Bad: Highlights Existing home sales have been leveling but the signal from pending home sales points to a new downturn. The pending home sales index for November fell 0.7 percent to 101.4 which is under Econoday’s consensus range and compared to expectations for a 1.5 percent gain. Year-on-year this index is down 7.7 percent vs a 7.0 percent decline in final sales of existing homes. Pending sales in November posted low single-digit contraction in both the South and Midwest...

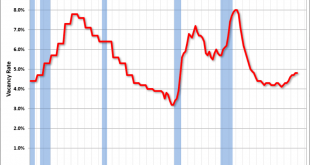

Read More »Rail traffic, apartment vacancy rate, durable goods orders, personal income and consumption, KC manufacturing

Rail Week Ending 15 December 2018: Economically Intuitive Sectors Continue In Contraction Written by Steven Hansen Week 50 of 2018 shows same week total rail traffic (from same week one year ago) improved according to the Association of American Railroads (AAR) traffic data. The economically intuitive sectors were in contraction this week. Weak: Highlights A swing higher for the always volatile aircraft group gave an outsized lift to durable goods orders in November, rising...

Read More »Housing starts, Existing home sales, Fedex

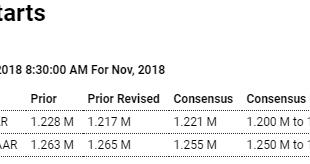

Up some but the chart not looking so good: Highlights Mostly goods news finally greets the housing sector as both starts and permits are showing an uplift in November results that top Econoday’s consensus range. Starts jumped to a 1.256 million annualized rate for a 4-month high with permits at a 1.328 million rate and an 8-month high. But not all the news is good. Strength in both starts and permits is concentrated in multi-family units, not single-family units where...

Read More »Containers, Housing index and sales

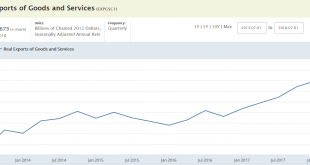

Analyst Opinion of Container Movements Simply looking at this month versus last month – this was a terrible month. The three month rolling averages significantly declined. This is the first dataset I have seen which could be a self-inflicted wound from the trade wars. The three month rolling average for exports is barely positive year-over-year. This data set is based on the Ports of LA and Long Beach which account for much (approximately 40%) of the container movement into...

Read More »US factory growth, China car sales, Euro Area, Germany, Fisher comment, State revenues, Las Vegas housing

The tariff thing keeps taking its toll: China Nov car sales fall 14%, biggest drop since 2012 (Reuters) China’s automobile sales fell 13.9 percent in November from a year earlier. The drop in sales to 2.55 million vehicles, a fifth straight decline in monthly numbers. The last time sales fell by more than this was in January 2012, when business was hurt by the timing of the Lunar New Year holiday. The November drop comes on the heels of almost 12 percent declines in each of...

Read More »China, Corporate debt and profits, Bank credit, Japan, Leveraged loans

China exports falling with tariffs: China’s November export, import growth shrinks, showing weak demand US exports turning south as well? The deceleration that started with the collapse of oil capex in Dec 2014 took a brief zig up late in 2017, and subsequently continued lower: Likewise the ability to generate gross profits has been fading: After tax and depreciation it’s not a whole lot different, with a one time leg up for the 2018 corporate tax cut that just brought it...

Read More »Fed comments, Trump watching stocks

A falling stock market will get the Fed’s attention and trigger real economic weakness and aggressive rate cuts. But those rate cuts remove interest income from the macro economy, which doesn’t recover until after net deficit spending (public or private) gets high enough to support aggregate demand growth. And the last recession didn’t reverse until after the federal deficit rose to over 10% of GDP: President Donald Trump has been consulting with his advisors to see if...

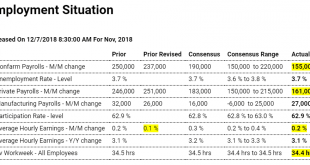

Read More »Employment, NYSE margin debt

Employment growth had been decelerating with the collapse in oil capex in Dec. 2014, but had started to accelerate with the initial impact of the year-end tax cuts, which now look to be fading: Highlights Sustainable non-inflationary strength is the indication from the November employment report as payroll growth proved favorable and moderate and wage pressures modest. Nonfarm payrolls rose 155,000 which is on the low side of expectations while average hourly earnings...

Read More »Trade, Factory orders, Vehicle sales, UK service sector, German PMI

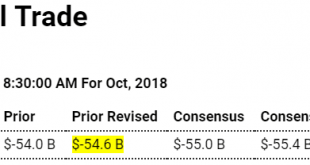

Deficit growing despite tariffs. Could be J curve effect: Highlights A slight 0.1 percent decline in exports and a slight 0.2 percent gain in imports made for a sizable 1.7 percent deepening in the nation’s trade deficit in October to $55.5 billion which is just outside Econoday’s consensus range. The deficit with China was very deep, at $43.1 billion in October vs $40.2 billion in September for a year-to-date deficit of $420.8 billion that is 23 percent deeper than this...

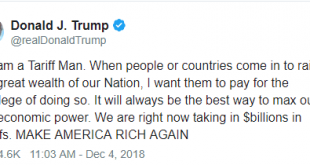

Read More »Tariffs, Congress

Imports are real benefits, exports real costs. Seems everyone of consequence has it backwards? A collapse in global trade can make 2008 look tame:

Read More » Heterodox

Heterodox