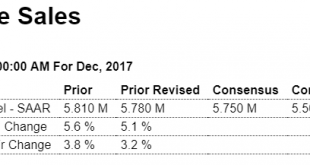

Less than expected and last month’s number revised a bit lower, so still no contribution to growth for the year: Highlights Lack of supply pulled down existing home sales in December and may very well pull down sales in January as well. Existing home sales fell 3.6 percent in December to an annualized rate of 5.570 million which is near the low end of Econoday’s consensus. But November, despite a small downward revision to a 5.780 million rate, remains by far the best month...

Read More »Housing starts, Apple repatriation

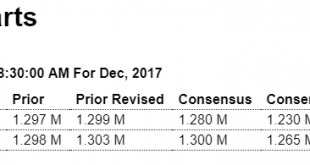

Starts were quite a bit lower than expected while permits held steady: From the Census Bureau: Permits, Starts and Completions Housing Starts:Privately-owned housing starts in December were at a seasonally adjusted annual rate of 1,192,000. This is 8.2 percent below the revised November estimate of 1,299,000 and is 6.0 percent below the December 2016 rate of 1,268,000. Single-family housing starts in December were at a rate of 836,000; this is 11.8 percent below the revised...

Read More »Housing index, Industrial production, Redbook same store sales, Healthcare comments

Up more than expected this month, but last month revised down, inline with a recent pattern of reporting a better than expected number that subsequently gets revised down to where it no longer looks so good: The year end blip up, funded by out sized credit card advances, may have reversed: Highlights Same store sales were up 2.6 percent year-on-year in the January 13 week, continuing the deceleration seen in the prior two weeks to fall to the smallest year-on-year weekly...

Read More »Bank lending review, $US, Dementia signs

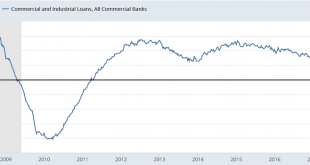

I’m using monthly totals this week to take some of the ‘noise’ out of the weekly numbers surrounding year end: Pretty clear here there’s been almost no loan growth over the last year or so: The growth rate of real estate lending also shifted around election time: Consumer credit, however, expanded into year and as consumers borrowed to sustain spending as income growth fell short: Large trade deficit: Large trade surplus: clinical dementia: “Problems these experts say...

Read More »Retail sales, $US

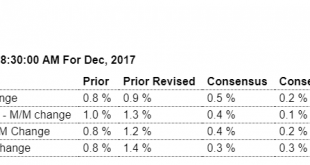

Highlights It was a very good holiday shopping season but perhaps not a great one. Retail sales rose a solid 0.4 percent in December which is just shy of Econoday’s consensus though November is revised 1 tenth higher to what is a standout gain of 0.9 percent. Core readings show similar strength with all pointing to a solid consumer contribution to fourth-quarter GDP. Nonstore retailers, a component which e-commerce dominates, did in fact have a great season. Sales here rose...

Read More »Jobless claims, Producer prices, Savings rate chart

Yes, they have been made very hard to get, and now economists are getting concerned that they are moving higher: Highlights In what might be an early sign of loosening in the labor market, initial jobless claims rose 11,000 in the January 6 week to a higher-than-expected 261,000. The gain is widespread and not centered in Puerto Rico where claims, at 1,778, are down about 500 in the latest week and back to pre-hurricane levels. Only one state, Maine, was estimated in the...

Read More »Consumer Credit, Small business index, JOLTS, Rig counts

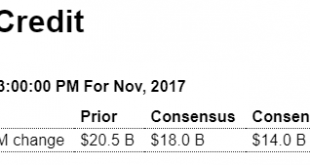

Things are starting to add up better with this jump in consumer borrowing. With real disposable personal income growth near 0, and spending growing at just over 2.5% through November, it’s now looking like consumers ‘dipped into savings’ by running up their credit card balances which tends to be followed by reductions in spending: Highlights Consumers were heating up their credit cards in November as revolving credit, up $11.2 billion in the month, made a sizable...

Read More »Bank loans and macro analysis

Bank lending began to decelerate after oil related capital spending collapsed late in 2014, and then collapsed further about the time of the presidential election: Note the consumer ‘dipping into savings’ some to sustain consumption via borrowing into year end as personal income flattened: Real disposable personal income flattened and consumer spending slowed but not as much as income, and was instead supported by consumers ‘dipping into savings’: This is now...

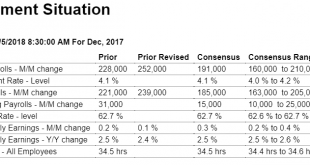

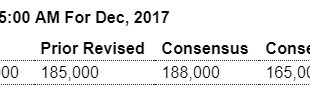

Read More »Employment, International trade

Weaker than expected, with the prior two months revised downward by a net 9,000 jobs. In any case employment growth continues its multi-year deceleration that began with the collapse of oil capex: Highlights Hiring cooled though employment levels are very high and there’s also a hint of wage inflation in December’s employment report. Nonfarm payrolls rose 148,000 which is lower than expected but still favorable and enough to absorb new entrants into the jobs market....

Read More »ADP, Light vehicle sales, Wolf quote

This is ADP’s forecast of tomorrow’s employment number. We’ll see tomorrow how well accurate they were: A bit higher than expected but down for 2017 vs 2016 (negative growth): Highlights Unit vehicle sales proved solid in December, at a 17.9 million annualized rate vs 17.5 million in November. Outside of October and September, which were driven by hurricane-replacement demand, December’s results are among the very best of the last two years. The results, which easily top...

Read More » Heterodox

Heterodox