio—well above the ratio of 1.2 to 1 registered at the same time ahead of first-quarter earnings season last year or the 1.9 to 1 ahead of the...

Read More »Retail sales, Construction spending, Chem activity, Apartment vacancy, Equity flows, South Korea exports, Trump comments

Not looking good: Not looking good: In contraction: South Korea March exports contract for fourth month (Reuters) Overseas sales slid 8.2 percent in annual terms in March. Imports shrank by 6.7 percent in March from a year earlier. This produced a $5.22 billion trade surplus, nearly doubling the amount in February, the Korea Customs Service data showed on Monday. Analysts say the fall in exports was led by a slump in semiconductor business, the country’s key export, as...

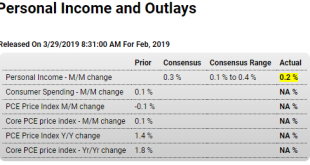

Read More »Personal income and spending, Border closing

Income and spending both weakening: Income: Ratcheting down with each setback: Spending: Highlights Consumer spending in January wasn’t able to meet Econoday’s consensus, up only marginally at 0.1 percent even against the easy comparison of December which is now revised yet 1 tenth lower to minus 0.6 percent. Weakness in January spending is centered in durable goods and reflects the month’s very sharp drop in vehicle sales. The Bureau of Economic Analysis is still catching...

Read More » Heterodox

Heterodox