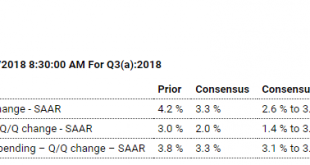

Looks like without the build in private inventories GDP was about 2% lower at about 1.4%, and health care added .77% where health care premiums paid count as personal consumption. Also, the price index deflator was lower by 1.3%: Bad: Bad: Highlights Lack of available new homes has been holding sales down this year though supply did move into the market in September, up 2.8 percent to 327,000 for a very strong 16.8 percent year-on-year gain that underscores how busy home...

Read More »Housing starts, Mtg purchase apps, Retail sales

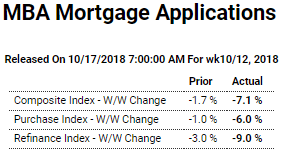

Gone from bad to worse: Highlights The highest interest rates in over 7 years took their toll on mortgage activity in the October 12 week, with purchase applications for home mortgages falling a seasonally adjusted 6 percent while applications for refinancing fell 9 percent. Despite the sizable seasonally adjusted decline, unadjusted purchase applications remained 2 percent higher than in the same week a year ago. The refinance share of mortgage activity decreased by 0.9...

Read More »Employment, Bank loans, Output gap chart, Foreign $ bonds

Looks like it’s turned up a bit with the tax cuts? Looks like this source of private sector deficit spending has gone flat again: Looks to me a lot more like a deficiency of demand than a demographic shift: This is a source of $US deficit spending that ‘offsets’ unspent incomes: China to raise billions in rare US debt deal as trade tensions persist (Nikkei) China is planning to sell $3 billion in U.S. dollar bonds this month. China is planning to sell bonds that mature in...

Read More »Car sales, Redbook retail sales, Mtg apps, ISM and Markit services index

A bit stronger than expected, but still trending lower, particularly adjusted for population: Highlights Unit sales of motor vehicle proved very strong in September, rising sharply to a 17.4 million annualized rate from 16.6 million in August. This points to a sharp rise in dollar sales of motor vehicles for the September retail sales report which in prior months had been flat. Note that some of the month’s gain may reflect replacement demand tied to Hurricane Florence which...

Read More »The Center of the Universe 2018-10-01 20:02:17

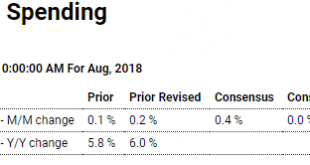

Lots of evidence of slowing; Highlights A marginal headline gain of 0.1 percent in construction spending masks significant declines in residential spending during August. Residential spending fell 0.7 percent in the month to more than offset a 0.2 percent rise in July. Looking at sub-components, single-family spending was also down 0.7 percent in August with multi-unit spending down 1.7 percent. Home improvement spending fell 0.6 percent. Strength in the report is in...

Read More »Trade, Pending home sales, New home sales, Durable goods, Bank lending, Earnings

Need more tariffs… Highlights Amid the unfolding of tariff effects, exports are moving in the wrong direction and look to be a big negative for third-quarter GDP. The nation’s trade deficit in goods was a whopping $75.8 billion in August with exports down 1.6 percent for a second straight month. Imports are also a negative for the trade balance, up 0.7 percent following a 0.9 price rise in July. Not good: Highlights It’s hard to find good news in the housing sector and...

Read More »PMI, Existing home sales, Permits, Homebuying index, Fed book, China car sales, Federal budget

Highlights Amid a backdrop of rising inflation pressures, sharp slowing in the services PMI sample pulled down September’s composite flash and masks a strong showing for manufacturing. The PMI composite fell to 53.4 which is well below Econoday’s consensus for 55.1 and also below the low estimate for 53.8. Services fell to 52.9 vs a consensus for 55.0 while manufacturing, however, rose to 55.6 vs expectations for 55.0. Weakness in services is centered in the year-ahead...

Read More »Employment, Rental markets

The change in total nonfarm payroll employment for June was revised down from +248,000 to +208,000, and the change for July was revised down from +157,000 to +147,000. With these revisions, employment gains in June and July combined were 50,000 less than previously reported. Read more at https://www.calculatedriskblog.com/#eVuYdeqRRy7O1pt6.99 Looks like the private sector credit ‘burst’ has run it’s course and the downtrend is resuming? 4.6 million people who weren’t...

Read More »Construction spending, Trade

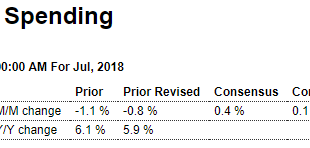

Highlights A solid rise in residential spending offset a mixed showing for non-housing components and made for a 0.1 percent July rise in overall construction spending to barely come within Econoday’s consensus range. Residential spending rose 0.6 percent but July’s gain was entirely centered in home improvements which jumped 2.1 percent to offset outright declines of 0.3 percent in single-family homes and 0.4 percent for multi-families. Private non-residential spending fell...

Read More »Personal income, Pending home sales, Real house prices

Flattened out at modest levels of growth with no sign that the tax cuts have led to an acceleration: Pending home sales fall for seventh straight month in July Signed contracts to buy existing homes fell 0.7 percent in July compared with June, according to the National Association of Realtors’ pending home sales index. The gauge was down 2.3 percent compared with July 2017. That is the seventh straight month of annual declines. Pending home sales are an indicator of future...

Read More » Heterodox

Heterodox